Ethereum price is reached near the level of $ 2,650 after a strong monthly rally of 45%. From the time of the press, it will be traded at $ 2,631, a decrease of 3.79% in the last 24 hours, suggesting that the sales pressure in the short term. But below the surface is a classic technical setup that could decide the next big step to its resistance around $ 2,700 – $ 2,800.

Liquidation cluster: a problem or an opportunity?

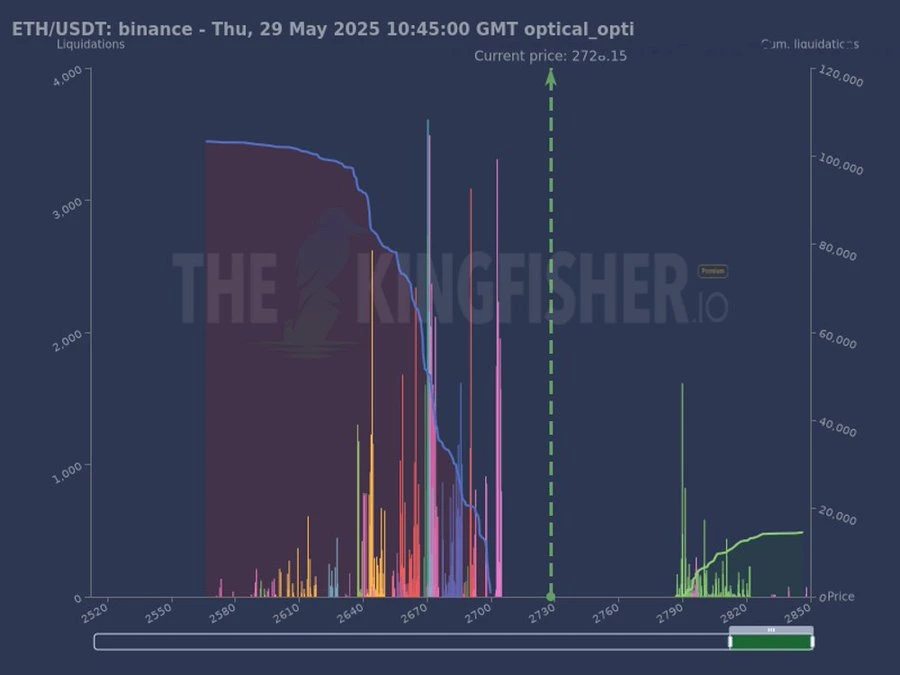

According to a postalalist, “The Kingfisher”There is a significant concentration of long liquidations between $ 2,600 and $ 2,700. This creates a liquidity “magnet” that means, if ETH dives into this zone, we can see a domino effect of liquidations. With the price that is currently near $ 2,631, ETH is closer to the crucial zone.

Conversely, if ETH does not break out and falls below $ 2,510, this would invalidate the bullish pattern. A further breakdown under $ 2,320 would open the gates for $ 2,200, where the next major support is.

Read our Ethereum (ETH) Price forecast 2025, 2026-2030 for long-term goals!

FAQs

Ethereum -Price Today is $ 2,631.27 with a daily change of -3.79%.

The most important levels include $ 2,800 for a bullish breakout, $ 2,510 for a bearish bias and $ 2,319 for confirmation of a steeper correction.

If you are a long-term investor, accumulation on dips can offer $ 2,400- $ 2,500 value within the range. Short -term traders have to wait for a breakout above $ 2,800 or a breakdown below $ 2,510 for clearer signals.