- Bitcoin’s short-lived breakout quickly unraveled, while a geopolitical fake-out caused activated forced liquidations.

- Will escalating macro risks continue to suppress the follow-through?

On June 16, Bitcoin [BTC] bad up to $ 108,944, The invalid of the local Bearish arrangement with a decisive short squeeze that liquidated $ 45.7 million in short positions.

More critical, this outbreak followed three days of compression just around $ 105k resistance zone, where traders expected a repetition of the rejection at the beginning of June that sent BTC to $ 100,424.

This time, however, BTC rather rather than withdrawing. So was this breakout the first confirmation of a local soil, or will geopolitical overhang this movement before the follow-through occurs?

Emergency -Escalation sends Bitcoin Tumbling

Bitcoin caused almost another major liquidity grip around $ 109,700, where traders had stacked nearly $ 50 million in lifts. But the movement was short. Price was just before the sweep.

Instead, BTC decided and dropped 3.2% to an intraday depot of $ 105.412 at the time of the press. In the process, three long heavy liquidity clusters Was swept away, each stacked with around $ 25 million in leverage.

So what did the setup kill? A macro -nep.

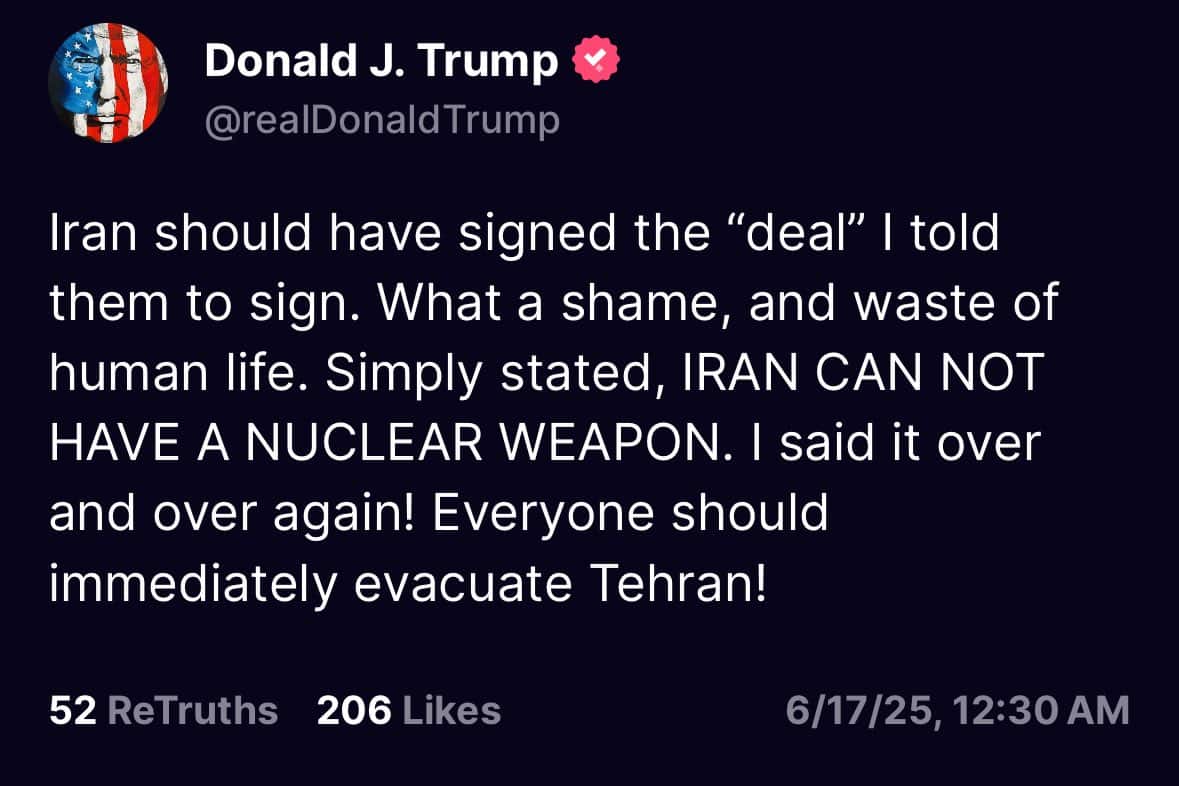

You see, the rally was fed by Buzz that Trump had concluded a peace agreement between Israel and Iran. But that story collapsed quickly, while he turned off the reports and caused an emergency alarm instead.

Source: Truth Social

What came after was a classic bullfall.

Late Longs jumped into chasing the move, only to be wiped out because things were hardly reversed. Open interest rate fell 1.47%, with the liquidations about the futures signaled, while 23,900 BTC flooded back on exchangeMarking a peak of 231% of the day before.

And yet this feels more like the early signs of wider macro fragility. With directional conviction that is still missing, Bitcoin slides back into the “wait -and -see” mode, trapped between headlines and hesitation.

G7 interruption adds weight to the story

Markets quickly moved to the risk-off mode. It started with President Trump, who ordered an emergency evacuation in Tehran, already a signal with high bet. But the real kicker came when he broke down his G7 visit abruptly.

But things escalated further. Lawrence Jones from Fox News reported That Trump said the National Security Council to be in the emergency situation.

All this accumulated a growing speculation of a potential American military intervention, something that risk assets were quickly in price. Bitcoin, recessed under the resistance of $ 105k, who had difficulty converting the level into a confirmed soil.

Source: TradingView (BTC/USDT)

In the meantime, Bitcoin’s financing percentages are still leaning Heavy long, set the stage for another potential cascade.

At this pace one step back to $ 100k more and more likely if the Macro Fud is not accelerating.