A liquidity of an unexpected setback is an unexpected setback, as a huge whale that was identified as HTX, 93% of the available USDT removed from one of the best credit pools. This locks other whales in a position where they cannot remove their interests, because most USDT is already claimed by borrowers.

A gigantic whale removed up to 93% of the available USDT liquidity on Aave, which means that all other credit givere fish were in their positions. USDT has a high use rate on Aave, because it is one of the preferred assets to borrow.

An address that was identified as HTX, formerly Huobi, withdrew $ 400 million USDT in a single transaction.

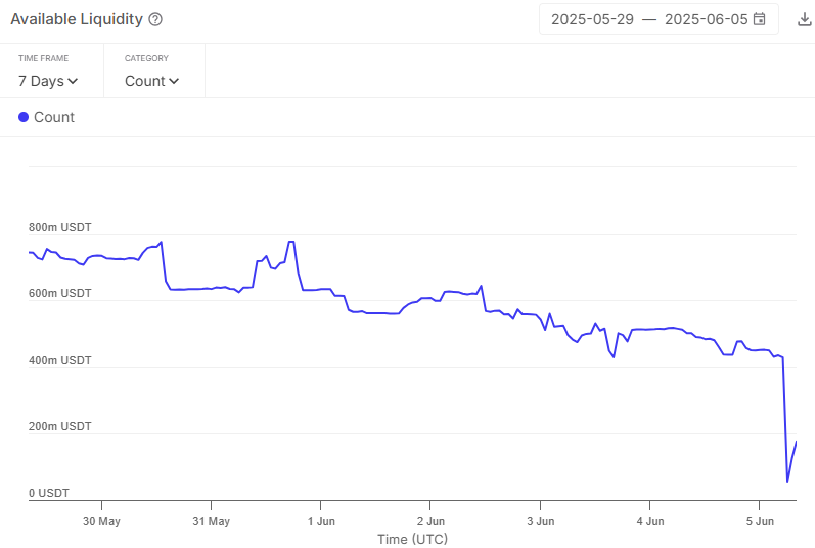

Liquidity in Aave USDT -Pools crashed in the short term before new deposits prove to be the growing yields. | Source: Defi -risk

HTX has moved part of its USDT last week, as observed by analysts in chains, with the potential to allocate the liquidity to other tasks.

The Huobi Recovery wallet and the HTX 52 wallet were involved in a series of USDT operations. In the past, portfolios have also linked to Justin Sun USDT deleted Van Aave for a series of swaps between chains, which also involves Binance to move between the tron and ethereum versions of USDT.

Available liquidity on Aave V3 has fallen by more than $ 307 million in the last 24 hours, which immediately led to a large peak in USDT rentet rates. The removal of liquidity led to an immediate peak in the apy of the swimming pool, with spikes as high as 40% on an annual basis. All remaining money lenders make big profits, although they cannot remove their liquidity.

The exact purpose of the recent liquidity operation remains uncertain. Top Defi apps continue to attract whales for their passive income chances, but are also vulnerable to comparable large-scale liquidity activities. HTX remains one of the best deposits in Aave and still delivers considerable liquidity to loan pools.

HTX recording caused a short-term peak in borrowing, deposit rates on Aave V3

Immediately after the large uptake of liquidity, borrowing retained a percentage of 28.6%, while deposits fell by 24.65% in an annual basis. The rates continued to normalize within an hour after the large -scale withdrawal, to sink back to 8%, still an unusually high level.

更新 : 不要小瞧搬砖人的力量啊!😆

短短半小时, USDT 存款 APY 已经降回 8.07% 了 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们 太有实力了朋友们

不过 htx 目前仍是 aave USDT 存款金库的榜一大哥 尽管撤走了 尽管撤走了 4 亿枚 USDT 也还有 12 亿枚 占总存款数量的 占总存款数量的 占总存款数量的 占总存款数量的 占总存款数量的 占总存款数量的 32.6% pic.twitter.com/hklwcooydhu

– AI 姨 (@ai_9684xtpa) 5 June 2025

After the big withdrawal, Aave started to pull deposits from other whales, make an attempt to make the best out of the situation and grab the niche that was opened by the HTX payment.

Aave has not been capitalized and, according to analysts, still has $ 1.2 billion in available USDT, including Stablecoins. However, the recent withdrawal showed that Defi is still unpredictable when it comes to available liquidity and rates.

HTX sent the money back to a well -known address from Huobi Recovery without a earlier warning.

USDT -Relocation turned out to be a stress test for Aave

The recent withdrawal only influenced one USDT pool, with sufficient liquidity in other assets, as well as USDT. After the news, Aave -Tokens only suffered a small setback and lost 2.7% to $ 262.90.

The ability to withdraw $ 400 million without influencing the protocol revealed the resilience of Aave and the self -correcting nature of Polish.

Aave V3 is currently committed $ 24 billion Locked in value, borrowed by more than $ 16.6b. The health of the protocol is also linked to the significant delivery of Native Stablecoins GHO, with more than 238 m in circulation. Aave remains the leading credit protocol, with versions on more than 23 chains.