Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

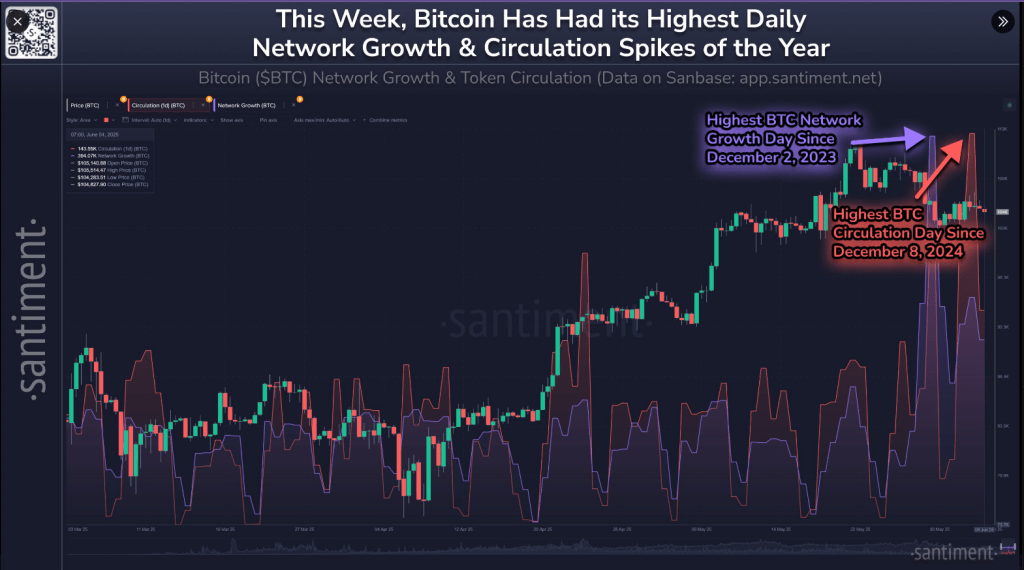

The price of Bitcoin has hardly moved in the past week, but other signs indicate a growing activity on the network. On June 5 Bitcoin Trade around $ 104,300, a decrease of 0.50% in 24 hours and by 2.5% on the last seven days. Nevertheless, data shows that more people become members of the network and more coins are passed on.

Related lecture

Wallet Creation Jump

According to SantimentAlmost 557,000 new portfolios appeared on 29 May. That was the highest number since December 2023. It means that thousands of people open portfolios, although the price has remained slightly less than $ 105,000.

People normally open new wallet to send and receive bitcoins, but they somehow come across the idea through new sources, increased conversations between friends or create simple curiosity. In any case, an increased wallet indeed indicates a much wider use.

📊 Bitcoin’s on-chain activity has risen sharply this week, because his price is floating just below $ 105k:

📈 May 29: 556,830 new $ BTC Wallets made (the highest since December 2, 2023)

🔄 2 June: 241,360 Coins circulate (the highest since December 8, 2024)

Growth in a network … pic.twitter.com/2DXKNVXRKT

– Santiment (@santimentfeed) June 5, 2025

Increased token movement

On 2 June, more than 241,360 BTC changed ownership. This was considered the busiest day since December 2024. Reports from Santiment suggest that a high coin turnover usually coincides with increased traffic.

Traders can move coins in and out of trade fairs, or investors can shift portfolios. Large swings in daily token movement can indicate a shift in sentiment – people who are preparing to buy or sell.

At the moment it usually seems that more users send coins to each other, so that the network is busy even when the price is standing still.

Big holders step in

Data from Intotheblock shows that large holders – often called “whale“Are in stock. Their inflow of coins has risen by 145% over the past seven days and by 214% in the last 30 days.

When large players load, this can tighten the range at trade fairs. That makes it harder for new buyers to come in without the driving price higher. If whales keep buying at this pace, this can lead to more upward pressure on the price as soon as daily investors withdraw.

Related lecture

Buy Mid -layer Investors

It is not only the really big holders that add coins. Wallets that held between 10 and 10,000 BTC added more than 79,000 BTC in just one week. This means that these medium holders have collected around 11,320 BTC per day on average.

From 2 June they had a total of more than 13 million BTC. If both large whales and these middle level holders continue to stack, it further reduces the number of coins that floats at trade shows. Less available coins often means that any shift in demand can relocate the price more.

Featured image of imagen, Graph of TradingView