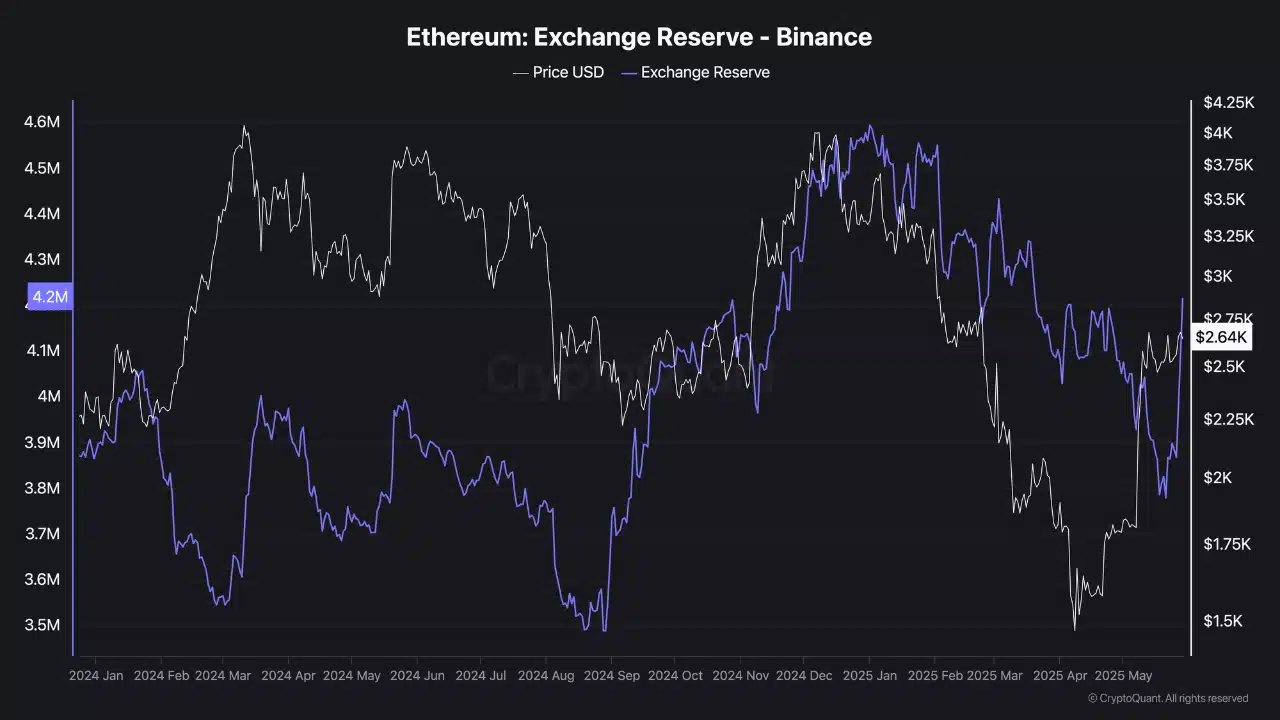

- The exchange reserves of Ethereum on Binance climbed sharply and indicate the growing pressure on the sales side.

- ETH is confronted with a dense liquidation resistance between $ 2,700 and $ 2,830, which closes the upward momentum.

Ethereum [ETH] Remained locked in a narrow range between $ 2,400 and $ 2,700, but Binance on-chain data revealed an increasing risk below the surface.

Infact, Binance Exchange reserves spiked at levels that were last seen before previous sale, pointing to an increase in the tokens moved to exchanging masters a sign of assembly sales pressure.

This was exacerbated by stable outflows, even if the price was kept above $ 2,600. From writing, ETH acted at $ 2,623.84 after a daily decrease of 3.60%.

Source: Cryptuquant

Why do negative Netflows continue to exist despite the price action on sideways?

The Netflows from Ethereum remained strongly negative, with -248.83k ETH registered in the last seven days and -60.9k ETH for 30 days.

Although this usually suggests on accumulation or withdrawal of investors to cold storage, the flat price promotion implies that these recordings follow heavy prior sales activity.

The 24 -hour Netflow also showed a smaller decrease in -4k ETH, which is stable to reinforce the flow of capital, not accelerating.

Therefore, although the price above $ 2,600 applies, this trend exposes underlying hesitation. Without renewed inflow or copper confidence, the price cannot retain the current level.

Source: Intotheblock

Trader Note and liquidation barriers weigh heavily

In the last 24 hours, the open interest rate fell sharply by 8.99% to $ 18.14 billion, because traders withdrew from both sides of the market.

Lower OI usually indicates a lack of conviction, and without aggressive positioning, volatility tends to compress before an outbreak or breakdown.

However, what is more, is Binance’s ETH/USDT -Liquidation heat, which shows dense liquidation walls stacked between $ 2,700 and $ 2,830.

These clusters have repeatedly activated the sales pressure, creating resistance zones that absorb bullish momentum. Every failed attempt to break this region has led to sharp reversations, as can be seen on the 24-hour graph.

Source: Coinglass

Unless ETH is standing with a considerable volume to erase these barriers, bulls can get stuck underneath. THese liquidation zones act as a ceiling until market order shifts strongly for buyers.

The lateral movement of Ethereum hides deeper market weakness.

Declining OI, negative Netflows and strong liquidation zones suggest that the sales pressure is sculpting.

If Bulls cannot reclaim $ 2,700, the support of $ 2,480 could subsequently come under pressure. For now, caution remains offered because ETH navigates a tight reach with a limited momentum.