- XRP Futures ETF debuts strongly with nearly $ 6 million in commerce quantity on the primary day.

- Spot XRP ETF approval is gaining power regardless of sec -delay and steady authorized obstacles.

Ripple [XRP] attracts renewed institutional curiosity after the headwind of the rules lastly ended after 4 years.

On Could 19, CME Group launched his XRP Futures ETF, with a powerful day by day buying and selling quantity of just about $ 6 million on debut.

CME’s XRP ETFs carry out higher than ETFs?

That stated, the newly launched XRP ETFs have rapidly surpassed Ethereum [ETH] Futures ETFs in efficiency, which signifies strong institutional curiosity.

If the momentum continues, XRP can problem Bitcoin [BTC] Futures ETFs. Nonetheless, reaching that degree stays bold. BTC ETFs frequently see commerce volumes within the billions.

Nonetheless, the early success of XRP merchandise reinforces the matter for future approvals from Spot ETF.

XRP drives on this institutional wave and has seen a substantial worth rally. It skipped 1.33% to $ 2.33, with open rates of interest rises at $ 4.69 billion, on the time of press.

Day one among commerce – particulars

CME group information reveal The XRP -Futures had a powerful debut. 4 normal contracts traded on the launch day, every representing 50,000 XRP. This was good for round $ 480,000 in a notional quantity at a mean worth of $ 2.40.

Most actions got here from 106 micro contracts, every masking 2,500 XRP. Collectively they’ve contributed greater than $ 1 million in further quantity.

This buying and selling sample signifies that giant gamers enter the market. On the identical time, smaller institutional contributors are actively engaged on XRP -Futures from the beginning.

Though the SEC postponed the assertion about a number of crypto ETFs, together with that related to XRP and Solana [SOL]Momentum round XRP funding autos continues to develop.

ETF Retailer President Feedback on Spot XRP ETF

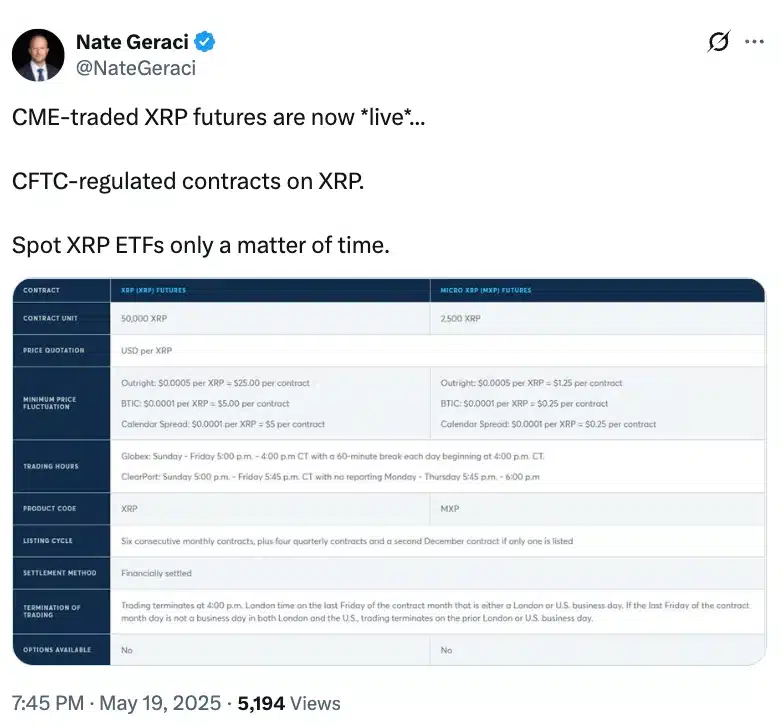

Be aware about this, the President of the ETF retailer, Nate Geraci, just lately emphasised X (previously Twitter) that place XRP ETFs are inevitable.

This emphasizes the significance of CMEs Stay, CFTC-regulated XRP-Futures contracts.

Supply: Nate Geraci/X

Sentiment on decentralized prediction platform Polymarket Additionally stays optimistic, with a likelihood of 83% priced for any approval.

However with the applying from Franklin Templeton now pushed till 17 June, within the coming weeks it may be essential in shaping the following part of institutional entry to XRP.