- Bitcoin noticed a excessive commerce quantity on the derivatives markets, however not on the spot markets.

- The development of liquidation ranges at $ 100k and decrease the costs may decrease.

Bitcoin [BTC] reached a file excessive of $ 111,980 on Binance on Thursday on 22 Might. It was reported that the open curiosity (OI) reached a file excessive of $ 74 billion. The inflow of capital into the derivatives market in current days meant Bullish conviction.

On the identical time, numerous liquidations have been constructed up beneath the extent of $ 100k. This may entice the worth to the south, as a result of the worth is attracted by liquidity. Ought to merchants count on a withdrawal within the brief time period?

Supply: Coinyze

Information of Coinyze confirmed that the OI pattern was flattened after BTC has reached a brand new all time. The financing velocity had been extremely optimistic, however within the final 24 hours it has fallen to impartial ranges.

Merchants should put together for a withdrawal within the brief time period

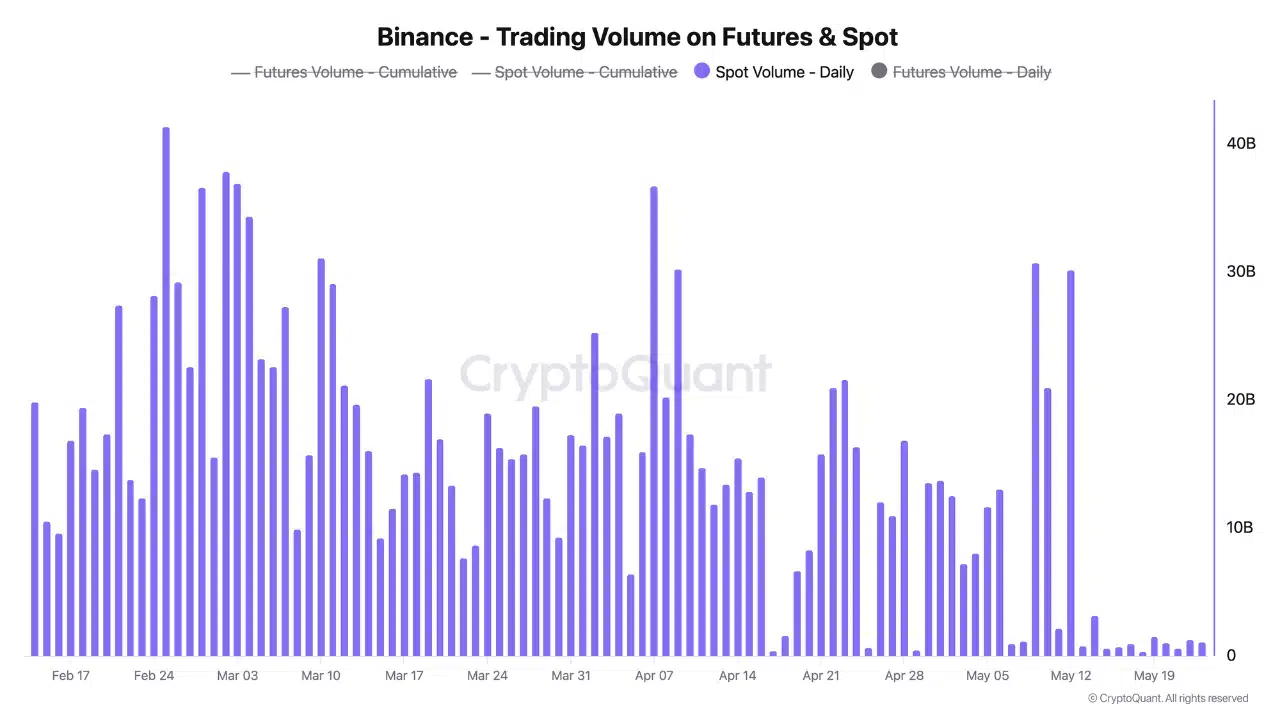

Supply: Cryptoquant

In a message about cryptoquant insights, consumer Darkfost Be it that the spot demand decreased. The futures buying and selling quantity went robust and emphasised a excessive speculative significance. But the lower within the spot quantity was when Bitcoin entered his worth discovery part a disappointment.

The shortage of spot demand recommended that traders have been cautious with shopping for BTC above the $ 94k $ 96k space. This area had earlier in Might as a resistance earlier than the worth broke out to nearly contact the $ 112k marking.

A rally led by the derivatives market can run the chance of elevated volatility and deeper withdrawal.

Supply: BTC/USDT on TradingView

The 1-day graph of Bitcoin zooms out to cowl the worth motion of the previous six months, emphasised a attainable vary (white). Two routes have been attainable within the coming weeks- a persistent uptrend, or a reset to $ 100k and even $ 93k.

When shapes attain, worth motion inside attain causes the liquidation ranges to construct across the extremes of the vary. The retracement as much as $ 77.5K in March and the next restoration noticed brief liquidations constructed up at $ 99.6k, $ 108k and $ 113k.

The primary two ranges have been swept. The lowering spot demand recommended {that a} market set was attainable and that $ 113k is out of attain in the interim.

Supply: Coinglass

The three -month graph underlined the development of liquidation ranges at $ 100k and $ 92k as the subsequent potential targets.

Relying on the worthwhile exercise and whether or not the bulls can discover their ft once more, Bitcoin can once more give $ 106k to the bears.