- Bitcoin Traders select to threat within the midst of uncertainty

- If historical past is a information, volatility might be an engine

Bitcoin’s [BTC] Volatility is the best energy and the deepest mistake. Even with establishments that buy, corporations that preserve robust and picked up sensible cash, it’s 120 days since BTC got here nearly $ 110k.

So what does it cease? Whereas ambcrypto marked, traders have held revenue to keep away from deeper drawings.

Though that will appear Bearish, it has not been with out a strategic benefit. In that sense, Bitcoin’s volatility can construct up the momentum for the following leg.

Distribution and volatility alerts in the long run

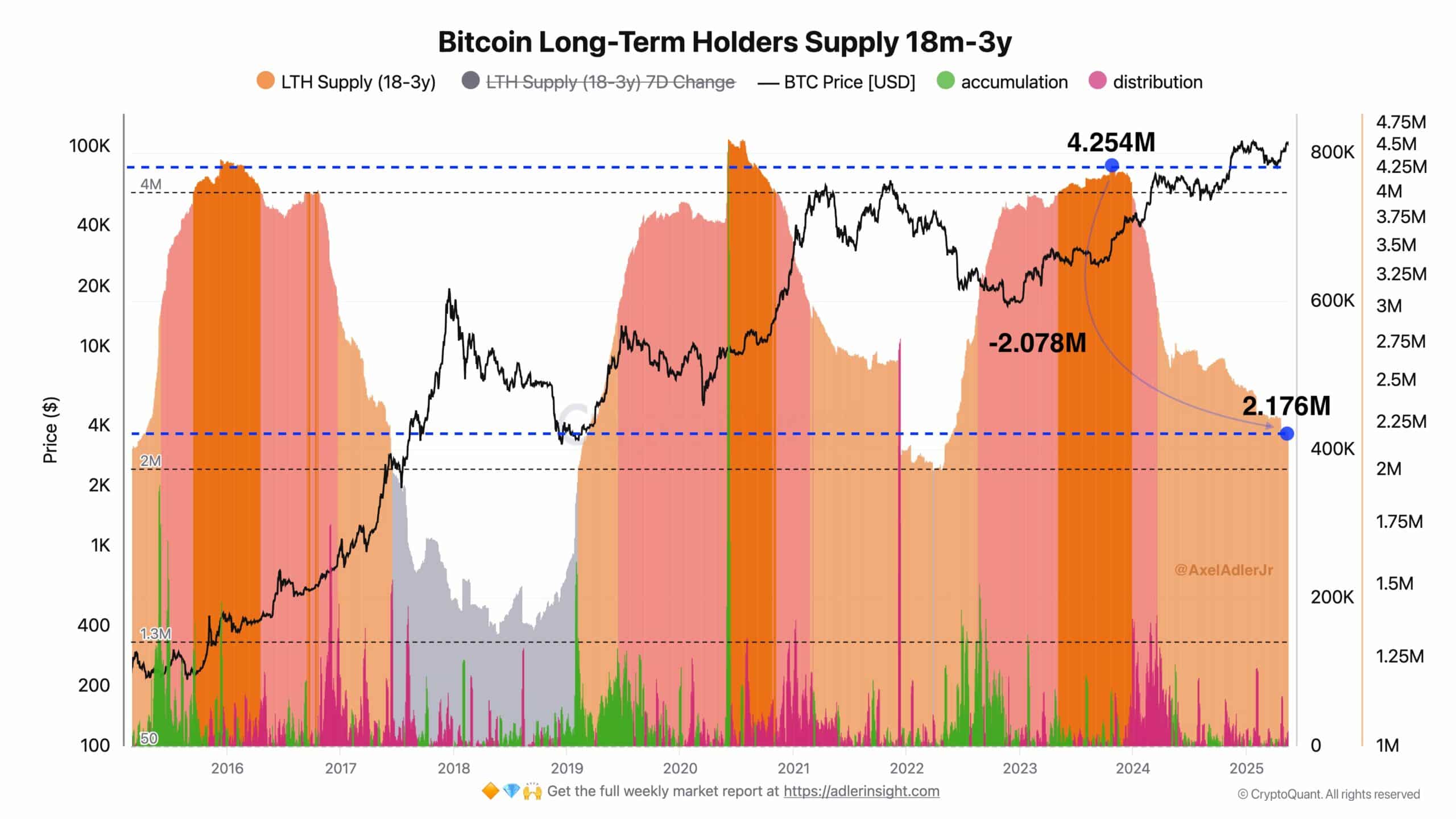

The hooked up graph revealed an necessary development.

Since November 2023, long-term holders (LTHS) have discharged that with BTC from 18 months to three years than 2 million cash. They’ve yielded round $ 138 billion in realized earnings.

Supply: Cryptuquant

This regular lower in LTH meals, from a peak from 4,254 million to 2,176 million BTC, is an indication of a transparent distribution part. It even appears to be like rather a lot like what we’ve seen throughout earlier bear markets.

Particularly in 2022, when the same sample preceded an annual lower of 63% of Bitcoin’s opening of $ 46,017.

What makes the present cycle totally different is the result. Regardless of related ranges of lengthy -term distribution and worthwhile, Bitcoin is to proceed to traits. It has risen nearly 200% in the identical part.

That tells us that one thing has modified. As an alternative of inflicting a crash, all this sale and volatility can shake issues and type the stage for a stronger, smarter accumulation.

Bitcoin’s subsequent huge likelihood

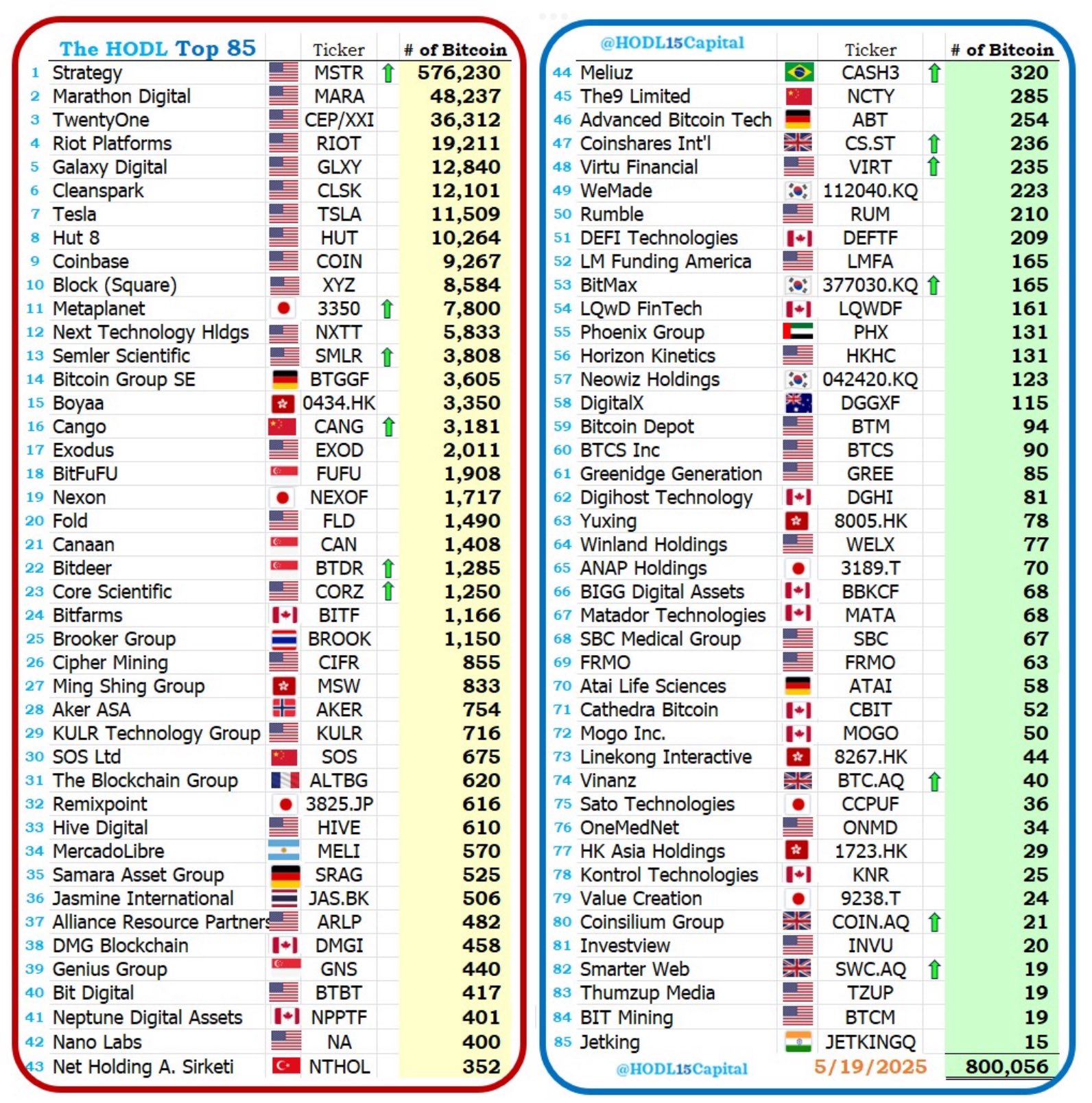

Following this cohort carefully is important. Primarily based on their present BTC treasure field, data-driven evaluation of a Leading expert projects That Bitcoin of a most of 500K might come in the marketplace in direction of the top of the 12 months.

This will imply the construct -up of a major wave of exit -liquidity under the floor.

In accordance with Ambcrypto, such a launch will inevitably put the volatility of Bitcoin underneath renewed stress. That’s the reason the power of the market to soak up massive -scale distribution to check with out disturbing the broader rebellion.

Nonetheless, with institutional and enterprise curiosity in Bitcoin that now surpass ranges which are seen within the 2023–24 cycle, this volatility might be lower than a risk. As an alternative, it might look extra like a special likelihood.

Supply: X

If historical past is a information, Bitcoin might once more display his resilience, bulls provide strategic entry and type the stage for additional worth discovery.