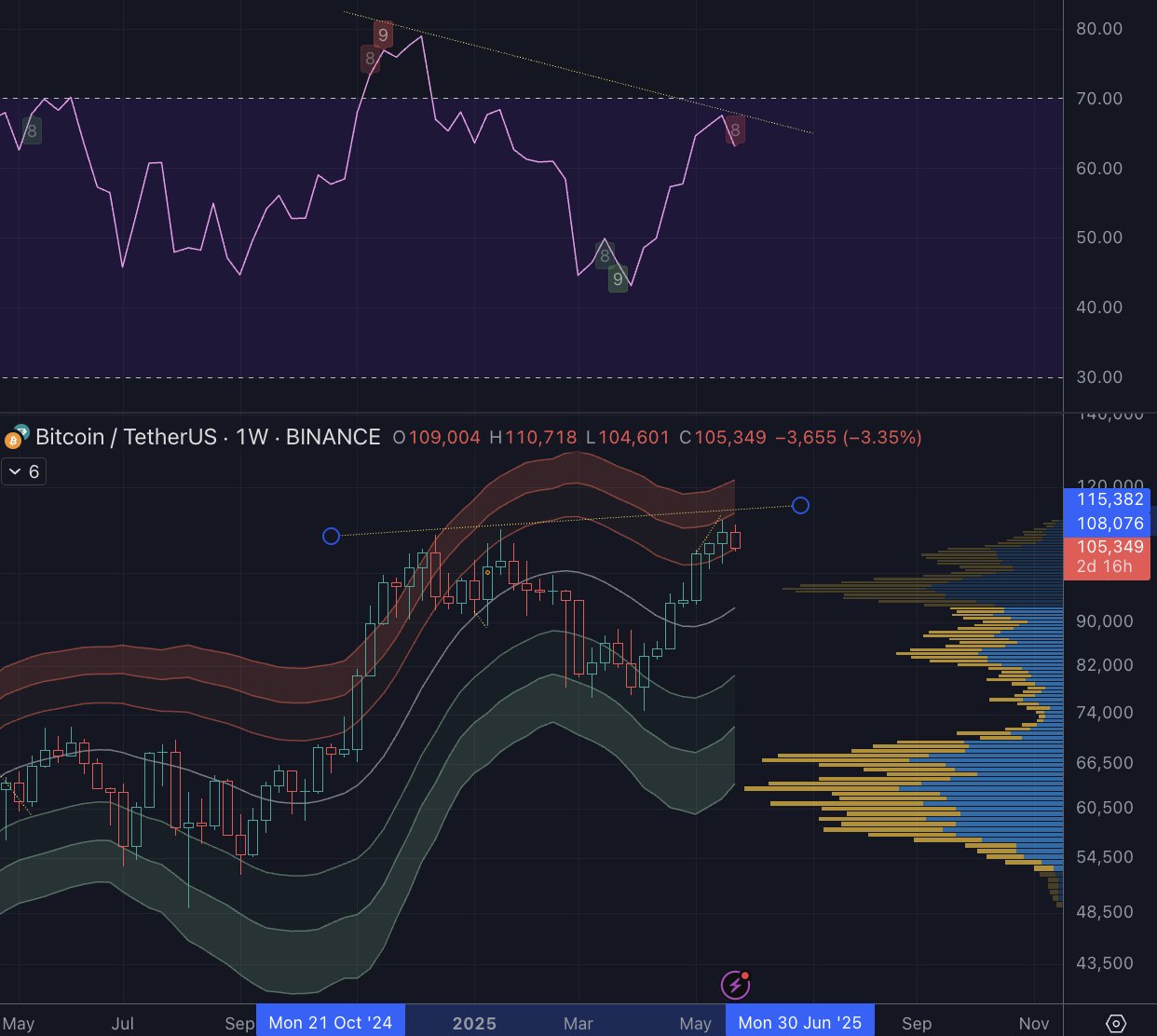

Veteran on-chain analyst Willy Woo says that Bitcoin (BTC) is on the edge to go to a long correction phase.

Woo tells his 1.2 million followers on the social media platform X that BTC has until Monday to prevent a Bearish divergence being pressed on the weekly graph.

A bearish divergence happens when the price makes higher highlights, while an indicator such as the Relative Strength Index (RSI) makes lower highlights, suggesting that an active bullish momentum loses.

Woo says,

‘Dear Mr. Bitcoin, you have [until Monday] To gather or you are going to print a bearish divergence on weekly cards and then we will be bored for weeks and weeks. “

With the help of patented data from his Bitcoin analyzed company, the Bitcoin vector, Woo says that BTC seems to be strong, but can “equal” itself after a rally faster than normal in the previous months.

“Our Bitcoin Vector -Framework remains strong despite the withdrawal.

What happens is technical resistance in the form of a bearish divergence that takes place against strong foundations. In short, BTC has risen faster than normal and is even. “

While many traders are still betting on the traditional four -year -old Cycli, Woo out BTC is increasingly being linked to external macro forces, and that predictable, cyclical price patterns are now a thing of the past.

“BTC is global macro this cycle. Which does not necessarily mean bet on beautifully cared for four -year cycles. BTC is switching.

Internal forces, the halvening, become weak, global liquidity powers BTC – that is why BTC becomes the canary in the coal mine for global macro movements. “

At the time of writing, Bitcoin acts at $ 104,737

Follow us on X” Facebook And Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Generated image: midjourney