Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Bitcoin has passed a wave of volatility in recent days, caused by the escalating conflict between Israel and Iran. As geopolitical tensions rise and worldwide markets struggle with uncertainty, risk assets such as BTC have to deal with increased pressure. Despite this turbulent background, Bitcoin has succeeded in maintaining his foot above the most important support levels, which demonstrates remarkable resilience.

Related lecture

Bitcoin is currently acting just below his all time and is in a consolidation phase that many analysts regard as the calmness before a potential outbreak. Top Analyst stretches Capital shared insights that indicate that the final large weekly resistance, which has previously covered price rallies, can now weaken as a point of rejection. If confirmed, this shift may indicate a critical turning point in the market structure and open the door to price discovery.

Investors keep a close eye on, while BTC is strongly holding, while macro – including rising American treasury yields and fears for energy compounds – can swallow. With the broader market for further developments in the middle, the ability of Bitcoin suggests to maintain higher lows and to approach resistance with Momentum that the bulls will soon be able to reclaim full control. In the coming days, the next phase of the BTC market cycle can be crucial.

Bitcoin is waiting for clarity if tensions in the middle -east market form sentiment

The conflict between Israel and Iran continues to dominate the headlines and influence the global markets. While tensions escalate, investors remain careful and follow closely geopolitical developments and their macro -economic wrinkle effects. In this uncertain environment, Bitcoin has entered a consolidation phase, with no bulls under control.

The lack of a clear direction stems from diverging investors expectations. Optimistic market participants expect a diplomatic resolution to be achieved in the coming days or weeks. A peace agreement can lower market anxiety, lower oil prices and restore the momentum on risk assets – including Bitcoin. On the other hand, more careful investors fear that the situation could worsen. Long -term conflicts can cause volatility in the energy sector, push inflation higher and tension economic stability, especially in regions that depend on the import of oil.

This week can be decisive for the next major move from Bitcoin. Price promotion remains tight, but all eyes are aimed at the long -term weekly resistance. According to KapitalThe last large weekly resistance – compared to a strong rejection point – now seems to weaken. This structure shift suggests that Bitcoin may be preparing for a breakthrough in price discovering area, as macro conditions stabilize.

Related lecture

BTC price applies to important support in the midst of consolidation

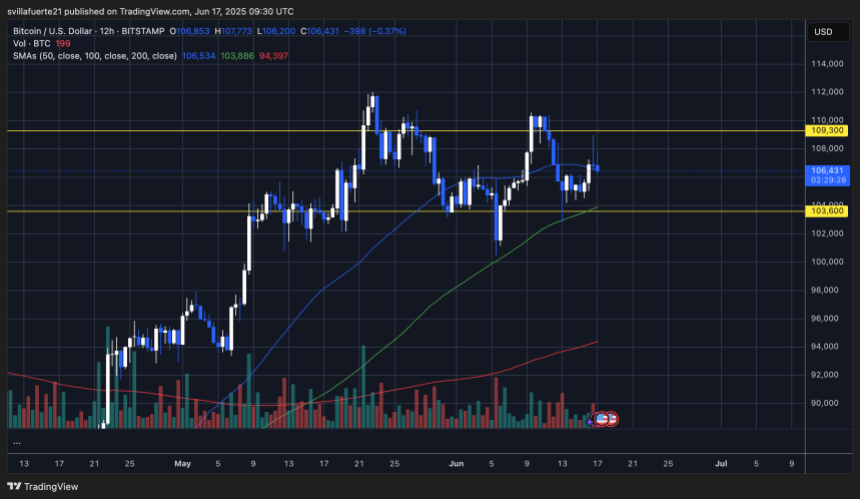

The 12-hour graph for Bitcoin shows that BTC continues to act within a tight reach, and is held above the critical support of $ 103,600 while struggling to break neatly due to the $ 109,300 resistance. This zone has repeatedly succeeded as a ceiling for price action since the beginning of May, in which sellers enter around $ 109k and buy buyers dips near $ 104k.

The recent bounce of just above the level of $ 103,600 reflects the current buyer’s interest on that range, reinforced by the 100-day SMA (Green), which offers dynamic support. In the meantime, the 50-day SMA (blue) is curving somewhat up and shows early signs of positive momentum, although the price still has to be clearly reclaimed and retaining above it.

The volume remains moderate, which indicates a lack of strong conviction on both sides. For bulls To get the full control back, BTC must penetrate the resistance of $ 109,300 with persistent volume and retain that breakout level. An absence to do this can lead to a different rejection and a potential retest of the lower limit near $ 103,600.

Featured image of Dall-E, graph of TradingView