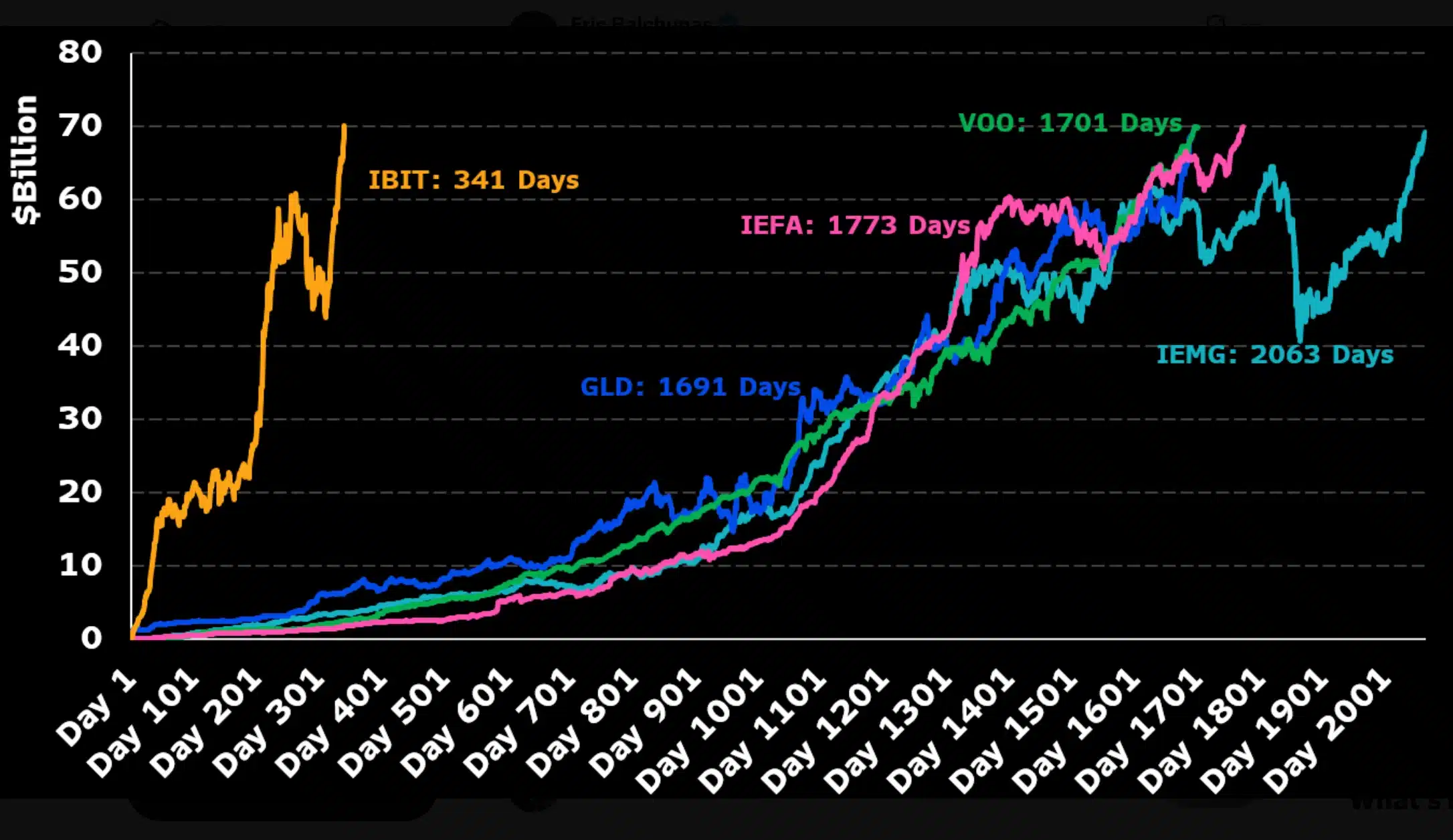

- The IBIT of BlackRock became the fastest ETF to exceed $ 70 billion AUM in just 341 days.

- IBIT held 661,000+ BTC, making it the largest institutional Bitcoin holder worldwide.

Blackrock’s place Bitcoin [BTC] ETF has written history by becoming the fastest fund with exchange that exceeds more than $ 70 billion in assets.

The milestone reflects broader market confidence and positions BlackRock’s offer as a potential game changer in the evolution of crypto investment products.

Analyst appreciates the IBIT growth of BlackRock

Note about the same, Eric Balchunas taken to X (formerly Twitter) and noticed,

“Ibit just blew through $ 70 billion and is now the fastest ETF ever in just 341 days that figure has hit.”

Balchunas also emphasized that the IBIT of BlackRock exceeds expectations and reaches almost five times faster $ 70 billion in assets than SPDR Gold shares (Gld) -the previous record holder.

Eric Balchunas in Ibit

While GLD took over more than 1600 trading days to reach the milestone, BlackRock’s Ibit has achieved it in a fraction of time, which strengthens the explosive market input.

That said, since the debut in 2024, ETF has secure In 2025 alone, more than $ 9 billion in inflow and earns a place in the top five of the American ETFs.

This coincided with BlackRock recently 2,704 bitcoins worth around $ 283.9 million, together with 28,239 Ethereum [ETH] Tokens worth an estimated $ 73.2 million.

Settings jump in IBIT

This increase in the familiarity of BlackRock is also reflected in the number of settings that participated in the list of Ibit embracing.

For example, the Moscow Stock Exchange has listed Bitcoin Futures linked to IBIT.

Moreover, JPMorgan is also planning to roll out Loans supported by ETF, starting with the flagship Crypto Fund of BlackRock, which indicates growing trust and usefulness in Bitcoin-oriented investment products.

That is why BlackRock’s IBIT has become the largest institutional holder of Bitcoin with more than 661,000 BTC -underwearing, which exceeds both the strategy of Binance and Michael Saylor.

What is more?

Currently appreciated at $ 71.9 billion, the meteorical increase in the ETF has also positioned it in possible to overtake Even the estimated companies of Satoshi Nakamoto against the following summer, according to Eric Balchunas from Bloomberg.

Therefore, since IBIT shares trade near $ 62 and Bitcoin crosses the $ 110,000, the ETF continues to dominate its colleagues, so that almost $ 49 billion in net entry is obtained since the 2024 debut.

As expected, this route paints IBIT as the most influential player under Spot Bitcoin ETFs on the American market.