- Aave has published a message to fully explain how V4 architecture relates to V3.

- Although markets are independent between networks in the V3 architecture, all assets in the V4 are united in a liquidity hub.

Last year, the company behind the Decentralized Finance (Defi) Lending Protocol Aave, Aave Labs, a management proposal to collect community feedback on its groundbreaking upgrade to its next generation version 4. At that time, the development time line was announced to stretch from the second quarter of 2024 (Q2 2024).

A message has been published to fully explain how the Aave V4 “the Ethereum of Defi -Loingen could become” and how it differs from the V3 architecture.

In the V3 architecture, the protocol was emphasized to use independent markets on various networks. What it means is that every market has its insulated liquidity pool. Assets delivered to the V3 are supplied to specific markets and cannot be borrowed outside the jurisdiction of that market. The inability to use liquidity on one market to meet the demand of borrowing in another leads to frictions in the launch of new markets.

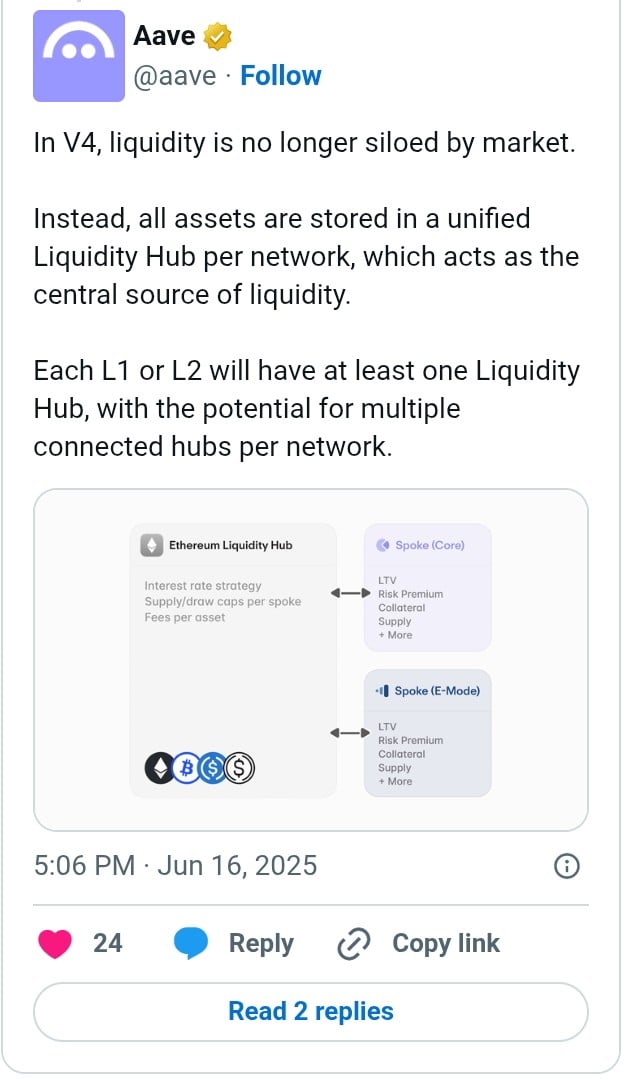

The Aave V4 architecture has a fascinating effect. According to the report assessed by CNF, all assets in V4 “are united in a liquidity hub based on the network.”

When users deliver assets to AAVE V4, those assets are stored in the liquidity hub, but the user does not interact directly with the hub. Instead, the liquidity hub works behind the scenes, while users deal with different spokes as an access point to the protocol. The liquidity hub follows all assets using a shares -based system that makes calculations more efficient and keeps everything within the right limits if interest rates accumulate over time.

Spaken have been reported as a part of Aave 4 that is handled directly by users. Each can offer specific loan and loan functionality because they are connected to a liquidity hub. With every spoke that is designed to have its own rules and institutions, they can be seamlessly optimized for captured ethderivates, stablecoins, etc.

Some remarkable benefits of Aave V4 and recent updates

In comparison with the previous versions, it is said that Aave V4 prevents the fragmentation of capital between networks to the same chain. The liquidity flow via the liquidity hubs increases use and ensures that both suppliers and borrowers have access to better rates. Above all, this architecture encourages innovation, which is more difficult in the previous version.

In the meantime, the Aave effectively functions and attracts breathtaking partnerships with Ripple’s Stablecoin Rlusd that integrates on the core market, as noted in our earlier post.

Aave has also started a strategic initiative to upgrade his tokenomics by starting phase one recently, including the Buy and Distribute program. As detailed in our last news item, a token sale of $ 4 million was approved with a weekly allocation of $ 1 million for a month. In the meantime, the program is expected to continue for six months.

Apart from this, Aave has made an effort to rub shoulders with industrial giants through partnerships and upgrades. As described in our recent blog post, it works together with Chainlink to integrate his Smart Value Recapture (SVR) service.

In the midst of the background of this, Aave is struggling to keep above a crucial level of support, as it drops by 3% In the last 24 hours to act at $ 276. According to our recent analysis, the actual trend can probably break out to reach $ 300 in the short term. A handle above this level can send the price to $ 338, as also stated in our previous newsletter.