- Ethereum fell 9%, but whales and settings bought the dip aggressively.

- BlackRock now contains 1.5 m ETH and signals long -term bullish sentiment.

Ethereum [ETH]The market performance of the market became sharp hit on 13 June, fell by 9% and the liquidation of $ 298 million for 80,000 traders.

The current market dynamics of Ethereum

While panic grabbed a large part of the market, opportunistic investors saw value in the deterioration, so ETH was collected below $ 2,500.

The actively fell from $ 2,771 to a low of $ 2,443 before stabilized near $ 2,509.

Trade war fear has fueled the wider sale, but Bullish reveals underflows.

Open interest streamed Up to $ 35.22 billion in just 24 hours, with top fairs such as CME, Binance, Gate and Bitget, each of which see an average of $ 4 billion in ETH exposure.

This coincided with a modest recovery of the price of ETH to $ 2,538.66 at the time of the press, an increase of 0.37% according to Mint market cap.

In addition, in the midst of increased market volatility, an important Ethereum -Walvis has indicated a strong bullish conviction by opening a considerable $ 16.6 million long position.

BlackRock chooses Ethereum despite the volatility

Despite these mixed signals, BlackRock, currently the largest asset manager worldwide with $ 73 billion in crypto exposure, has consistently purchased Ethereum for more than two weeks.

This follows the announcement of BlackRock about his goal to considerably expand the influence on both public and private markets, with a plan To stimulate sales from $ 20 billion in 2023 to more than $ 35 billion by 2030.

If realized, this growth could further solidify the role of BlackRock in shaping institutional investment trends in both traditional and crypto assets.

This pattern of strategic purchasing of deeply voicual entities suggests a long -term front views that regards the current price levels as an opportunity instead of as a risk.

Execs in

Note about the same, Jeremy noted”

“Blackrock has bought Ethereum over the past two weeks. They have now collected $ 570 million from $ ETH. Smart money does not slide, they double.”

As the optimism around Ethereum continues to build, institutional accumulation has become increasingly clear.

Data from Arkham Intelligence shows that BlackRock now has more than 1.5 million ETH, with a value of around $ 3.83 billion, which confirms its position as a dominant force in the Ethereum market.

Sharplink Gaming recently also bought 176,271 ETH worth $ 463 million, who positioned himself as the best listed Ethereum holder.

Has ETH been made up for a rally?

In addition, ETFs also saw the inflow rise Until June, and so the question arises: is Ethereum ready for another rally?

Well, technical indicators such as RSI and MACD are both under neutral levels, which point to persistent bearish pressure.

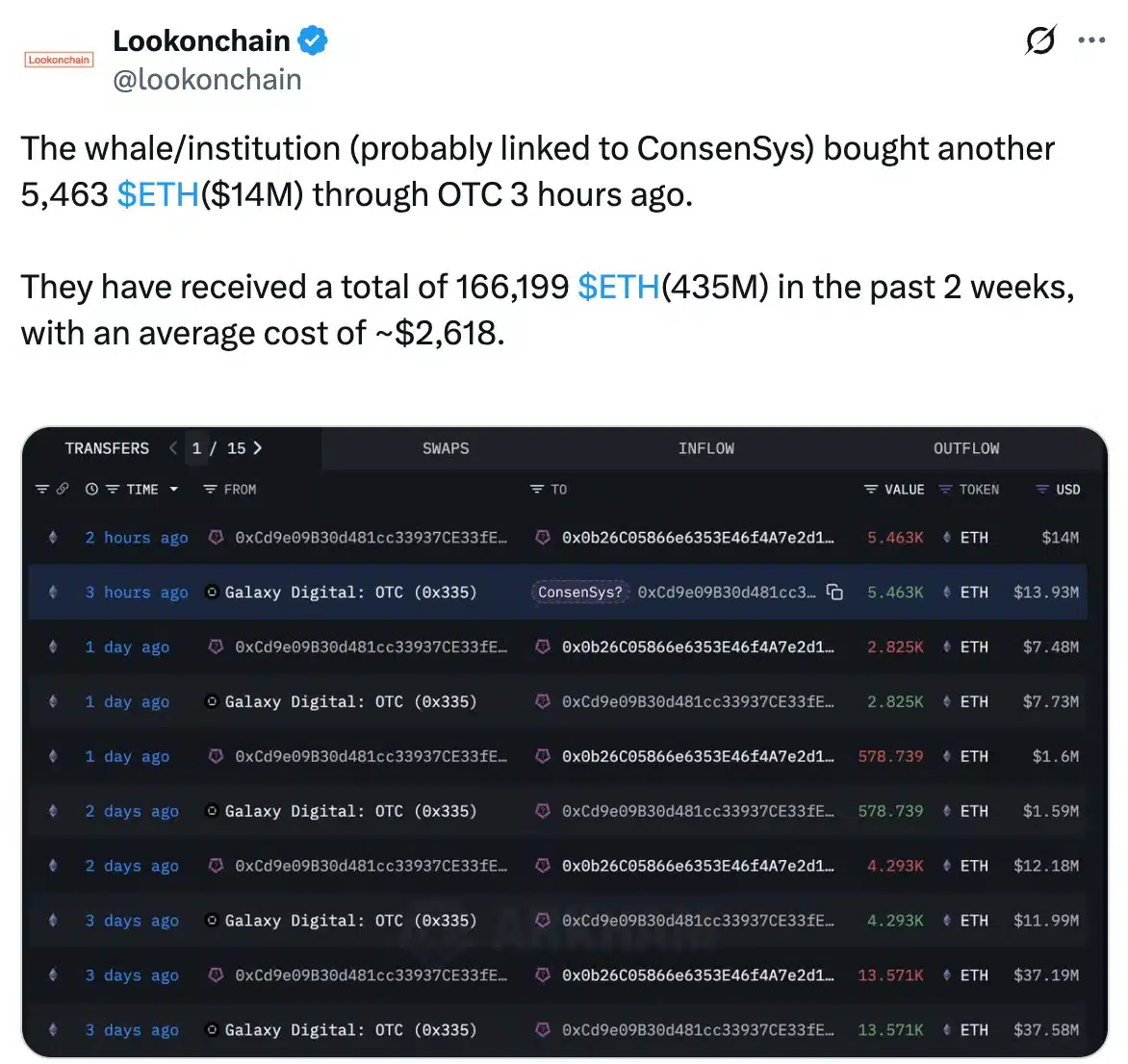

However, lookonchain data showed that whale accumulation of ETH, which points to growing bullish momentum ahead.

Source: Lookonchain/X

In conclusion, Intothlock data further confirmed the coming Bullish, because more than 77% of the ETH holders currently have a profit, which can reflect strong confidence from the holder and in the short term.

Source: Intotheblock