- Whale sales contrasts with $ 3.3 billion inflow and long -term holders who add 881K BTC.

- N / a peaks, new address growth slows down and liquidation zones threaten increased volatility.

On June 11, Bitcoin [BTC] Accumulation portfolios saw the largest inflow of one day of 2025 and absorbed 30,784 BTC worth $ 3.3 billion.

This wallet, often bound to long -term holders and not linked to exchanges, now collectively have 2.91 million BTC.

This happened in particular while Bitcoin traded around $ 104,719, which reflected a daily decrease of 2.41%. Despite the short -term volatility, the size and conviction of this inflow suggest a long -term bullish bias.

This behavior implies that large holders position a potential benefit, even if the retail sentiment seems careful.

Whales versus LTHS

A prominent Walvispallet recently deposited 1,000 BTC worth $ 106 million to Binance and continued a sales line that started in April 2024.

So far, this wallet has discharged 6,500 BTC, which indicates a strong intention to achieve profit as the price approaches the most important resistance.

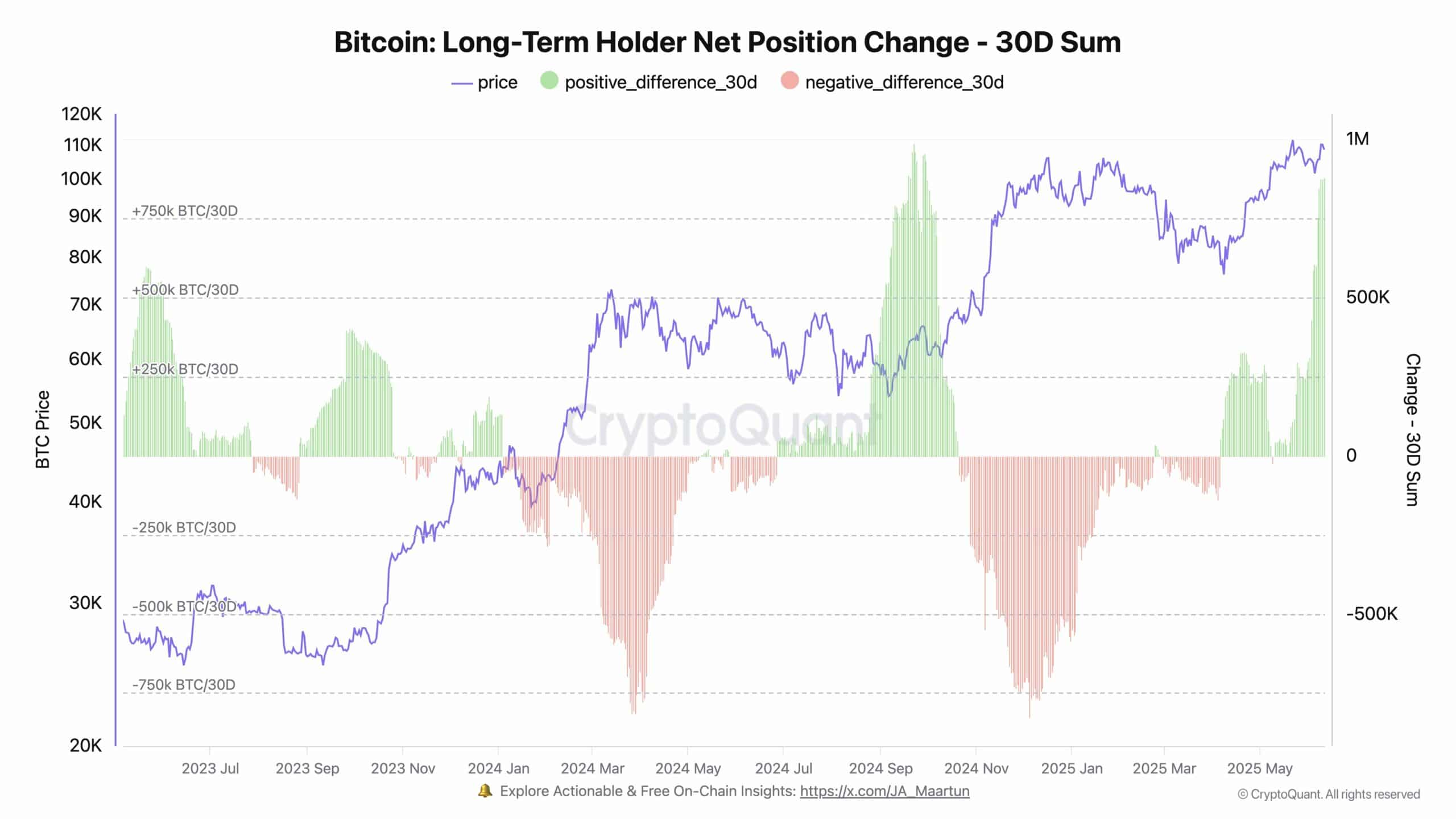

However, the whale still contains 3,500 BTC, indicating that it is not a complete output but a tactical distribution. Long -term holders, on the other hand, have added a stunning 881,578 BTC in the last 30 days, according to cryptoquant.

This aggressive accumulation reveals non-reversing convictions in the upward upward for Bitcoin uphill in the long term, despite short-term volatility and whale exits.

Source: Cryptuquant

Can Bulls conquer the $ 112k wall?

The price of Bitcoin has failed several times to break the $ 112k resistance. The market structure still leans bullish because of the rising trendline support.

However, the relative strength index (RSI) fell below 50 and emphasized the declining momentum. Therefore, unless buyers reclaim the $ 106k zone soon, increases the risk of a new withdrawal to $ 101K.

Nevertheless, Bulls can catch late shorters if they succeed in pushing the prices above this congestonone. Market decision around this level will probably define the next step of BTC.

Source: TradingView

Did BTC’s appreciate its usefulness?

The ratio of the network value / transaction (NVT) increased by 15.21% to 36.49, which reflects the growing divergence between market capitalization and transfer volume at the chain.

Such peaks have indicated historically speculative overvaluation. That is why this statistics now suggest that the price of Bitcoin can rise faster than the actual demand for transactional use.

If this trend persists, it can precede a local top. However, high NVTs can also occur in early stages of the high -time uptrends, especially when holders prefer accumulation over expenditure.

Source: Cryptuquant

What does BTC keep active?

In the past week, active addresses rose by 1.69%, while new addresses fell by 2.36%. This suggests that the current users remain involved, even if the new user’s inflow is slow.

That is why the market is probably running at the internal momentum instead of attracting fresh capital.

Although this dynamic can support short -term rallies, long -term sustainability usually requires the expansion of the user base.

Nevertheless, the increase in active portfolios signals still include that set holders are still participating, which stabilizes the network during uncertain circumstances.

Source: Intotheblock

Liquidation clusters focused on volatility

The 24-hour Binance Liquidation HeatMap emphasizes dense long liquidations of around $ 105k and $ 102k. That is why price movements in these zones can activate stop loss.

This setup increases the volatility risk as bears pushing under these thresholds. However, if BTC holds above $ 104k, this can catch short positions and initiate a relief bouncing.

These clustered zones often work as bending points and reinforce which side also gains strength. Consequently, traders must check these levels for sharp movements in both directions.

Source: Coinglass

Will holders in the long term feed the next outbreak?

Despite the price rejection in the vicinity of $ 112k and sold in the short term, long-term accumulation and record current in HODL portfolios are a strong conviction.

Network fundamentals seem to be mixed, with weakening user growth but steady activity of current participants.

Increased valuation statistics suggest caution, but the behavior of buyers implies trust in long -term benefits.

Therefore, if Bitcoin can reclaim $ 106k and defend important support, the next leg to new highlights could be underway.