The Room Decentralized Finance (Defi) has recently witnessed an increase in activity, in which protocols such as hyperliquid and Ethena get attention and appear successful.

Despite their growth, many have wondered whether these protocols are really decentralized. Are these successes a coincidence or a sign of a larger shift in the Defi room?

Hyperliquid proves that users want Defi, but not full decentralization

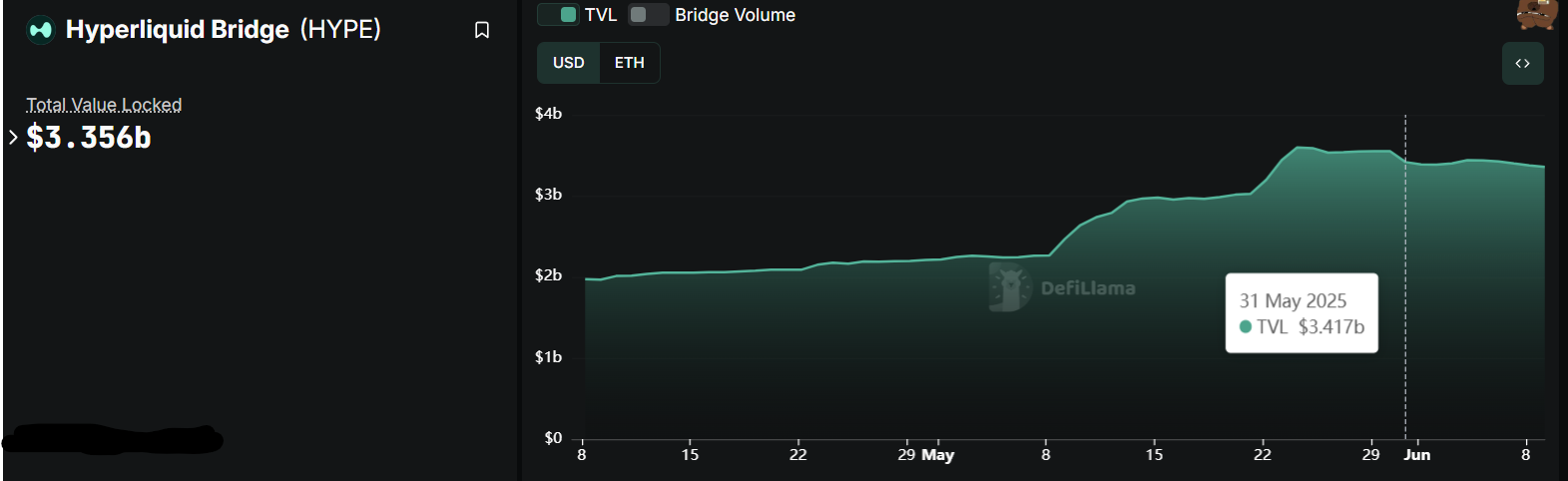

Hyperliquid, a prominent Defi protocol, saw a remarkable increase of 54% in its total value (TVL) within just one month in May. The TVL rose from $ 2.21 billion to $ 3.35 billion, indicating the growing investor’s interests. This Golf suggests that even if some aspects of the protocol are not fully decentralized, the still considerable capital and trust of investors attracts.

Hyperliquid TVL. Source: Defillama

Hyperliquid uses a hybrid model for order matching. Initially, orders off-chain are matched, but the entire procedure, including making the order book, is designed to be verified and to be established on the chain. This combination ensures rapid implementation and maintains itself in maintaining high standards of integrity and safety.

However, this approach also makes it partially decentralized, in contrast to Uniswap, Lido Dao and Aave.

Tracy Jin, COO of Mexc, only speaking against Beincrypto, stated that the operating model did not matter. This is because the community starts to see that a project does not have to be fully decentralized to succeed.

“Paradoxically, projects such as Hyperliquid and Ethena have succeeded, especially because they deliberately left full decentralization. Instead, they concentrated on core values such as permissionless access and transparency. Users were able to interact freely with the protocols, trust that everything was visible and verifiable at the chain. Jin said.

She further stated that the success of Hyperliquid could probably cause a shift in the way developers work. She stated that teams that use the hybrid-centralization space are often sent faster and offer users clearer value propositions.

In addition, Pauline Shangett, CSO at Changenow, told Beincrypto that there is a chance that the hybrid model can become the cornerstone of the crypto industry.

“We will not see a shift in favor of both [DeFi or Centralization] side. Hybrid solutions are the future of industry. In most marketing materials, the Defi -after pressure remains as a way for companies to distinguish themselves from their competitors. Conversely, they will try to hide elements of centralization. But all this will only happen in the first instance. Ultimately, we will accept the new reality and not cheat on ourselves, “Shangett noted.

Users will therefore probably give priority to solutions that work, even if they are not fully decentralized. Jin added that at the end of the day, regardless of the operational model, it is counting that projects determine the trust of investors.

“Investor Trust is the basis of Defi. If that erodes, the entire ecosystem will suffer. Without trust, users will not deposit liquidity, institutions will not collaborate or invest, and the innovation cycle delays. Capital can go back to centralized exchanges or even a crypto leaves in the search for stability and predictable.

Hype Price’s trip during the month

Hype has demonstrated impressive growth, with an increase of 64% in May and that momentum in June. From the moment of writing, hype acts at $ 36.33. This persistent increase indicates that investor’s interest is strong and that token can be on the way to further profit.

Currently, the decentralized financial token is only 16.25% of his all time of $ 42.25, which was reached in December 2024. To achieve this price target, the hype must secure the support level of $ 36.47. If the Altcoin successfully holds this level, it can reach the Ath and even push it even higher, by continuing its upward process.

Hype -price analysis. Source: TradingView

Despite the positive momentum, continuous sales by investors remains a concern for the price stability of hype. If the sales pressure rises, the price can fall below $ 36.47 and go to $ 31.26. A non -stuck support would invalidate the bullish prospect.

This could probably further activate, which may fall to $ 27.31, which marks a considerable shift in market sentiment.