Bitcoin (BTC) price has experienced increased volatility because the crisis in the middle -east indicates a further escalation. The flagship Munt fell no less than $ 103,396 on Tuesday, which resulted in a similar step for the wider Altcoin market.

As a result of the increased volatility, more than $ 513 million was liquidated from the crypto-delivered market, with the long traders being good for $ 421 million. Nevertheless, crypto traders remain optimistic for a bullish rally quickly as demonstrated by the BTC Fear and Greed Index, which floated around 68 percent.

Bitcoin -Question remains strong

As Coinpedia has seriously noticed in the recent past, the overall demand for Bitcoin is very increased by institutional investors. In the midst of the current short-term executions, the Bitcoin balance on centralized exchanges continued to fall to approximately 2.08 million at the time of this letter of 2.26 million on 24 April 2025.

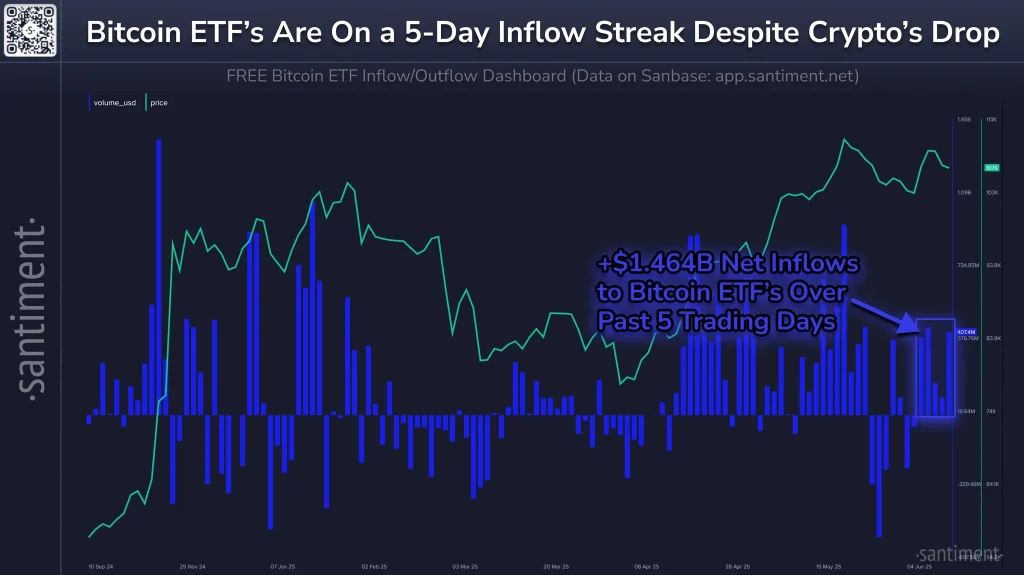

The American place Bitcoin ETFs and institutional investors, led by strategy and metaplanet, remain an important contribution to the falling delivery of BTC on centralized exchanges (CEXS). In the past five days, US Spot BTC ETFs have registered a net entry from cash of approximately $ 1.46 billion, led by BlackRock’s Ibit.

BTC Price reduced a bullish breakout from a falling logarithmic trend line in the two -hour period. Within the 2 -hour time frame, BTC’s Relative Strength Index (RSI) floated around over -sold levels, which suggests a rebound in the near future.

A consistent closure under the support range between $ 103k and $ 101K will, however, activate Bearish sentiment further in the following weeks.