- ETH repeats a effectively -known value sample, with a possible distribution part forward.

- Rising ETF Holdings and CAP realized hints for a shift in market dynamics.

Ethereum [ETH] Appears to repeat a effectively -known sample. Often the worth motion of altcoins of earlier observations follows a phases for accumulation-manipulation distribution.

Throughout the earlier Bullish Run in November, ETH witnessed a rise of 42%, a brief time period of value consolidation adopted.

After this there was a definitive distribution part with a successive value rally of 21%, making a document excessive of $ 4.1k. The value stage is taken into account the all time to day.

Historical past seems just like the every day graph and appears to be repeating itself.

Because the latest outbreak of the Bullish flag on 8 Could, costs have risen with an analogous proportion (42%) and gave the impression to be in a consolidation time in a consolidation part.

May a comparable distribution part comply with for a possible 21% rally, in all probability past $ 3k milestone value?

Supply: TradingView

Outstanding, The stochastic RSI, a momentum indicator that follows value motion primarily based on latest highlights and lows, waS is approaching the introduced zone on the time of the press – a area that would flash breakout alerts.

No assure, however this setup is a hand to credibility of a possible rally within the value of ETH.

ETH Capital Inflow suggests rising belief

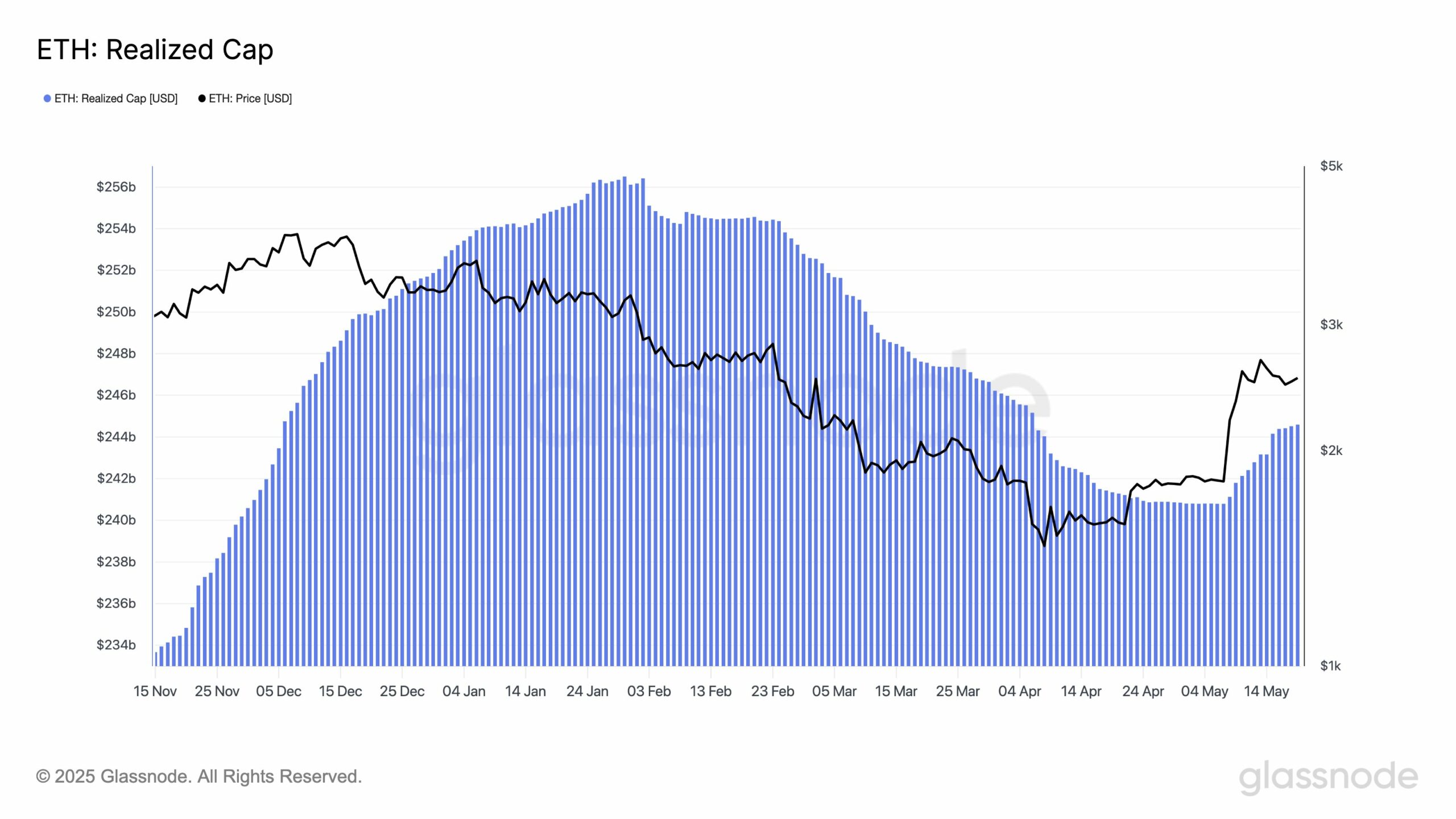

Ethereum’s realized capital, which displays the overall worth of all ETH on the value that they have been final transferred to in Could in Could to deal with our analytical lens on the chain statistics that displays the overall worth of all ETH.

It moved from $ 240.8 billion on 7 Could to $ 244.6 billion on Could 19.

The increase of $ 3.8 billion is an indication of an elevated perception in holders and suggests an inflow of latest capital.

Supply: Glassnode

The sort of speedy enhance normally signifies much less gross sales strain, as a result of extra buyers hold ETH with greater values. It signifies that Ethereum shouldn’t be solely traded, however can also be held for the long run.

The Golf tends to strengthen the bottom for a possible bullish rally as implied by the technical indicators Bullish bias.

ETF firms is gaining energy

Institutional gamers additionally make actions. In line with ambcrypttos of cryptoquant -data, ETF firms are quickly rising, which signifies a renewed investor’s curiosity.

With spot eth ETFs that get energy after approvals from Bitcoin ETF, a bigger capital influx can comply with quickly.

These firms normally replicate the institutional sentiment and the rising development means that establishments steadily warmth up for the lengthy -term views of ETH.

Supply: Cryptuquant

With restored technical momentum, extra realized capital influx and a rising ETF publicity, the foundations of Ethereum look higher. If the present tendencies persist, the trail to $ 3,000 shouldn’t be distant.

The projected goal at $ 3.3k is inside Eth radars.