Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

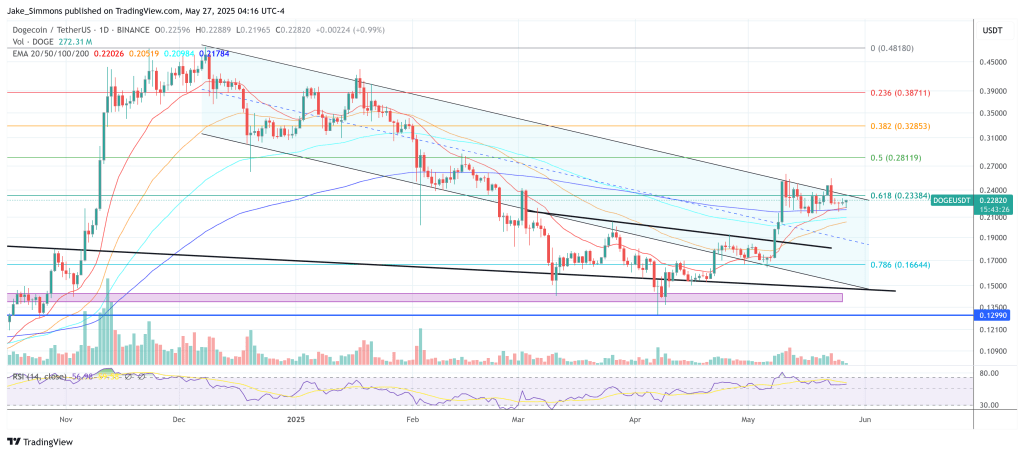

Dogecoin slid on Tuesday to the lower end of his monthly range when the Independent Chartist Quantum Ascent supplied a detailed breakdown of why he believes that the meme-guy is partially due to a corrective cascade that could end in the zone with high teenager. Halfway through the afternoon in Europe, the token fluctuated at $ 0.228, almost 12% under the peak of 11 May and nursing modest intraday losses.

Dogecoin enters the danger zone

Assessing the daily graph, the analyst reheat To the explosive movement that started on 8 May and produced an increase of 50% three sessions: “The last time we checked in here on 8 May, when we got this large green candle, we said, boys, it seems that we kicked our fifth microwave here,” he reminded viewers. His first upward projection was a modest 2.36 Fibonacci extension, but Dogecoin “actually went much higher”, a sign, he added, from a strong retail momentum, but also from a pattern that now looks.

Quantum Ascent has since migrated its golf counts to show that the thrust was only the fifth subgolf in a larger First-Wave-Opmars. “We are in the middle of an ABC while we speak … These blue waves will go here,” he said, again drawing the labels to mark the continuous racement. In Elliott-Wave Parlance, the C-Leg must at least be the A-Been, and the presenter has converted that rule into arithmetic: “Eighteen points eight percent from there … that’s one of our goals, about 20.5 cents.”

Related lecture

Deeper penetration is not only possible, but statistically common, he argued, because “often it comes down in this third or fourth wave.” With the sizes of the early May low to the top of the mid-May, he set the 0.500, 0.618 and 0.702 racements off-a band that extended approximately 19.5 cents to 17 cents and called it “the logical zone for a first-and-second golf reset.” A shallower stop at 0.382, about 21.8 cents, would be ‘a pretty shallow correction’.

One attempt to break higher is already stuck in what he has labeled the “Danger Zone” between the rehabilities of 0.618 and 0.786: “We have taken a stab for breaking, but we were not closed … We were bad, ended there on the 702, the rejection, and now it is a bit of overwhelming.” That failure leaves a nearby trigger level: “We break here so low with 21 cents, then we see at least 20.5 cents.”

The tape promotion, he added, looks like a Wyckoff-Heraccumulation structure: “Looks honestly a form of Wyckoff and we build the sign of power here before we leave.” Yet the Bullish Pay-Off, when it comes, is probably a few weeks ahead. The correction along the way is “a macro that we are working on now,” he said, and emphasized that the subsequent third wave would be decisive: “Macro Golf three – those are the fathers. Those are the big ones. Those are where we really get some juice.”

Related lecture

Macro context temperes any enthusiasm in the short term. Bitcoin-Wiens own fifth golf top previously arrived and his earlier cycle has already been highly overrun in its own ABC, and Quantum Ascent expects that Altcoins will “settle” alongside the Bellwether. “Whether it goes quickly in a C-Wave or we just keep meandering, we will have to wait,” he concluded, and for followers to look at volume profiles and closing levels instead of intraday licking.

As always, Elliott-Wave counts remain interpretative instead of predictive, and traders must adjust any positioning to their personal risk limits. Dogecoin retains the eighth largest market capitalization in crypto, but increased volatility means that even small price slats can translate into percentage of double -digit fluctuations.

At the time of the press, Doge traded at $ 0.228.

Featured image made with dall.e, graph of tradingview.com