- Bitcoin -my construction difficulties fell slightly, but rising costs and hashrates squeeze smaller miners

- Public miners stimulate production and hamster Bitcoin as a long -term strategy

Bitcoin’s [BTC] The mining difficulty fell slightly to 126.4 trillion, after a record high of 126.9t on 31 May.

Although the fall seems small, it reflects the growing economic pressure on miners such as rising hashrates, reduced rewards and rising costs push many push to the edge.

Nevertheless, public mine giants rewrite the rules of the game by increasing production and stacking BTC for the long term.

The costs of Bitcoin -Mouwen in 2025

Despite the price of Bitcoin that floats above $ 105k, profitability is increasingly elusive for many miners. The Halving of April 2024 reduced the block announcements to 3,125 BTC, reducing the income at night.

Source: Cryptuquant

In the meantime, energy costs and infrastructure requirements continue to rise, which increases the operational break life point.

The Hashrate of the Bitcoin network has recently covered 1 Zetahash per second, the competition intensively and it is more difficult for smaller players to remain viable.

Difficulty remains near peak levels and acts as a constant access barrier … and survival.

Public miners defy the opportunities

While smaller miners are confronted with growing pressure, public companies such as Marathon Digital and CleanSpark grow aggressively.

In May, Marathon 950 BTC – an increase of 35% compared to April – despite the market volatility of the market and rising network problems. CleanSpark also gained ground and produced 694 BTC, an increase of 9% month after month.

Both companies have significantly scaled activities, in which the Hashrate of CleanSpark reaches 45.6 eh/s. Their size and strategic implementation help them thrive, even if the profit margins become tighter about the mining sector.

Bitcoin Treasury Shift

A new trend takes shape: Public miners.

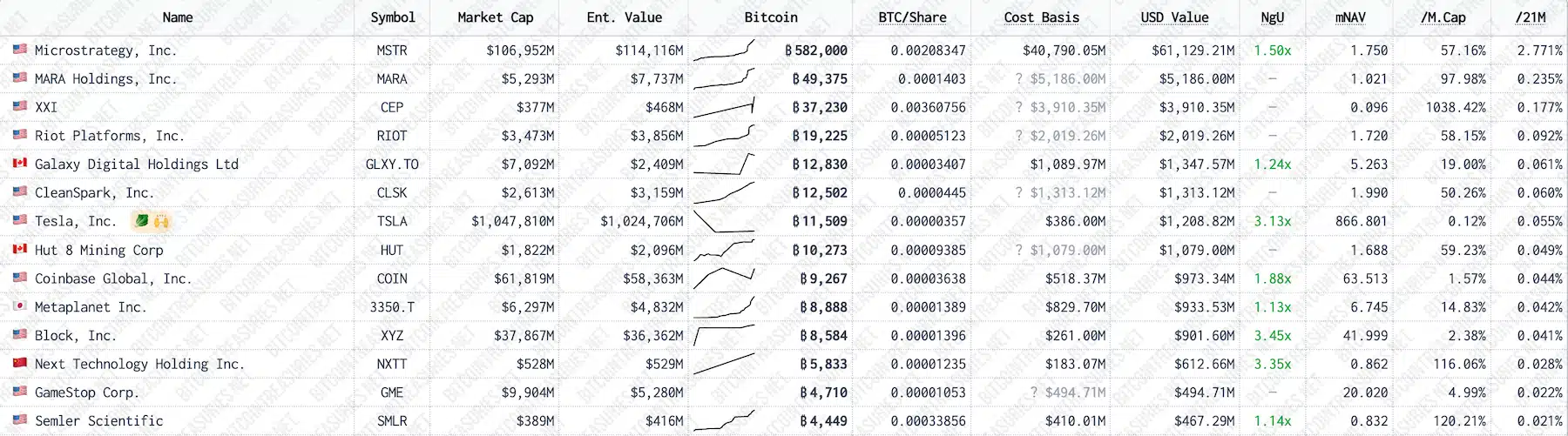

Source: Bitcoin Treasuries

Mara now has more than 49,000 BTC and confirmed that it was not sold in May. CleanSpark has joined the ranks and has collected 12.502 BTC in total companies.

This shows a growing conviction in the long -term value of BTC and a broader business strategy to adapt to Bitcoin’s monetary ethos.