Activity on the chain often translates into increased reimbursements for Defi and Dex protocols. Projects such as pancake wap share this income with holders, with some of those tokens that offer daily rewards.

Economic activity at the chain translates into significant daily income for different chains and decentralized protocols. In 2025, setting up coins will be back, this time with part of the real economic value on the chain.

Several of the leading chains and Defi protocols offer some variation on sharing income, which leads to a new incentive for keeping tokens. Setting off is not only for network security; It will be a guarantee for the growth of the ecosystem. Such tokens also show growth patterns that are often immune to the short -term volatility of the market.

Most leading chains have a handful of income -producing apps, although the largest volumes come from Ethereum, Solana, BNB Smart Chain and Tron.

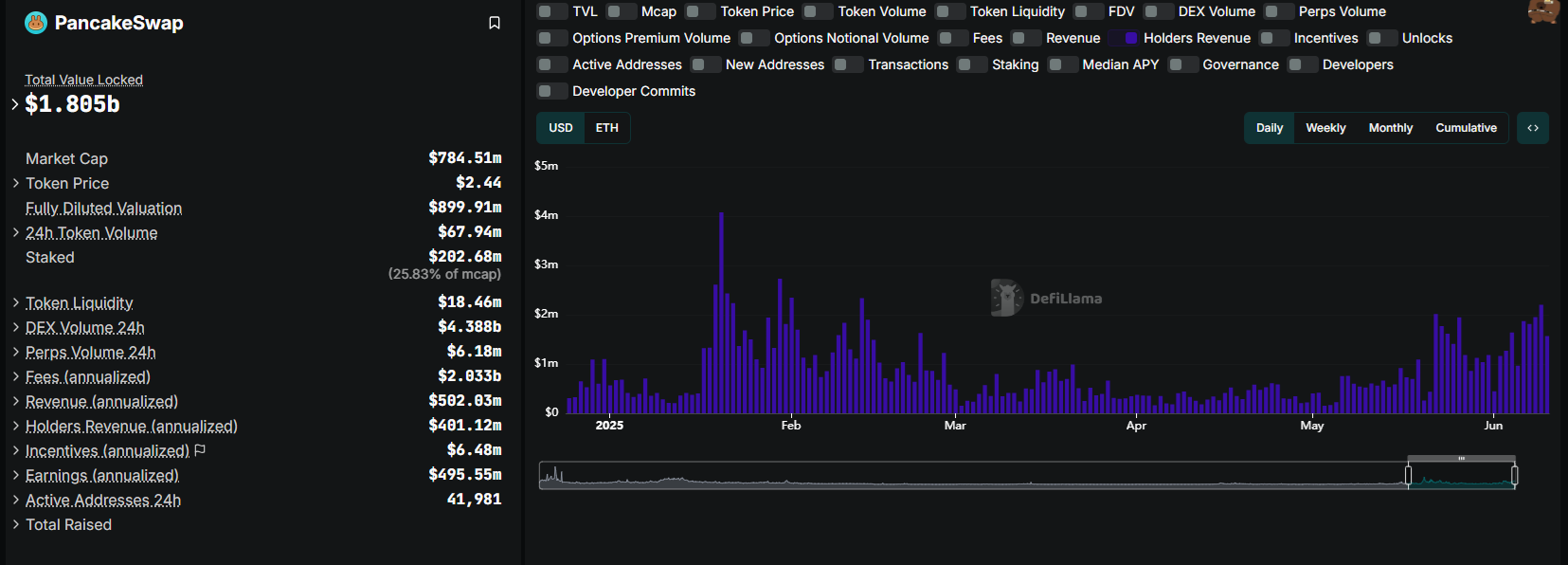

Pancakeswap’s cake leads in daily income

The Pancake Wap Dex leads in terms of passive income for cake farmers. In recent months, pancake wap has been used a lot to carry out token trade by Binance portion. This quickly increased the daily costs on pancake wap.

Pancakeswap has the largest income per holder for cake, because the DEX costs return to levels that are no longer seen since the Bull market of 2021. | Source: Defi Lama

Cake currently distributes $ 2.72 million in daily income, above all other protocols and chains. The Token also benefits from burns and the new tokenomics for sharing income.

The income exchange for pancakeswap returned to levels that are no longer seen since the Bullmarkt 2021-2022.

For more than two years, the Dex was largely forgotten before he regained the status at the beginning of 2025. The current expansion follows the growing interest in the BNB Smart Chain ecosystem, incentives and the mining of alpha points for the special token sale and Airdrops from Binance.

Income exchange drives value for altcoins and tokens

Pancakeswap showed that the best fuel for generating and sharing income is the availability of real activity.

The potential for passive income is also stimulating the growth of the hype, which encourages expansion instead of selling. Hype Holders also have access to more than $ 2.4 million in reimbursements on some of the more active days. Hype’s turnover exchange Since the start is what early holders has helped to retain their interest and to prevent a slide in the market price.

Of the top 5 protocols for sharing income, there are three DEXs, which produce income in direct proportion to the real demand and on-chain activity. Dex’s have even surpassed lending protocols and liquid reinforcement locations, as well as chains such as Solana.

As a result, cake acted near a high range of three months at $ 2.48. Cake expects a larger outbreak if the DEX retains its activity levels.

TRX also put the potential for striking rewards on an expansion trend. TRX traded almost three months high at $ 0.28, which avoided the volatility of other altcoins.

Hype also expanded to $ 40.96 and broke into a new price range.

Aerodrome, another perpetual Dex, also saw a strong recovery since April, with his token that yielded to $ 0.54 last week. Aerodrome offers around $ 411K in daily income, shared with governance topping holders.

Sharing income increased the expectations of an upcoming pancake swap token. Currently the Dex shares some of its income, even without a token. Some Dex’s, such as Uniswap, only share their income with Governance token holders, while simple uni holders do not receive part of the daily DEX costs.