- The price and value of Bitcoin increased considerably during the cycle

- However, miners have not kept pace with the aforementioned wave

In the past year, Bitcoin’s [BTC] Price performance in the charts were impressive, with the crypto several Aths hit. In fact, this period also saw its market capitalization to a new highlight of $ 2.1 trillion climbing.

And yet other market players have been difficult to confronted lately. Bitcoin miners are a good example of this.

The correlation of Bitcoin with the market hoods from Mijnbouwbedrijf is falling!

According to AlphractaL, The correlation of Bitcoin with crypto -mining companies has fallen considerably.

When such a market scenario comes, it often refers to a imminent volatility or a potential trend removal on the charts in the short term.

Source: Alfractaal

Normally, as the price of Bitcoin and market capitalization rise, the market caps of mining companies such as Marathon do. So the two usually move together because they are correlated.

This is because miners earn income from BTC, have significant reserves and are directly influenced by them. That is why when Bitcoin climbs, shares from mining company usually do that, and vice versa.

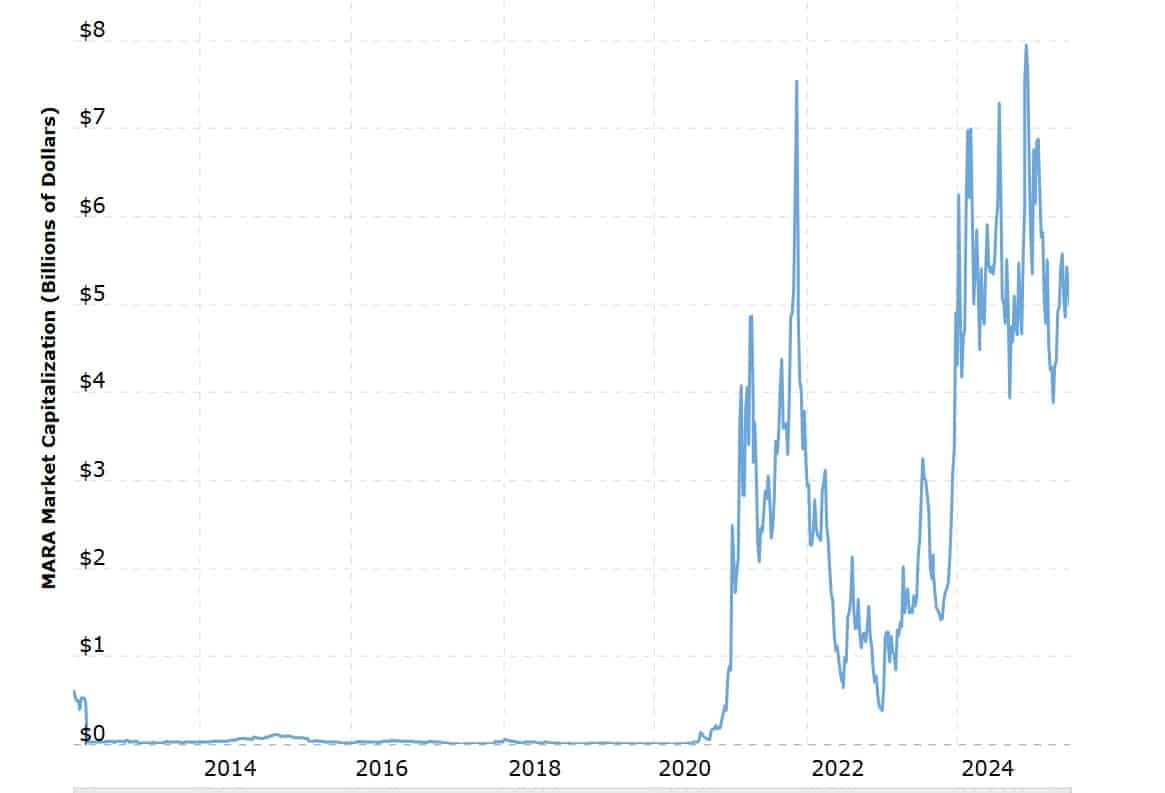

Source: Macrotrends

At the time of writing, this correlation seemed to break down. Since December 2024, for example, the market capitalization of Mara has fallen from $ 7 billion to $ 5 billion.

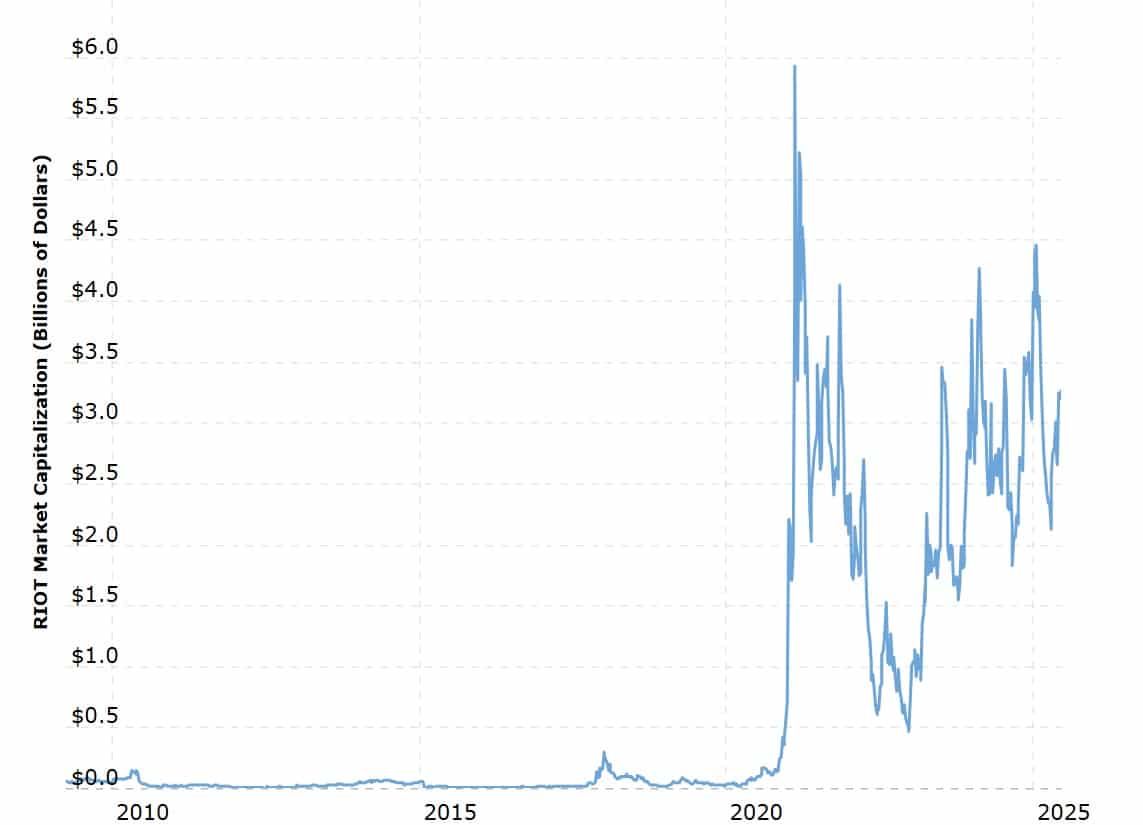

A similar pattern could be seen in the case of riot platforms, in which its market capitalization falls from $ 3.48 billion to $ 3.2 billion.

Source: Macrotrends

The aforementioned breakdown in correlation can also be proven by a look at the reserves of the miners. In 2025, figures fell for the same from $ 1.81 million to $ 1,807 million.

What this means is that miners have sold their BTC, which is probably the reason why their market value has fallen. When they load and reduce their possession, the value will fall, despite higher prices.

Source: Cryptuquant

What does this mean for Bitcoin?

When Bitcoin’s price and mine shares vary, this may mean that the market is about to move quickly. Under these circumstances, the price of Bitcoin can go up or down.

Historically, this also has a leading volatility indicator. Especially since the behavior of miner refers to a shift in the health of the market.

For example, during the COVID-19-Crash, bitcoin and miner values fell together. The same happened in 2022, after the FTX episode, which indicates a drop that marked a regime shift.

However, it is still worth noting that this is not necessarily bullish or bearish, but simply a regime shift. Mijnwerkingsing shares often fall and rise for Bitcoin. Therefore, if the decrease becomes significant, we could also see BTC pay off.

Bitcoin can currently disconnect because it enters a strong rally. Although macro -economic conditions may not be beneficial for mining companies.