- Ethereum’s Taker Sales volume spoke at $ 10.3 billion, which reflects a strong market -wide sales pressure from whales and retailers.

- ETH fell to $ 2.3k before he recovered to $ 2.4k, while Dip-Buyers absorbed the Bearish Golf.

Since he hit a local highlight of $ 2.8ka week ago, Ethereum [ETH] has exchanged within a falling channel. On the last day, ETH became a low point of $ 2.3k, which reflected a strong increase in close pressure.

This drop did not come from nowhere.

The price struggled to keep float as the profit booking increases. Of course the more ETH floated in a narrow band, the more holders chose to load, which revealed decreasing beliefs.

$ 321 million in a minute?

According to Cryptoquant Analyst Marchun, Ethereum witnessed an important peak in sales pressure.

He saw that Ethereum’s Taker sells volume All exchanges rose considerably and registered more than $ 321.3 million in one minute.

That is not a routine withdrawal. It marked intense aggression on the sales side, where both whales and retailers contribute to the peak in volume.

Source: Cryptuquant

A total of ETH registered a total of $ 10.3 billion in Taker Sell Volume before he cooled to $ 839.6 million. This level of activity often reflects anxiety or aggressive profit making.

Of course the panic was not only reflected in trade volumes. ETH also registered 1.2 million coins in exchange flows, usually of whales.

Source: Cryptuquant

Who buys what they sell?

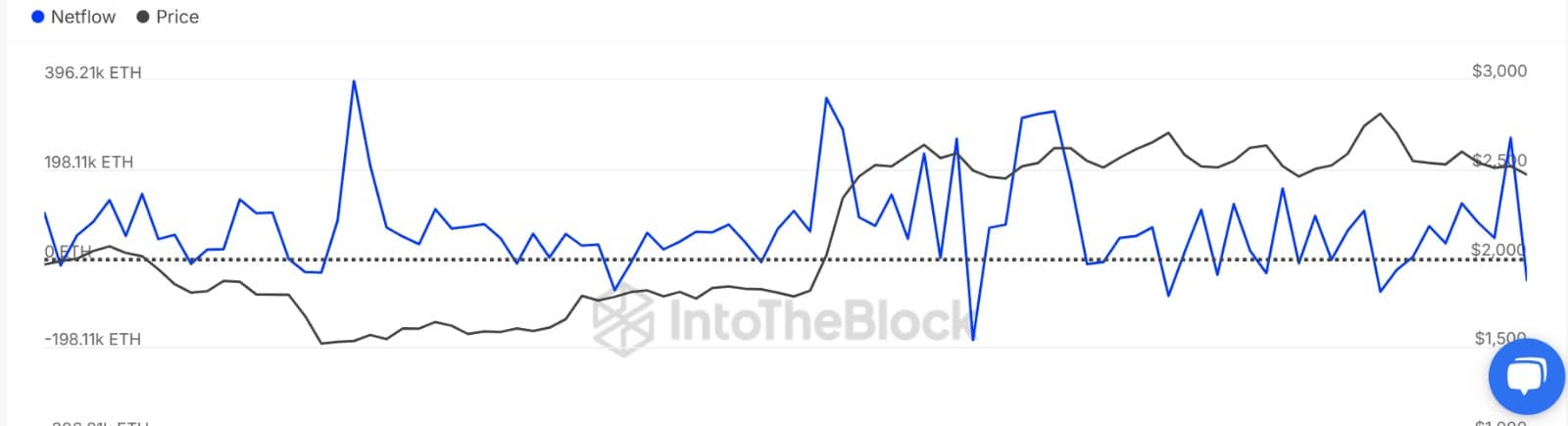

When we watched Netflow large holders, the data indicated that whales sold 519k ETH while buyers wrote 471K ETH.

This leaves a negative Netflow of -48.75K ETH, which indicates a higher sales activity of Ethereum great holders.

Source: Intotheblock

Such a negative netflow, in combination with increasing inflow and increased -selling tax volume, created a strong bearish sentiment. Or holders were defined or scrambling to reduce losses.

Buyers gets in, but is it enough?

As expected, this increase in sales activity had the price movement of ETH. It slid briefly from $ 2.5k to $ 2.3k. But that was not the end of the story.

At the moment, Ethereum recovered to $ 2,424. This mild rebound hints that some buyers saw the chance to buy the dip, absorb the pressure and stop further down, at least for the time being.

Wait for this tipping point!

Source: Cryptuquant

Interesting is that Exchange Netflow became negative, with outflows that beat the inflow with around 3.4k ETH.

Simply put, Ethereum buyers entered the market and the recently witnessed sales pressure. Yes, that is usually a bullish sign.

That said, the battle is not over. ETH has returned to a consolidation zone, where bulls and bears are locked in the short term.

Therefore, if the bulls can cover their positions, the ETH will encourage $ 2575 to reclaim, which is an important level to keep Bullish Momentum alive. Conversely, if sellers make the market again, ETH could fall to $ 2350.