- James Wynn Crypto Liquidation sweeps $ 99.3 million away while Bitcoin slid under $ 105k, so that one of the largest losses of the cycle was marked.

- Holders in the short term leave the market, which indicates speculative importance and a possible shift in price dams.

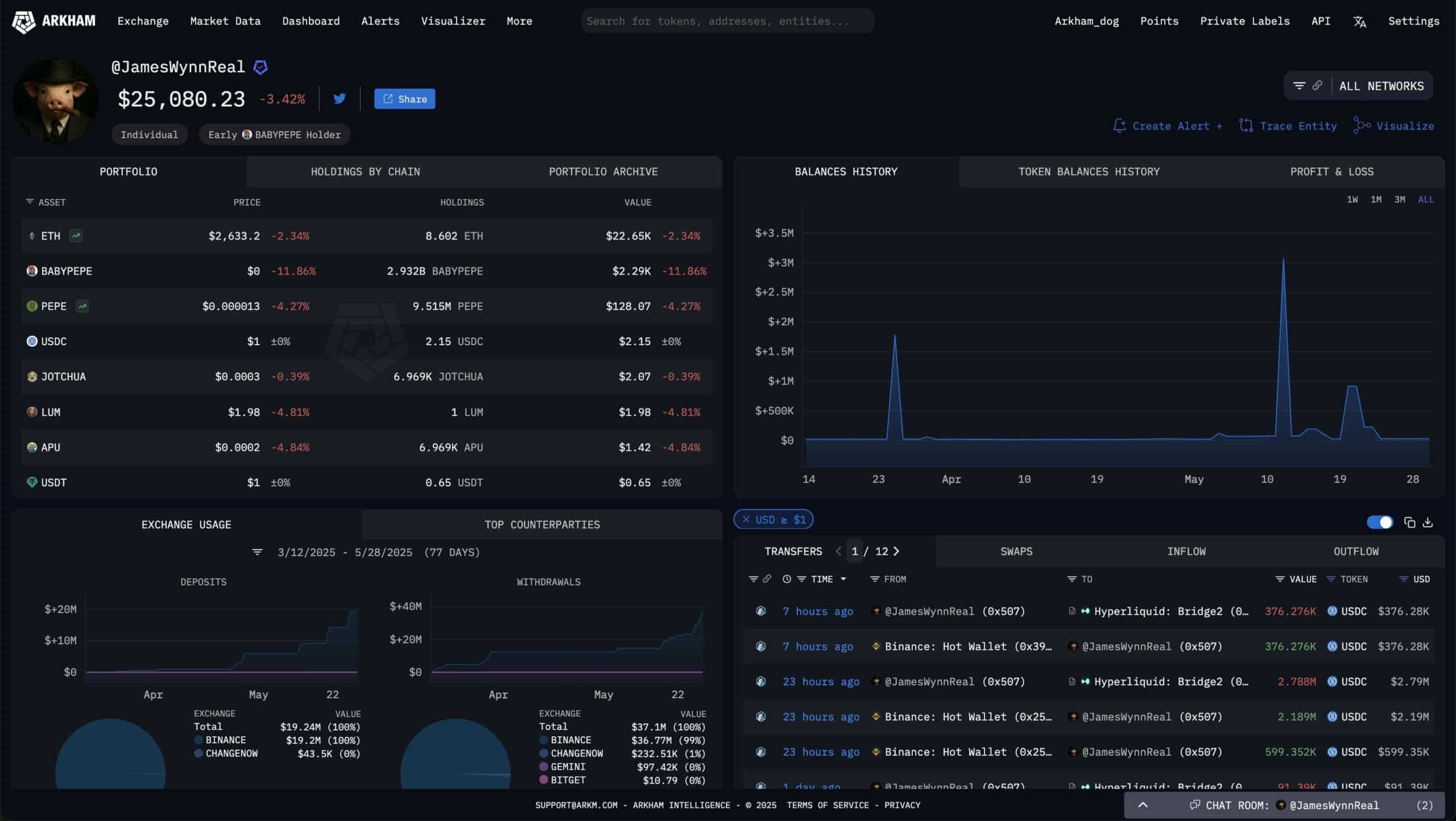

The crypto portfolio of whale investor James Wynn has taken A huge loss recently.

While Bitcoin [BTC] Fell temporarily below $ 105,000, Wynn was liquidated For 949 BTC – worth around $ 99.3 million.

The liquidation is due to the heels of a broader sale over the entire market, which has activated Tracade liquidations.

The steep fall has been added to the existing misery of Wynn. Last week the whale lost more than $ 99 million to non -realized value because BTC had no important support levels.

Source: Arkham Intelligence

Bitcoin’s fall caused mass -readings

The dip below $ 105k not only shook one whale. It led to a wider wave of liquidations on crypto fairs.

Wynn’s huge exit headed a fleeting session.

Derivate data showed open interest that briefly and then collapsed – classic signs of leverage deviations that take place in real time.

Source: Coinglass

Short -term holders take a step back

The impact is no longer exclusive for whales.

Data on chains show a huge reduction in holders in the short term after the correction. This refers to addresses that hold Bitcoin less than 155 days.

The decrease in cohort signals reduced the speculative appetite, so that the growing hesitation signals further arouse with traders who have contributed to the current rally.

With the unloading of short -term holders, the dominance of the long -term holders could soon rewrite the price patterns of BTC.

Source: Cryptuquant

What this means for Bitcoin in the future

The liquidation of James Wynn is a story about caution. The events reveal how volatile and ruthless the current market conditions can be for seasoned investors.

Although price promotion has not maneuvered a clear path, the shrinking pool of short -term holders can suggest that a period of consolidation is imminent.