Aster, a perpetual decentralized exchange (Perp Dex), has launched a privacy function of “hidden orders” less than three weeks after co -founder of Binance Changpeng “CZ” ZHAO proposed the idea of ”Dark Pool” maintenance trade.

In traditional finances (Tradfi) there are dark Polish private platforms with which institutions can carry out major transactions without revealing their orders on the market. Dexs, on the other hand, have historically prioritized for transparency, with order and liquidity data visible on the chain.

Aster, who has locked a total value (TVL) of $ 290 million, unveiled the hidden order mechanism on Friday in a post on X, formerly Twitter. Hidden orders are specialized order types with which traders can hide their order quantity from other market participants.

“Be the first to place Stealth Perp orders without revealing your size or presence in the public order book,” is the tweet from Aster. “Invisible orders, visible benefit.”

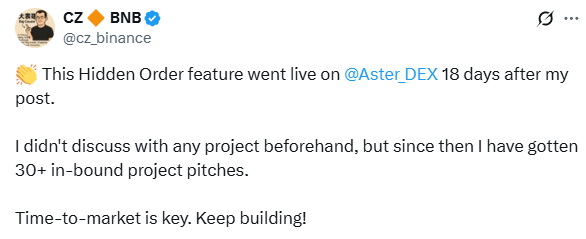

The post was then retweeted by CZ. “This hidden order function went live on @aster_dex 18 days after my message,” said the co-founder of Binance. In the same post, Zhao revealed that more than 30 projects have approached him since then with similar ideas.

The rollout of such functions underlines a growing interest in protecting traders against visibility risks in chains, such as frontunning and maximum extractable value (MEV) attacks. The development can also enter into a broader shift to privacy-first infrastructure within Decentralized Finance (Defi).

“There is a growing demand in Defi for dark pool mechanics, especially from funds and traders who want to avoid MEV, Sandwichen and toxic current exposure,” said Vinson Leow, the CSO at Momentum.

However, Leow pointed out that although functions such as Aster’s hidden orders are ‘a step forward’, the consideration is that it limits transparency. He called this crucial for price discovery and confidential composability. “Dark Pools must integrate selective disclosure and retain auditability without revealing [live] Trade intention to scale up, “he said.

Luis Bezzenberger, the head of the product at Shutter Network, repeated this sentiment and stated that although privacy is favorable in the short term, if orders remain hidden too long, this can damage market transparency and efficiency. “An interesting direction can be threshold-fhe (completely homomorphic coding) on top of threshold cryptography, so that we can balance privacy with a fair, verifiable arrangement,” he suggested.

Zhao originally presented the idea on 2 June in response to the much -published losses of pseudonym James Wynn, who publicly shared his $ 1.2 billion BTC -long position on Hyperliquid. Wynn later claimed that this public disclosure made him a target, which led to attempts to liquidate his position and resulted in about $ 17.5 million in losses. “The only reason why the price has fallen is because they are hunting me,” he said in a tweet that week.

“For Perps (or futures) it is even more important not to let others know/see,” CZ said at the time. “If others can see your liquidation point, they can try to push the market to liquidate you. Even if you have a billion dollars, others can get you with you. This was possible what we have recently seen.”