- Bitcoin’s CDD, UTXO losses and network growth suggest that Bitcoin is in a holding pattern in the midst of mixed sentiment.

- Mild dominance on the purchase side and persistent volatility carefully reflect optimism without strong momentum.

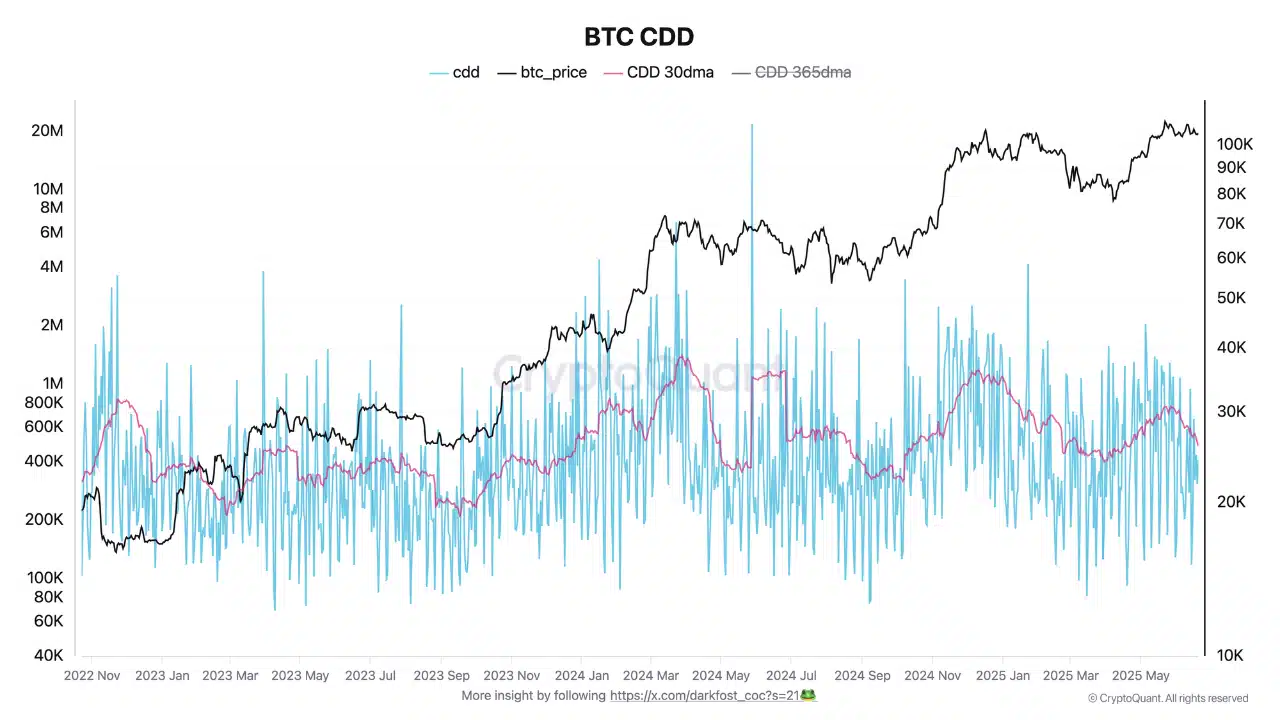

Bitcoin’s [BTC] Coin days destroyed metriek rejected Up to 500K, against peaks above 1 million. This suggested that long -term holders showed restraint despite the approach of BTC for all time.

In fact, the CDD 30-day advancing average confirmed this cooling, by pointing a clear shift from aggressive profit to calm accumulation.

Of course it supports the idea that diamond hands are still not finished playing the long game.

Source: Cryptuquant

Bitcoin’s Utxos in loss rose by 42.81% to 12.23 million, while Utxos fell 1.2% to 305.15 million in profit.

This indicates that a remarkable part of the recent buyers has been introduced at higher prices and is now covering underwater positions. So the stress is located, not market -wide, at least for the time being.

Source: Cryptuquant

Are buyers still here?

The BTC Taker Buy/Sell Ratio has yielded up to 1,028, a profit of 1.04% that made buy-side take a little ahead.

This level, just above the neutral line, implies that eternal market participants remain carefully optimistic. However, the modest strength in the purchase volume does not indicate a full bullish breakout.

This subtle buying interest refers as conviction but without the noise.

Source: Cryptuquant

BTC volatility remains increased, yet controlled.

The newest reading of 0.011 shows sharp spikes but no follows. These bursts have been often since mid -April, but the overall trend has not been reversed.

This tells us something simple: traders are alert, not alerted. Volatility may look wild on the graph, but it does not tip the market in chaos.

Source: Santiment

What does the crash in network growth mean for the Bitcoin question?

The network growth of Bitcoin extinguished from more than 500k to 76.5k, a steep fall that can indicate the weakening interest of users.

This contraction shows a significant purchase of new addresses that interact with the network, which indicates a delay in organic demand.

The peak in June was probably the result of temporary excitement that could not be maintained.

Source: Santiment

Put it all together, fewer long-term sellers, increasing non-realized losses, modest purchasing pressure and cooling network growth, and you get a market in Limbo.

Bitcoin does not give a signal to a top, but it does not load ahead. Until indicators on the chain such as network growth or Temer activity strengthen, BTC can remain stuck in consolidation, quietly called for the next step.