- Bitcoin mini workers increase activity as Mara Digital Mines 950 BTC in May without selling.

- Since BTC sees more than $ 1.2 billion in flowing out, increased inflow from miners can help stabilize prices in the midst of ETF-driven outputs.

Bitcoin -Mijnbouwgigant Mara Digital Holdings reported A solid can, with 950 BTC on its reserves. This is a 35% higher mining result in April and emphasizes the rising hash current and efficiency of the company.

Mara had a combined total of 49,179 BTC at the end of May and sold none of his Bitcoin companies during the month.

This steady accumulation reflects Mara’s confidence in BTC in the long term, while market volatility continues to weigh on the sentiment of investors.

The high -profile miner who does not offer sales pressure is a crucial sentiment in current market conditions.

Larger enrollment of miners versus ETF outflows

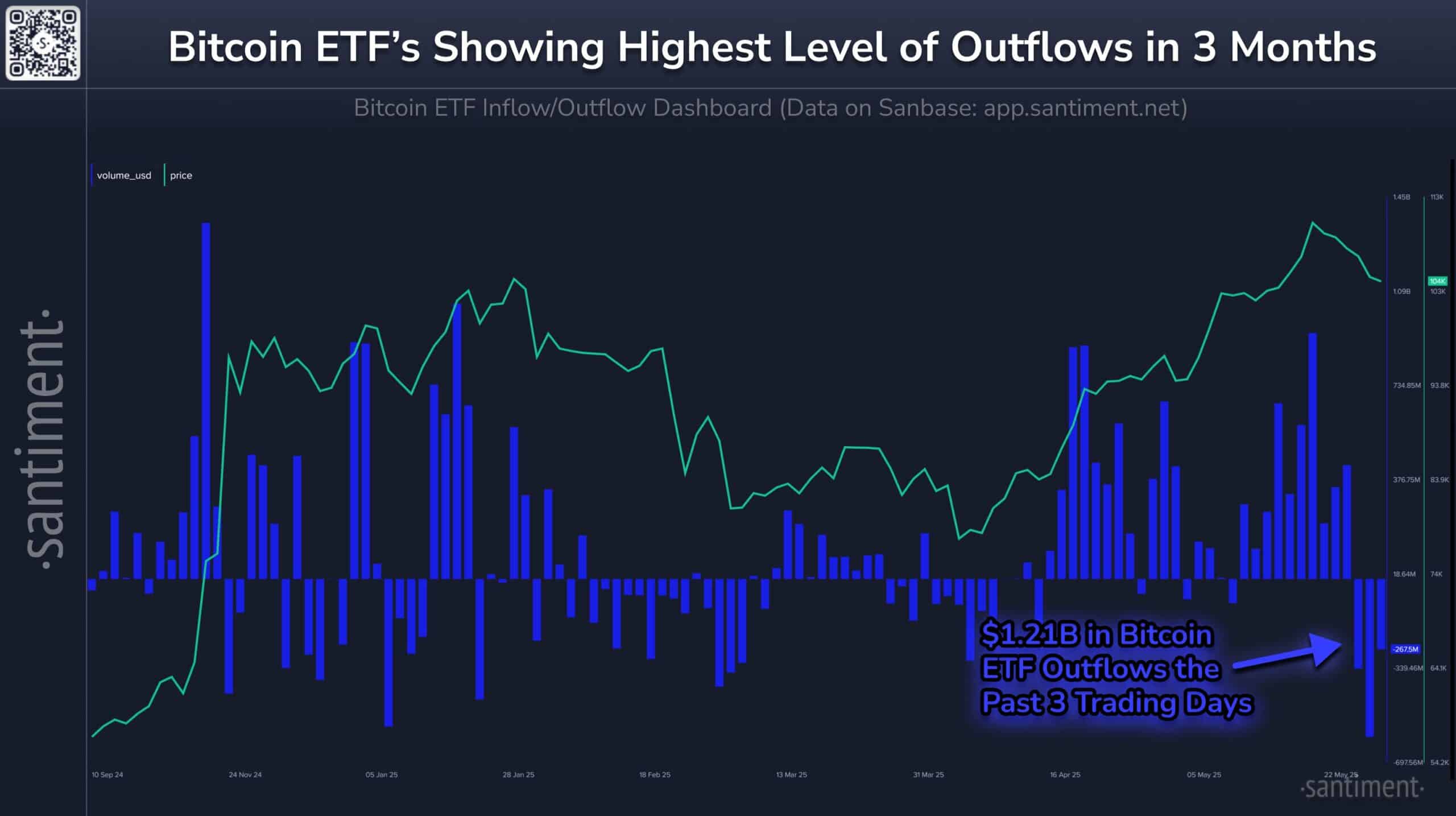

While miners like Mara BTC stores in their reserves, the rest of the market witnesses a huge outflow of capital from Bitcoin ETFs.

According to Santiment, Bitcoin ETFs saw $ 1.21 billion in net outflows over only three trading days, which marks the best drawing in three months.

The diverse theme – more hoarding while ETFs discharge – can become a most important balancing influence for the market.

Provided that ETF outflows continue to occur, the activity in chain miners could increasingly play a crucial role in stabilizing prizes in the future.

In other words, we watch a rare tug of war: institutional repayments on the one hand, miners discipline on the other.

Source: Santiment

Can miners resist Bitcoin ETF pressure?

The inflow of the miner can offer respite in the short term, because Bitcoin tries to regain his bullish momentum.

Historically, supports in the inflow of miners in combination with reserve accumulation on the first run local soils or stabilization periods.

It does not mean that a rally is guaranteed – but it tilts the balance to resilience.

The greater question is whether this miners support is resistant to a continuous ETF capital flight. If the outflow in an increasing way, even strong miners may have difficulty holding the line.

Source: Cryptuquant

Miners’ sentiment can be an important meter

With Bitcoin in the vicinity of important support levels, the balance between mining reserves and ETF flows will depend in the coming weeks.

May’s May reports from Mara add a bullish hope to other fearful soil.

While the market is waiting for a directional outbreak, the inflow of miners can turn out to be a calm stabilizer.

Whether the inflow of the miner is sufficient to compensate ETF outflows, is the gamble of everyone but for now it offers a bullish undertone for the short-term prospects for Bitcoin.