XRP price is currently navigating turbulent waters as part of the wider crypto market volatility. The total market capitalization of the industry has fallen by 3.81%, now at $ 3.3 trillion. This sharp decline was activated by widespread traders liquidations of a total of $ 712.76 million. Long positions in particular include $ 644.84 million.

XRP suffered for $ 29.68 million in liquidations, with no less than $ 29.26 million from longs and only $ 419.93k of shorts. This great ratio reflects Bullish bets on surplus and subsequent panic outputs. In this XRP price analysis we investigate where the token could be led in the midst of the recession of events.

Whale activity is increasing in the midst of price fall?

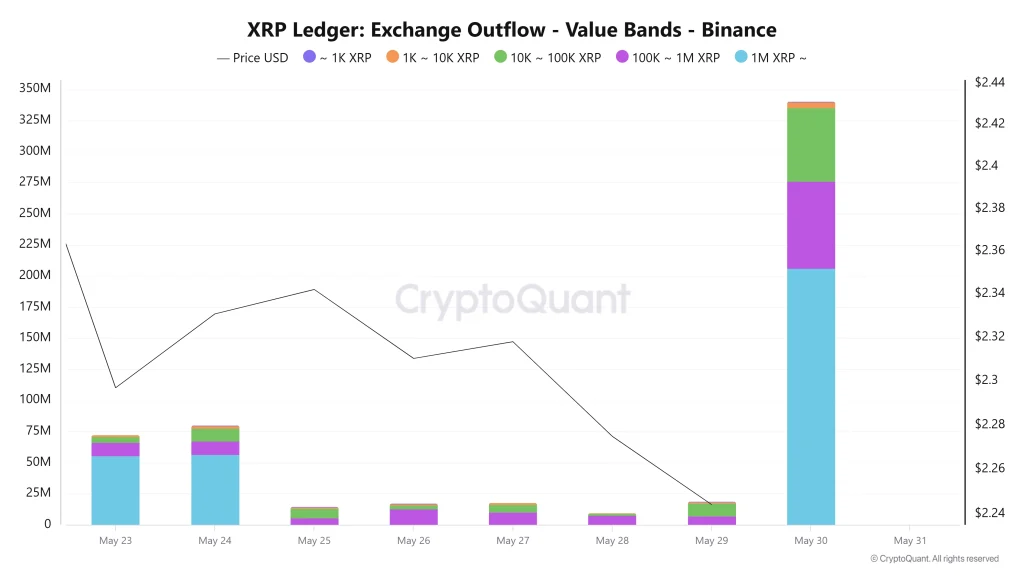

The exchange flow graph through Cryptoquant Today shows an important increase in XRP movements, ie on 30 May, with more than 330 million XRP that leaves in different tires. Especially in the category of 1 m+ XRP (light blue), followed by 100k – 1 m XRP (purple) and 10k – 100k XRP (green). This peak in slide usually suggests that whales move assets from centralized exchanges, possibly to cold storage or alternative platforms, often a bullish signal in the long term.

On the price diagram, XRP is close to its 24-hour low of $ 2.18, with resistance provision for $ 2.26. If Bulls succeed in reclaiming this level, XRP could return to the range from $ 2.4 to $ 2.5. However, the continued rejection of this resistance can reduce the price to the most important support zone for $ 2,0145.

Also read our Ripple XRP price forecast 2025, 2026-2030 for long-term price objectives!

FAQs

The rise in the volume is probably powered by panic sales and liquidations instead of buying interest, which has contributed to the price decrease.

It indicates a significant whale movement, possibly for long -term property or strategic repositioning, which could reduce the sales pressure on the exchanges in the short term.

XRP price is now traded at $ 2.19 with a daily change of -4.38%.