The Post Bitcoin Bull Run Income when BTC CAGR Hits 31% first appeared on Coinpedia Fintech News

The strong performance of Bitcoin in April and May has re -applied the hope for a large bullish breakout. From 9 April to 22 May, the Bitcoin price rose by 46.32%, including a meeting of 18.48% between 5 and 22. Price repair also pushed its composite annual growth rate (CAGR) higher, signaling renewed market optimism.

BTC CAGR -Spikes as the price restores

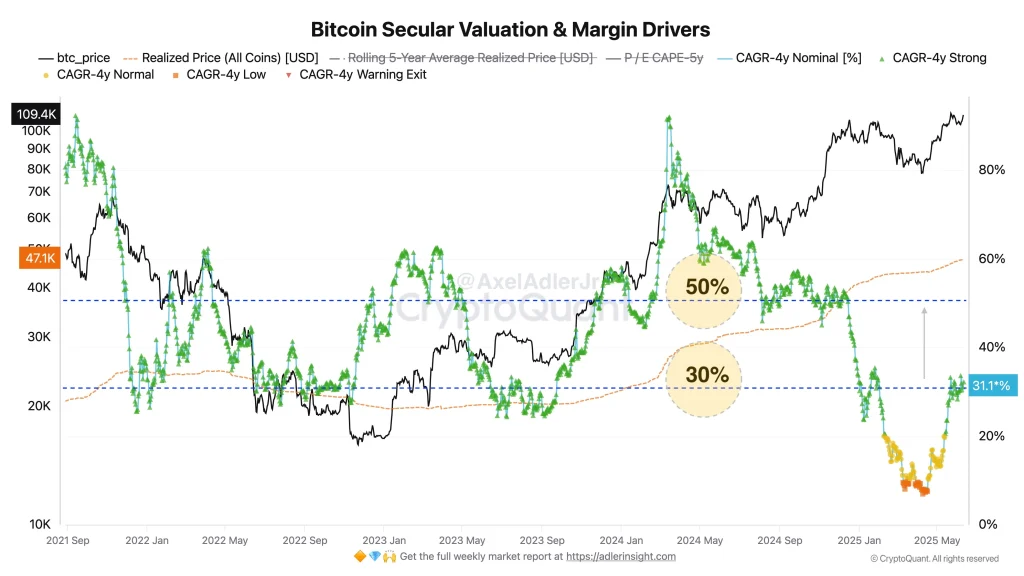

Crypto analyst Axel Adler JR has recently emphasized a remarkable peak in the 4-year CAGR of Bitcoin. In April 2025 it had just fallen 7%As a result of the volatile start from Bitcoin until the year. BTC grew by 9.54% in January, but in the coming months a sharp decrease decreased – down 17.5% in February and 2.19% in March. The price even became a low point of $ 74,446.79 in April.

However, the market recovered strongly. By June 2025, Adler reports that Bitcoin’s CAGR has been back to 31%.

“This sharp rebound shows how quickly the trend can shift in the long term when a strong copper momentum enters the market,” Adler said.

Yet he notes that 31% CAGR is still under the historic bull market peaks, which implies more room for growth.

$ 168k BTC by October?

Axel Adler JR predicts a possible Bitcoin race target of $ 168,000 by October 2025, based on Momentum in the Futures market and the leverage continues.

He bases this projection on accelerating growth and historical patterns observed during previous bull runs.

.article-inside link {margin links: 0! Important; Border: 1px Solid #0052CC4D; Border left: 0; Border-Right: 0; Filling: 10px 0; Text align: left; } .Entry ul.article-inside-link li {font-size: 14px; Line height: 21px; Font weight: 600; List style type: none; margin-bottom: 0; Display: Inline block; } .Entry ul.article-inside-link Li: Last-shild {Display: None; }

- Also read:

- Imitating Saylor is dangerous! Novogratz warns against strategy “copycats”

- “

Risk adjustment: CAGR versus standard deviation

In the discussionread, X users Manu suggested a more refined way to interpret CAGR by dividing it through the standard deviation to eliminate volatility and emphasize risk-corrected returns.

Adler agreed to the approach and stated that it offers a cleaner picture of market performance, but also emphasized another critical point:

“The real bending point comes when investors start to take a profit based on expected returns.”

According to him, the risk of a bear market is growing as soon as the BTC trading volume crosses 1 million coins, because taking profitable profit findings can disrupt the supply-recurring balance.

.article_register_shortcode {padding: 18px 24px; Border-Radius: 8px; Display: Flex; Line items: Center; margin: 6px 0 22px; Border: 1px Solid #0052CC4D; Background: Linear-gradient (90 Erdeg, RGBA (255, 255, 255, 0.1) 0%, RGBA (0, 82, 204, 0.1) 100%); } .Article_register_shortcode .Media-Body H5 {color: #000000; Font weight: 600; Font size: 20px; Line height: 22px; Text align: left; } .Article_register_shortcode .Media-Body H5 Span {color: #0052CC; } .Article_register_shortcode .Media-Body P {Font-Weight: 400; Font size: 14px; Line height: 22px; Color: #171717B2; Margin top: 4px; Text align: left; } .Article_register_shortcode .Media-Body {Padding law: 14px; } .article_register_shortcode .Media button a {float: right; } .Article_register_shortcode. Primary button img {vertical-align: middle; Width: 20px; margin: 0; Display: Inline block; } @Media (min-width: 581px) and (max-width: 991px) {.article_register_shortcode .media-body p {marge-bottom: 0; }} @Media (Max-Width: 580px) {.Article_register_Shortcode {Display: Block; Filling: 20px; } .Article_register_shortcode img {max-width: 50px; } .Article_register_shortcode .Media-Body H5 {Font-Size: 16px; } .Article_register_shortcode .Media-Body {Margin-Left: 0px; } .Article_register_shortcode .Media-Body P {font-size: 13px; Line height: 20px; Margin top: 6px; margin-bottom: 14px; } .Article_register_shortcode .Media button a {float: unset; } .Article_register_shortcode .Secondary button {margin-bottom: 0; }}