The ongoing conflict in the Middle East has led the wider cryptocurrency market under the leadership of Bitcoin (BTC) price. In the last 24 hours, the BTC price fell by more than 3 percent to trade around $ 105k on Friday 13 June 2025 during the American trade session.

The wider Altcoin market had a similar decrease, which resulted in more than $ 1.1 billion stretching from crypto -delivered markets in the last 24 hours. As a result, crypto-traders are mixed with some remaining optimistic, while some are waiting for a clear signal to re-introduce.

Bitstewijke Cio Matt Hougan gives a daring Bitcoin forecast

The Cryptocurrency market has experienced a stablecoins summer after the current goodwill of the regulations of large areas of law, led by the United States. As the global money supply (M2) grows exponentially, the more institutional investors have spread to the Stablecoins market, which significantly improves crypto -liquidity.

After the Bitcoin and the wider Altcoin fall in recent days, Matt Hougan, the CIO at Bitwise, emphasized that an accumulation is more likely before a parabolic rally before the end of this year.

“I think this is the ‘summer of accumulation’, a moment for long-term investors to build positions prior to an epic Eoy-Run,” Hougan noted.

What does the graph say?

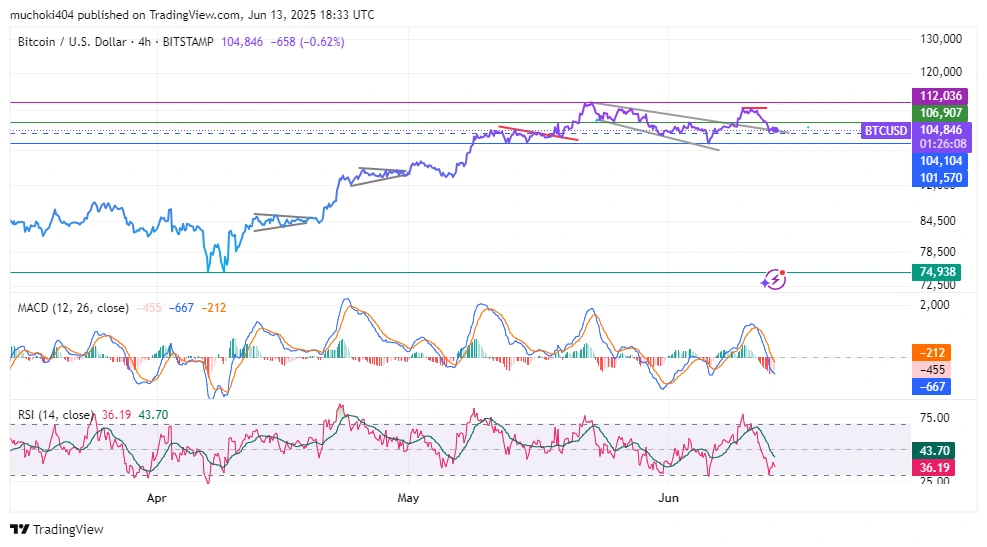

After enjoying an impressive meeting after the end of the trade wars in the past two months, BTC price experienced a considerable resistance level of around $ 112k. The flagship coin could not collect more than $ 112k and has since been withdrawn into a crucial purchase zone of around $ 105k.

In the four-hour period of four hours, Bitcoin’s Relative Strength Index (RSI) and MACD line KAS indicated on potential reversal. Moreover, the RSI is floating around the sold -over levels and the Histogram of the MACD has suggested a decreasing sales pressure.