- ETH fell by 3.95%for the past 24 hours.

- Ethereumwalfissen sold 684.1k ETH tokens in the last day.

In the past three weeks, Ethereum [ETH] got stuck while the prices continue to act within a parallel channel. During this period ETH has traded between $ 2.4k and $ 2.7k.

This price stagnation has left most of the holders impatiently and has begun to sell the rising sales activity even spread among long-term whales.

In fact, according to the analyst on-chain @Ai_9684xtpaTwo sleeping and old whales have started discharging their ETH companies. On the last day, the two whales sold a total of 1,546,67 ETH.

One whale deposited 959.69 ETH worth $ 2.54 million to OKX. After this down payment, this whale still has 50,704 ETH tokens worth $ 132 million.

The second whale sold 587 ETH worth $ 1.56 million via Kraken. This whale has been sold since March and has placed 14,398 ETH worth $ 28.47 million.

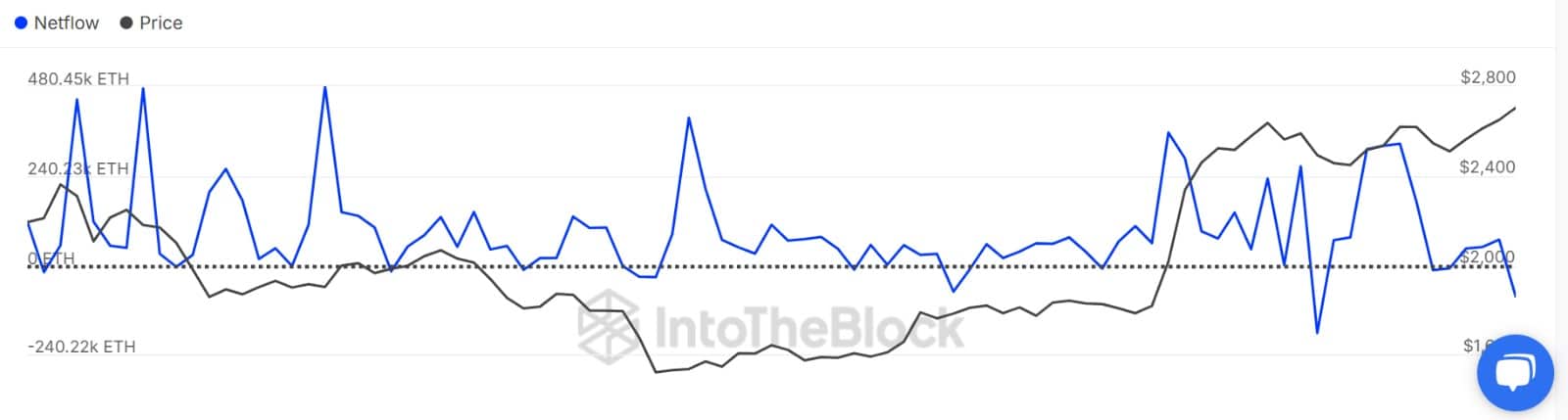

Source: Intotheblock

The two deposits did not happen separately, but within a wider selling spree between whales. On the last day, Ethereum -Walfissen discharged a total of 684.1k ETH tokens.

This signals a huge exchange outflow.

As such, the Netflow of large holders has fallen to a negative territory and hit -83.5K. When the Netflow of a large holder becomes a negative value, this indicates that whales have sold more than they have bought.

So there is more capital outflow, which reflects a strong lack of trust from large holders.

Source: Cryptuquant

In addition to the rising sales activity of whales, the Ethereum market has been taken over by sellers. Looking at Taker’s Buy-Sell ratio, sellers have dominated, with the metric to a weekly layer.

When this metric falls to a negative value, this suggests that sellers surpass buyers.

Source: Cryptuquant

Because of this sales activity, the exchange rate ratio has increased to a weekly high. This not only stems from an increased sales activity, but also runs the risk of selling the pressure.

OVERVOVER LEADS LOWER PRICES if demand drops.

Impact on ETH

Undoubtedly, rising sales activities on the market have negatively influenced the price movement of Ethereum, which fell 3.95% in the last day.

That is why a continuation of the current sales activity could see ETH infringement on the consolidation range and fall to $ 2324.

However, if the market succeeds in absorbing the pressure on the sales side, the Altcoin will retain within reach and act between $ 2.4k and $ 2.7k. An outbreak from this zone needs a cooldown when selling activities.