Good morning, Asia. This is what makes new in the markets:

Welcome to Asia Morning briefing, a daily summary of top stories during American hours and an overview of market movements and analysis. For a detailed overview of the American markets, see Coindesk’s Crypto Daybook Americas.

The Blockbuster deal from Telegram with Xai, with which the AI company of Elon Musk would integrate into Telegram and the two companies share income, is still a work in progress despite an announcement of Pavel Durov earlier Wednesday, US Time, that the deal was inked.

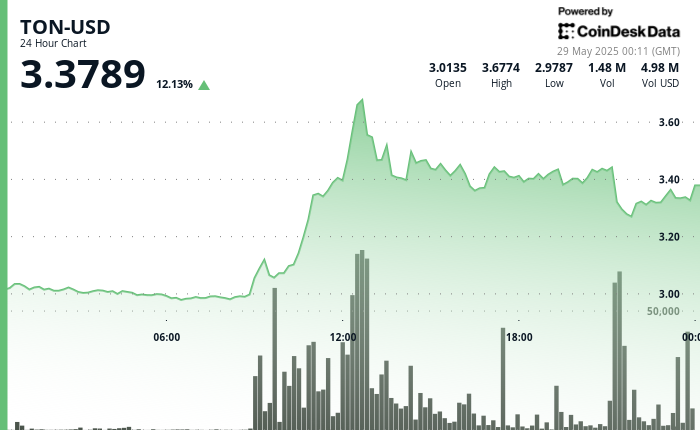

Ton, a token that is affiliated with the telegram ecosystem, is traded at $ 3.30 and collects there from $ 3 after the first – now refuted – has been announced of the partnership. The token has been removed from an earlier high of $ 3.68, after Elon Musk had posted on X that no deal had been signed between the two companies. Ton is still with 11% in the day, according to the Coindesk market data.

Although Durov has now confirmed that no deal has been signed, the founder of Telegram said that there is an “agreement in principle”, which is perhaps the reason why Ton still has considerable support for the $ 3.30.

All eyes will be on telegram and Xai, while the Asia working day starts to see if more clarification is coming from both sides.

Decentralized Bluesky is not a web3 company, says CEO

Vancouver-Jay Graber, the CEO of fast-growing decentralized social media platform Bluesky, started her start in web3 as a developer for Privacy Coin Zcash, but she wants to keep her X-competition firm in web2.

On Web Summit in Vancouver on Wednesday, Graber argued that the sustainability and the resource-intensive design of Blockchain Technology makes it unsuitable for consumer-oriented social networks, where content is fleeting and personal.

“Why do you need your photo of what you post for lunch forever maintained in this digital archive?” She asked on stage and emphasized the inherent scalability and cost limits that caused her decision to avoid blockchain at Bluesky.

Graber, certainly not against crypto. She says that there is still genuine value in technology for things such as payments and digital identity, even if web3 sometimes often presents solutions in search of a problem and has a trend of attractiveness to centralization.

“There is a period when everyone created blockchain like this hammer, and we just went to try blockchain for everything,” said Graber. “Every system that tries to do it ends with concentrations because it is easy, and ease eventually wins at the end of the day.”

For her, the future of Bluesky lies in combining the ideals of decentralization, such as user autonomy and portability, with practical web2 infrastructure to create a platform that prioritizes the needs of users.

“Blockchain will probably find its place somewhere in the world of technology, but Bluesky is not on a blockchain because we only make the best choices for our users,” she concluded.

Nvidia’s income Beat Boosts shares, offers a modest lift to AI tokens

Shares of NVIDIA rose about 4% on Wednesday after the hours after a stronger than expected profit to report than expected first quarter, emphasized by a turnover increase of 69% compared to last year and a jump of 73% in its data center activities driven by a robust demand for AI chips. The net income rose 26% to $ 18.8 billion, which means that Nvidia’s year-to-date performance is modest higher, previously reported.

The winning report offered a slight lift to AI-related crypto tokens such as Bittensor (TAO), near the protocol and internet computer (ICP), although the profit was modest.

However, NVIDIA has tempered future expectations, which could warn the warning of the second quarter in the market estimates as a result of rate -related trade tensions between the US and China.

Market movements:

- BTC: Bitcoin fell 1.2% to $ 107,800, although Nydig sees more room for profit. At the same time, Crypto Markets picked up an American court and blocked Trump’s broad rates as unconstitutional, with BTC trade filled in.

- ETH: Ether acts above $ 2700 while Asia starts his working day. Earlier, Coindenskalerist wrote Godbole ETH in an outbreak of more than $ 3,000 and forms a bullish “rising triangle” pattern with rising support and resistance at $ 2,735, because higher lows signal the purchasing pressure and accumulation for a potential price dump.

- Gold: Gold has slipped 1% to $ 3,267.47 in the middle of a cooling -safe port, although rate and geopolitical uncertainty linger.

- Nikkei 225: The Nikkei 225 opens in the Green, an increase of 1%, because investors in export-reliant Japan look at a recent announcement that the Supreme Court has blocked Trump’s rates with careful optimism, even when Crypto made it.

- S&P 500: While the S&P 500 was closed in the red, the futures have risen by 1% as traders await more clarity about the movement of the court to block Trump’s rates.