- Bitcoin’s halving schedule reduces mining rewards, improving the scarcity driven value.

- How much offer is it really about the rest of the market?

Bitcoin’s [BTC] Edge about Fiat is not only that it is decentralized, it is that there will only be 21 million coins.

In contrast to normal money that governments can print endlessly and view the value, the range of BTC is locked up, making it more likely over time, because it becomes scarce.

With the next Bitcoin and the following, a reduced offer can influence price action, making it possible to be a stronger bullish momentum.

Counting to the ultimate scarcity of Bitcoin

Glassnode reported that Bitcoin has now mined 900,000 blocks since its foundation. Each mined block releases new Bitcoin, which increases the delivery.

Due to halves, however, block senses are cut every 210,000 blocks in two. This means that the issue of Bitcoin slows down considerably as it approaches the 21 million limit.

Source: Glassnode

To put that in perspective: MIners process Bitcoin -blocks every 10 minutes and generates around 6 blocks per hour – with 144 blocks daily.

Before halving, each block rewarded 6.25 BTC, which resulted in 900 new BTC that enter the market per day.

After halving, the rewards fell to 3.125 BTC per block, which reduced the daily Bitcoin issue to 450 BTC – almost half.

Since then, BTC has increased by 47%, which reflects the impact of reduced delivery.

1.7 million left, and drying quickly

In particular, miners expect the next halving to hit 1,050,000 around block height in 2028, so that the block remuneration will be cut to 1,5625 BTC.

Perform the figures, and that is only 1,5625 BTC × 144 blocks = 225 BTC per day that hits the market, half of today’s already thin issue.

That is a large diet. With only 1.7 million Bitcoin left over to mine before we hit the 21 million cap, every halving Bitcoin makes even scarce. And if you look at the upper portfolios, the supply squeeze feels even tighter.

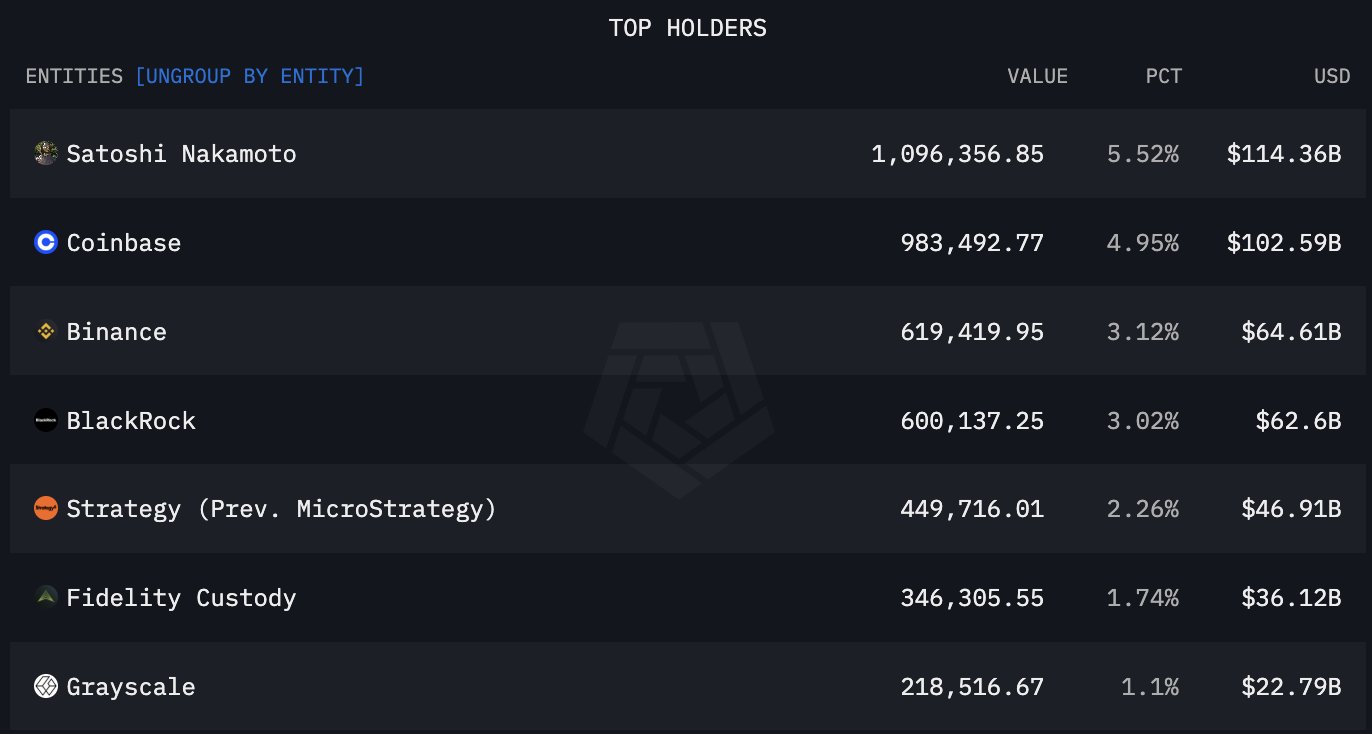

The graph below emphasizes how the top 8 holders control 4.51 million BTC, with around $ 471 billion. That means that they are more than 21% of the The total range of Bitcoinlove the market.

Source: X

But that is only the opening act. If demand continues to rise and the market capital from Bitcoin is racing to $ 3 trillion or $ 5 trillion, every BTC can easily rise to $ 143k, $ 238k or even after.

Of course these figures are raw estimates, but that is the genius of the BTC design. It is like a high-stakes auction without a spare price: how high can the bids go?

So with supply tightening And big players who keep strong, BTCs “Digital Gold” story is only working. The stage is set for a number of serious profit in the long term.