- The RCV outputs of Bitcoin Buy Zone as reserves and whale activity signal increased market risk.

- MVRV ratio and mining flows hint when taking profit, while valuation statistics show mixed network strength.

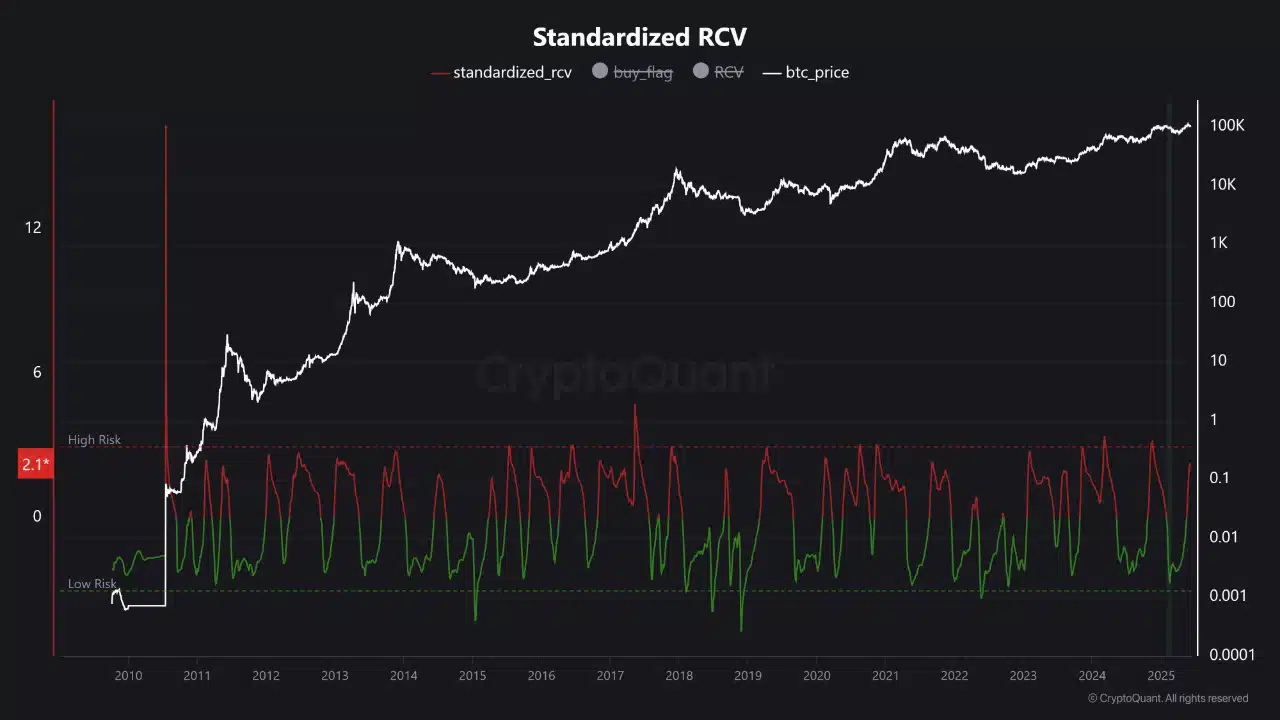

Since leaving the battery zone with a low risk, Bitcoin’s [BTC] 60-day realized CAP Varianance (RCV) has caused a reassessment of the market.

Previously, purchase signals were active when RCV levels were negative, coupled with upward price momentum.

Now, although the yellow buy flags have disappeared, no sales trigger has yet emerged, because the momentum of 30 days remains strong. This transition state reflects a shift from optimum accumulation to a more careful market phase.

While BTC traded above $ 109,000, the market showed the market when the market showed bullish energy, but the growing RCV levels suggest a reduced reward potential for new long entries.

Source: Cryptuquant

Are BTC Rising Reserves set the stage for a sale?

Exchange Reserve USD has risen 3.45% to more than $ 273 billion, indicating a potential increase in sales pressure.

A higher reserve indicates that there are more coins available at trade fairs, often prior to increased volatility or downward corrections. This upward trend is usually in line with market participants who are preparing for the discharge of companies at higher prices.

Therefore, although the momentum remains intact, the increase in reserves could reflect a strategic shift between holders, especially because favorable accumulation conditions fade.

If this trend persists, the chance of price wind in the short term can become stronger on large trading platforms.

Source: Cryptuquant

Caution comes as miners and whales reposition

The behavior of miners and whales also supports growing caution. The position index (MPI) of the miners stood at more than 96%, which indicates the increased outflow of miners, although values remain somewhat negative.

At the same time, the exchange rate ratio reflects consistent enclosure from top holders to exchanges.

Historically, this dynamic signal reduced the market order of important participants. Although not yet extreme, these coordinated movements can indicate a distribution phase that take shape.

That is why current market participants must keep a close eye on wallet flows, especially of players with a high impact, because they often precede broader trend covers in the price structure of Bitcoin.

Source: Cryptuquant

Not -Realized profits stack on: Will holders take a profit?

The MVRV ratio of BTC has risen 3.88% to 2.32, which shows that a majority of holders are now on significant non -realized profits.

When this ratio rises above 2, it often indicates that investors are increasingly tempted to obtain profit.

Therefore, the higher these metric climbs, the more vulnerable the market becomes for a withdrawal. Although it does not confirm imminent correction, it does suggest that the benefit can be confronted by internal sales pressure.

Traders must remain alert, because even mild shifts in sentiment can activate widespread sales in an overheated market environment.

Source: Cryptuquant

Disconnect appreciation? Network use offers mixed instructions

Chain rating indicators Show different signals. The NVT ratio fell more than 31%, while the NVM ratio fell nearly 24%, suggesting that improved transaction activity compared to the market capitalization of BTC. Normally this points to increased network efficiency.

However, the decline can also indicate a decoupling, whereby the market valuation exceeds actual use. This creates a subtle imbalance that could dispute the current price levels if it is not corrected by stronger transactional transit.

As a result, the underlying trends of the surface activity remain positive, trends remain too uncertain to confirm the full bullish conviction across the board.

Source: Cryptuquant

Is BTC on its way to a distribution phase?

BTC remains in an upward trend driven by Vitrage, but risk signals are starting to get to the surface.

The disappearance of purchase signals, rising exchange reserves, careful mining behavior and increased MVRV all suggest a potentially turning point.

Although not yet in the entire distribution mode, the market is no longer in its accumulation phase.

Traders must now concentrate on protecting profits, looking at a confirmed sales trigger and avoid overexposure as Bitcoin’s risk-reward profile continues to evolve.