Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

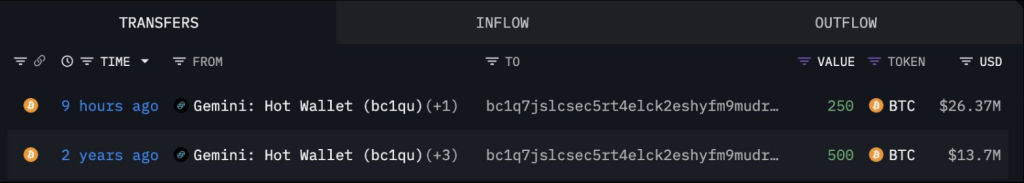

Based on reports, a long -term Bitcoin WHALE made a surprise movement this week and understood 250 BTC for approximately $ 26.37 million. It is the first time that this wallet has shown activity in two years.

Related lecture

The purchase has played on both traders and analysts on-chain. Some see it as a sign that big players are preparing for more action in the coming weeks.

Whale returns after two years

According to lookonchain data, the same whale Got 500 BTC from Gemini in 2022 when Bitcoin traded near $ 27,400, a movement worth nearly $ 14 million at that time. Now that BTC is floating around $ 105,000, the interests of whale are on a non -realized profit of more than $ 39 million.

That kind of profit margin attracts attention. Other large holders often keep a close eye on these movements. They wonder if this is the start of a wider trend or just the game of one wallet.

A whale that had been dormant for 2 years bought another 250 $ BTC($ 26.37 million) 9 hours ago.

2 years ago this whale withdrew 500 $ BTC($ 13.7 million) from Gemini at $ 27,401, now sitting with a non -realized win of $ 39 million.https://t.co/C0U92ISSFC pic.twitter.com/vcb4v3m0uzz

– Lookonchain (@lookonchain) June 8, 2025

Big profit on early bet

Early adopters have seen a huge advantage in Bitcoin over the years. The withdrawal of this whale 2022 came just before a multi -year price tree. Since then, Bitcoin has risen nearly 300%.

Not everyone can make such movements. Small investors often feel behind when a wallet shifts this size of coins. Yet some traders say it can create a wrinkle of optimism. When large holders buy, retail traders sometimes stack themselves in, having the same profit.

Technical indicators show mixed signals

In the charts, BTC seems to shape an inverse cup and handle pattern with a considerable neckline at $ 100,800 as great support. The price has fallen in the handle and a dip under $ 100,800 could propel Bitcoin to $ 91,000, which coincides with its 200-day exponential advancing average (EMA).

The relative strength index of Bitcoin (RSI) is 52, indicating that the bullish momentum fades. A fall below 50 could introduce extra sales pressure. For the bulls to get the check back, BTC has to recapture the EMA resistance of 20 days, which is just above $ 105,000.

Related lecture

Market volatility and liquidations

Last week there were some wild price movements that were partially fed by Social Media Battles Between US President Donald Trump and billionaire Elon Musk. The price of Bitcoin fell below $ 101,000, which caused almost $ 1 billion in liquidations on the futures markets before he would recover to more than $ 105,000 within a few hours.

The miners’ capitulation signal was also detected by the Hash ribbons indicator of Cryptoquant, pointing in the short-term pain for poorer-off-miners, but some potential rallies for us as soon as they pulled through it.

Featured image of Unsplash, graph of TradingView