Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

In the midst of the chaos that was fueled by the attack of Israel on Iran, Bitcoin has climbed again and shaking the losses of the conflict. Not only has the price seen an increase in the lows of the last week, but there has also been a remarkable change in the daily trade volume of the cryptocurrency. This indicates continuous interest despite worldwide factors and could mean that the expectations of war are already priced for the cryptomarket.

Bitcoin sees almost 100% jumping in volume

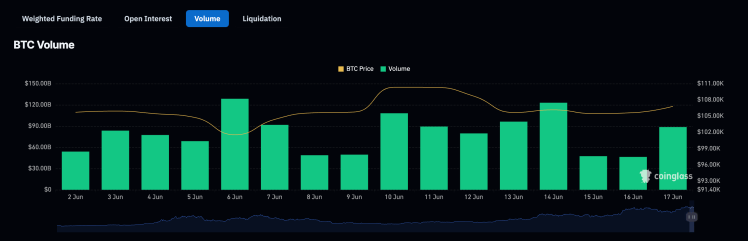

According to data from CoinglassThere has been a turn in the tide for the Bitcoin -Trade Volume After starting the new week in a slow trend. On Sunday and Monday, Bitcoin’s daily trading volume had $ 50 billion. However, as the Bitcoin price rose to Tuesday, the trade volume also did.

Related lecture

At the time of writing, the daily trade volume of Bitcoin had already crossed $ 88 billion for Tuesday, which led to an increase of almost 100% in trade volume during this time. This follows the trend of high volatility that comes with raised volumes, because the Bitcoin price waved wild between $ 105,000 and $ 108,000.

The sharp jump in volume comes when the Bitcoin open interest remains high On almost all time, while the rest of the market is struggling. Coinglass data shows the current open interest at $ 71 billion, less than $ 10 billion remedies from the $ 80 billion of all times highly registered in May 2025.

In the light of altcoins that remain low trends while Bitcoin stays close to all time, it suggests that the most attention in the Crypto market is now focused on Bitcoin. As a result, the leading actively continues to determine the direction of the market, whereby dominance remains high above 64%.

How war can influence this trend

The positive developments around Bitcoin are coming, because there seems to be one Cooldown in the conflict in the middle -old. But with so little time on expectations, the expectations are that the war may only start, with some people call it the beginning of ‘World War 3’

Related lecture

The Kobeissi letter is to X (formerly Twitter) to address These predictions from the Second World War, revealing how the markets would react if there was really a possibility that this happened. The first was that a chance of 50% of the Second World War would not have seen the S&P Crash 2%, but more a crash of 30%. Gold would be $ 5,000/oz and oil would go for $ 100/barrel.

Moreover, a chance of 90% of the First World War 3, as explained in the post, would probably ensure that the S&P crashes 50%, with the prices of gold and oil rise to $ 10,000/oz and $ 200/barrel respectively. Given the correlation of Bitcoin with the stock market to date, there is no doubt that such a crash would have been transferred, causing disastrous losses for the cryptomarkt.

Given this, the Kobeissi letter explains that the markets say that the chances of the Second World War are small. At the moment they expect a solution for the conflict. “Futures everywhere on the board saw de-escalation coming this morning,” read the message.

Featured image of dall.e, graph of tradingview.com