- ETH fell 9% after airstrike, but whales collected more than $ 16 million due to direct purchases and Aave loans.

- Ethereum remains accessible; A drop below $ 2,400 can open the path to $ 2,150 support.

Following Israel’s air raid on Iran, whales whale the opportunity to collect Ethereum [ETH] Because the prices crashed considerably.

Of course, such an action aroused speculation – was this the start of the accumulation before a larger movement?

Borrow, buy and collect Ethereumwalvissen

During Asian trading hours, Onchain Data Nerd reported That a crypto -walvis $ 5 million borrowed from Aave and 1,844 ETH achieved worth around $ 4.6 million.

While there are two more Crypto walletProbably belonging to the same whale, bought 4,521 ETH for $ 11.7 million, giving a good example of a “Buy the Dip” strategy.

Source: X

$ 202 million in ETH outflow of stock exchanges

In addition, on 13 June, spot data from Coinglass alone revealed an exchange of $ 202.03 million from ETH Wallets.

Source: Coinglass

This substantial outflow is usually considered a sign of accumulation and can create purchasing pressure, or, in the current market situation, reduce sales pressure.

Critical battle zones for ETH

Given the current market sentiment, traders do not hesitate to bet on short positions.

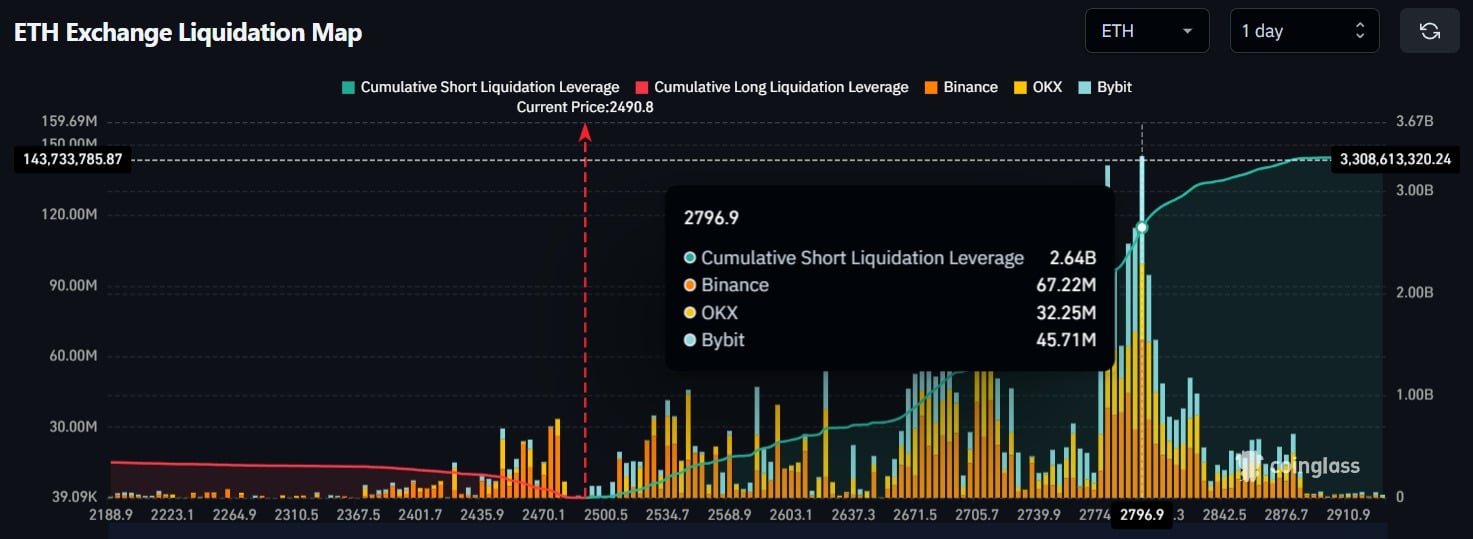

The liquidation map showed an enormous imbalance: short positions near $ 2,796 fell to $ 2.64 billion, while long positions at $ 2,440 had only $ 201 million.

Source: Coinglass

These substantial bets on short positions indicate a bearish sentiment in the short term among traders.

During the press, ETH is traded near the level of $ 2,505 and has registered a price fall of more than 9% in the last 24 hours.

During this period, the trade volume increased by 35%, which points to increased participation of traders and investors in the midst of the price dip.

Price slips 9%, but….

According to Ambcrypto’s technical analysis, Ethereum is still in its long -term consolidation range between the level of $ 2,409 and $ 2,730, which creates an accumulation zone for investors.

Source: TradingView

Based on a recent price promotion and historic momentum, when the price of the active boundary of this reach is approaching, it tends to experience an upward rally.

Given the current market structure, there is a strong possibility that ETH will continue to trade sideways until major developments take place.

Given the geopolitical tensions, however, a breakdown is firmly on the table. If ETH slips below $ 2,400, the following important support is close to $ 2,150 – a zone – bulls must defend to prevent a steeper slide.