The American Bureau of Labor Statistics has released the CPI inflation of May, rose to 2.5% yoj, matching expectations. Without surprises and apparently no shocks for the markets. Despite the increase, Bitcoin, shares and altcoins remained stable without panic, not a rally, but simply quiet resilience. This suggests that the markets in mild inflation are priced as the new normal, because investors are more focused on speed decisions, ETF streams and wider macro stories than a CPI number.

Now that the BTC price has officially traded more than $ 100,000 for 30 consecutive days for the first time in history, the Upsswing will continue to new highlights?

Bitcoin has experienced a persistent adoption of states, banks and companies, which have marked a new era of institutional confidence in BTC. Like some reports116 public companies now have 809.1k Bitcoin, an increase of 312.2k a year ago. Moreover, almost 100k BTC has been added since the beginning of April alone, with 25+ companies that make new companies public. The data also shows that micro strategy and other institutions have intensified their accumulation since November 2024 when the market rose above the consolidation phase.

Since then, the BTC price has maintained a strong rising trend and it is only 3% to 4% away from the ATH. Nevertheless, the whales remain optimistic and not interested in removing their profit.

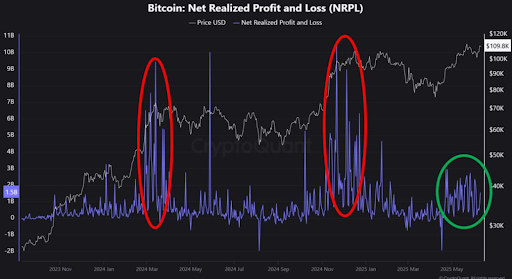

The graph above shows the net realized profit or loss, which every time the BTC price has risen above consolidation. This was aimed at extracting profit such as the whales and the investors may not have faith in the coming price action. However, the current breakout does not seem to have attracted them to switch off the win, because the whales seem to be bullish on Bitcoin and expect the price to retain a strong revival. This suggests that the BTC price can be retained a strong rising trend and eventually marks a new ATH soon.

Bitcoin currently entered the last resistance zone prior to an ATH, but has still not broken the barrier. Moreover, the price is a significant increase in volume of around $ 36 billion to almost $ 60 billion. This suggests panic sales, but the question remains whether the price will contain the most important levels about $ 106k after falling less than $ 108k. If this happens, a new ATH can be gone for a few weeks; Otherwise, the Bitcoin price (BTC) can get a deeper correction and reach levels just under $ 100,000 and cause a strong revival to mark a new ATH.