The next is a visitor submit and evaluation by Shane Neagle, editor -in -chief of the Tokenist.

With Bitcoin Dominance climbing to a spotlight of 4 years of 63%, it’s clear that the Altcoin market is just not doing so nicely. Many a memecoin has taught the crypto expertise, along with a continuing era of latest tokens that dilute the market.

Nonetheless, it stays the case that the underlying promise of blockchain know-how is to take away the intermediaries from monetary transactions. What’s much more vital to innovate peer-to-peer financing in a manner that leaves legacy banking.

Such a transparent instance of pushing monetary innovation is LSDFI, shortly earlier than derivatives for using liquid. Conventional funds (Tradfi) can not replicate it in its present Legacy framework. This alone makes it probably that the non-bitcoin facet of crypto perseveres.

Let’s have a look at how LSDFI defines capital effectivity and the way we will greatest use LDSFI.

How does LSDFI out-engineer Tradfi do?

In Tradfi we have now many monetary primitives, with the commonest money, loans, mortgages, bonds, shares and derivatives. These are the core blocks with which legacy finance builds, shops and switch to a contemporary economic system. Monetary devices, corresponding to ETFs, are then used to control these primitives for custom-made functions.

In blockchain-driven Decentralized Finance (Defi), the first primitive contract is the sensible contract corresponding to ERC-20, which represents kinds of belongings. The sensible contract, as a self -executive code on the blockchain that works 24/7, is the principle motive why Defi is a lot extra versatile and modern -friendly in comparison with Tradfi.

Within the case of LSDFI that is performed within the following manner:

- By way of self-spice portfolios corresponding to Metamask or Belief pockets, customers use their main belongings, often Ethereum (ETH).

- Setting is an integral characteristic of block-of-stake (POS) block chains. Establishing Capital alternative of energy-based computing energy that’s current in Bitcoin’s proof-work community (POW) serves the identical operate for securing the community as a type of collateral towards misconduct.

- Along with setting basicists, Defi protocols corresponding to Lido add an additional layer of flexibility by pole swimming pools, so that every quantity may be set plus accrued rewards for securing the community.

- In flip, such protocols generate a by-product smoke, within the case of Lido Steth, who represents Capital Studes. In different protocols corresponding to Rocket Pool, the by-product token could be dominated.

- These tokens, as liquid set derivatives (LSDs), unleash the consumer of locked capital, due to this fact they’re referred to as liquid.

- As such, LSDs can be utilized as composite primitives in mortgage collaterals and yields of agriculture, whereby customers provide liquidity to token swimming pools which were utilized for borrowing.

So as to say in any other case in additional exact situations, sensible contracts make it attainable to take away the inflexibility of native growth by releasing derivatives. These programmable belongings allow customers to take care of publicity to yield and on the identical time unlock liquidity.

Such an analogue doesn’t exist in Tradfi. The closest parallel is a financial savings account, the place registered funds earn curiosity whereas the financial institution calls them. However not like Defi, the preservator can’t re -use or make the most of financial savings capital elsewhere.

Derivatives in Tradefi exist as complete return weapons, choices or preservators, however these are one -off constructed and Siled devices. LSDs, then again, are pluggable, modular monetary blocks, free to roam between Defi protocols to make use of liquidity.

It’s ample to say that this is a vital achievement in monetary engineering, derived from the next mixture of capabilities:

Interoperability + transparency + capital effectivity

And since the usefulness of LSDs goes past their passive publicity, which Defi protocols make one of the best to make the most of their unchained liquidity?

The place to position LSDs?

In the end, the usefulness of LSDs relies on the usefulness of Defi protocols which might be prepared to simply accept them as such. That is already an issue as a result of there are numerous liquid insert platforms which have several types of LSD’s churn.

Lido ($ 22.18b TVL), Binance Stusted ETH ($ 5.4B TVL) and Rocket Pool ($ 1.6B TVL) are the most important throughout the inside Ethereum -EcosystemDelivering 2.4% – 2.7% annual proportion (ARR) revenues. For comparability, the common S&P 500 dividend income are floating round 1.27% for 2024, decrease than 2023’s 1.47%.

After all, these established liquid deployment protocols provide better safety and decrease dangers, the alternative of smaller Defi platforms. When there’s a excessive liquidity participation, corresponding to in Lido, that is watering down within the course of, which results in decrease yields.

Conversely, when the liquidity participation is comparatively low, the yield will increase as an incentive to draw extra individuals to supply liquidity. Instantly we see that it is a dynamic course of that requires fixed consideration from the consumer.

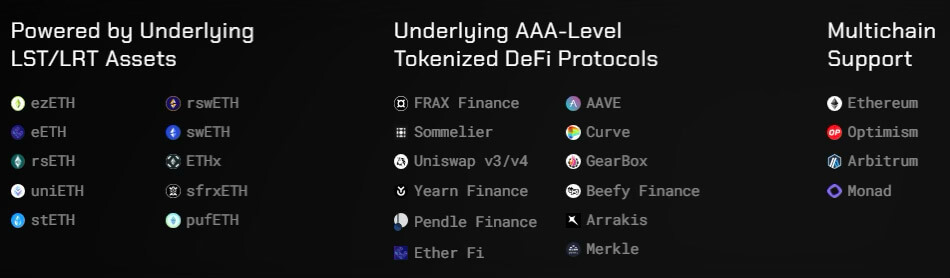

Nevertheless, this requirement alone units up a wall of complexity that’s too excessive for many Defi customers to be busy. Because of this, Defi protocols emerged to gather a number of LSDs to supply income choices. Such an answer is amplified protocol, particularly designed to combine a number of liquid reinforcement sticks (LSTs – subset of LSDs), relying on the altering liquidity situations.

For large acceptance, even inside Defi, it’s clear that this “Defi 2.0” push is critical to completely make the most of the potential of LSDs. Within the meantime, Legacy Defi protocols relieved a 12 months of financing LSD publicity by a combining token Yeth. By depositing one of many seven supported LSTs, with an APR with a big Lido yield, customers mint about 2.7%.

Within the meantime, traders should look past native tokens at Stablecoins.

By being tied to the greenback, Stablecoins are extra appropriate for the creditara as a result of they scale back the value limitation. This in flip creates a better demand and a better demand for stablecoins results in bigger yields. A great instance, locking ETH in Lybra Finance to Mint Eusd Stablecoin often delivers an APY between 6% to 7%.

Likewise, the rival chains of Ethereum have a decrease Defi -market share, which results in a better demand for liquidity. In Solana’s ecosystemJito Liquid STACK (JTO – $ 2.9 billion TVL) provides an APY of 8.13%, during which Sol Sting Mintosol -Tokens -these can then transfer over Defi apps which might be corresponding to how customers take care of Perpetual futures contracts On centralized crypto festivals – besides with the additional good thing about incomes the yield.

Jitosol -Tokens can then be utilized in Marginfi, Kamino Finance or Drift to earn much more Jitosol yields for delivering this liquidity. In the intervening time, nevertheless, Solana’s Jpool appears to ship the best yield for Stusted Sol, with 11.93% APY.

For traders who wish to diversify in a number of chains of a single platform, there’s Meta -Pool, which at present has TVL of $ 89.4 million over greater than 18k strikers and eight supported chains.

The Backside Line

LSDFI is a monetary enviornment that’s most fitted for fanatics who’ve the time and curiosity to study, experiment and to implement advanced methods. As with each sophisticated system, the extra superior it turns into, the extra the friction introduces, which places on broad participation. For many it’s higher to take a position about memecoins, having fun with tokenized playing regardless of their lack of foundations or usefulness.

Maybe that is the most important foible of Defi and Blockchain-driven funds. It’s also the paradox of innovation: probably the most highly effective instruments are sometimes the least accessible. Though Defi gives the promise of autonomy and open finance, it requires absolutely coping with time, technical fluency and a excessive tolerance for dangers – boundaries that exclude the bulk.

Nonetheless, LSDFI gives a compulsory look in a monetary future after the financial institution. And simply as solely a small minority understood the worth of Bitcoin early, those that prioritize the lengthy -term basis above can in the end be paramount to the next monetary evolution within the brief time period.