Chainlink, often considered a pioneer in the Oracle sector, is in the spotlight for the wrong reasons. A recent number with an Oracle update from Chainlink led to more than $ 532,000 in user fund losses in just 180 seconds. The incident has inflamed criticism and questions about the chain link price in the short term. From the point of view of the price, Link Price dropped 7.79% in a day to $ 14.54. In response to this, investors on chain data and KettingLink price analysis look to determine where the link may go in the midst of this turbulence.

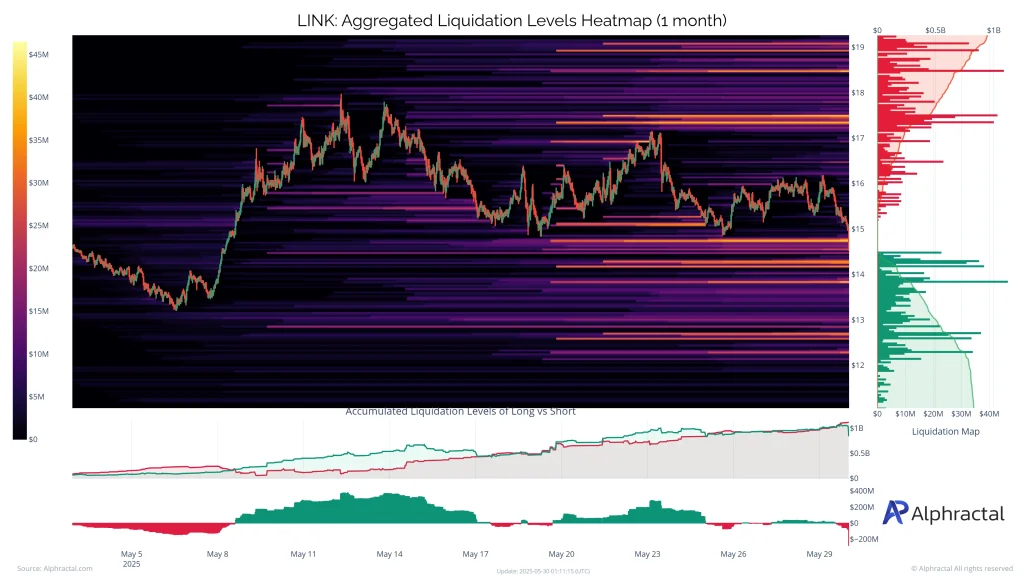

What does the liquidation heat say?

Recent Liquidation Heat Map of Alfractal Outlines a turbulent image for link. The map shows a sharp peak in long liquidations in the past week. This is often associated with capitulative phases, where excessive leverage on the long side is wiped out. It is interesting that from today 30 May the liquidation concentration has shifted, the majority of the remaining potential liquidations are now in short positions.

Technically, the breakdown below the current level could activate a drop to the next crucial support zone for $ 13.86. Conversely, if bulls succeed in reclaiming the $ 16 level, a test of $ 17.4 could be in the cards. This zone previously functioned as a strong resistance and the breaking of it could renew Bullish Momentum in the medium term. Moreover, $ 19.8 stands as a more distant, but critical resistance.

FAQs

A defective chainlink -Oracle -updated forced liquidations of a total of more than $ 532K, causing market panic and accelerating price decrease.

The Chainlink price today fell by 7.79% at $ 14.54.

The crucial support for link is at $ 13.86, while the resistance is $ 16 and $ 17.4.