Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

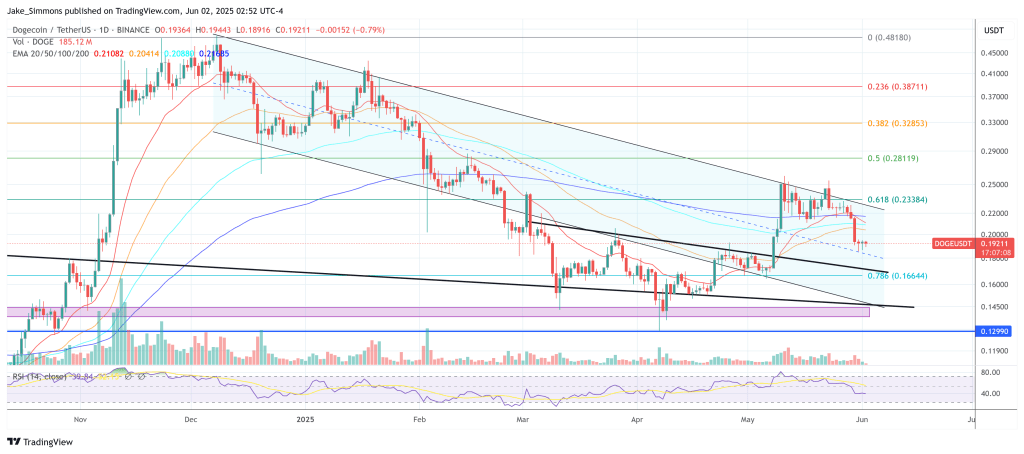

Dogecoin starts in Balance in June with the Mes Rand of a large technical support point, the next decisive swing that is probably determined by a narrow group of support that both Kevin (@kev_Capital_TA) and the Cantonese cat (@cantonmeow) have brought in sharp relief.

Dogecoin Showdown for $ 0.19

On Kevin’s Daily display The focus is the $ 0.1901– $ 0.1839 Corridor. The zone is not random: it is anchored by the 50 percent Fibonacci racement of the explosive Surge 11 May ($ 0.2597) and is over the overhead of the 0.618-0.65 Retracement cluster at $ 0.1976 and $ 0.2005.

Related lecture

The long red candle of Friday cut through the conversion line of Ichimoku and put in a mustache hair of that 0.50 FIB, which produced the first real retest of the newly beaten floor. A daily close to the following would expose the 0.382 marker of the same leg for $ 0.1694 and, further, the lower rail of the multi -year -old falling trend line that now goes to $ 0.14s later this month. Conversely, a long -term bid in the band would confirm it as the gathering place for a new upward attempt to the 0.703 extension at $ 0.2117.

Cantonese Cat’s Analysis frames The identical area as the neckline of a reverse head and shoulders carved for three months. The Swing Low from the mid-March was the left shoulder, the capitulation of early April produced a deeper head and the early May trough completed the right shoulder.

The neckline-dedicated turquoise between around $ 0.187 and $ 0.194-der decided on 9 May, after which the price was returned for a re-test of a textbook. Keeping the neckline keeps the reversal intact; Sliding underneath would go back to bears the pattern and the hand momentum.

Outlook in the long term remains bullish

A broader perspective comes from the monthly graph of the Cantonese Kat, where Dogecoin has pressed seven directly in the range of $ 0.16 to $ 0.42. That compression appears within a primary bullish trend defined by successive higher highlights (May 2024 and November 2024) and higher lows (August 2024 and April 2025).

Related lecture

Snip inside-bar squeezing this length is rarely sleeping: statistically, the break often travels at a distance that is comparable to the reach of the parent candle-accompanying 26 cents in this case-a control of both parties is struggling. Until that break the $ 0.16 floor and the $ 0.42 ceiling of November arrives the donest definition of the external borders of consolidation.

Resistance above the head remains layered. If buyers defend the neckline and reclaim the $ 0.20 handle, Kevin’s $ 0.2117 extension becomes the first waypoint. Beyond is the $ 0.25 – $ 0.26 band, which closed the Rally of May. A clean movement due to that board would almost certainly indicate that the monthly compression was resolved higher and the $ 0.29 figure line has put on the radar.

For the time being, however, the visual field of the market is limited to a line that is barely one cent wide. In between, it is $ 0.190 and $ 0.184-that the inverse main and shoulders of the neckline of the Memecoin meets Kevin’s critical Fibonacci board. As the analysts agree, the immediate fate of Dogecoin depends on whether that ledge will hold or crumbles in the coming days.

At the time of the press, Doge traded at $ 0.19211.

Featured image made with dall.e, graph of tradingview.com