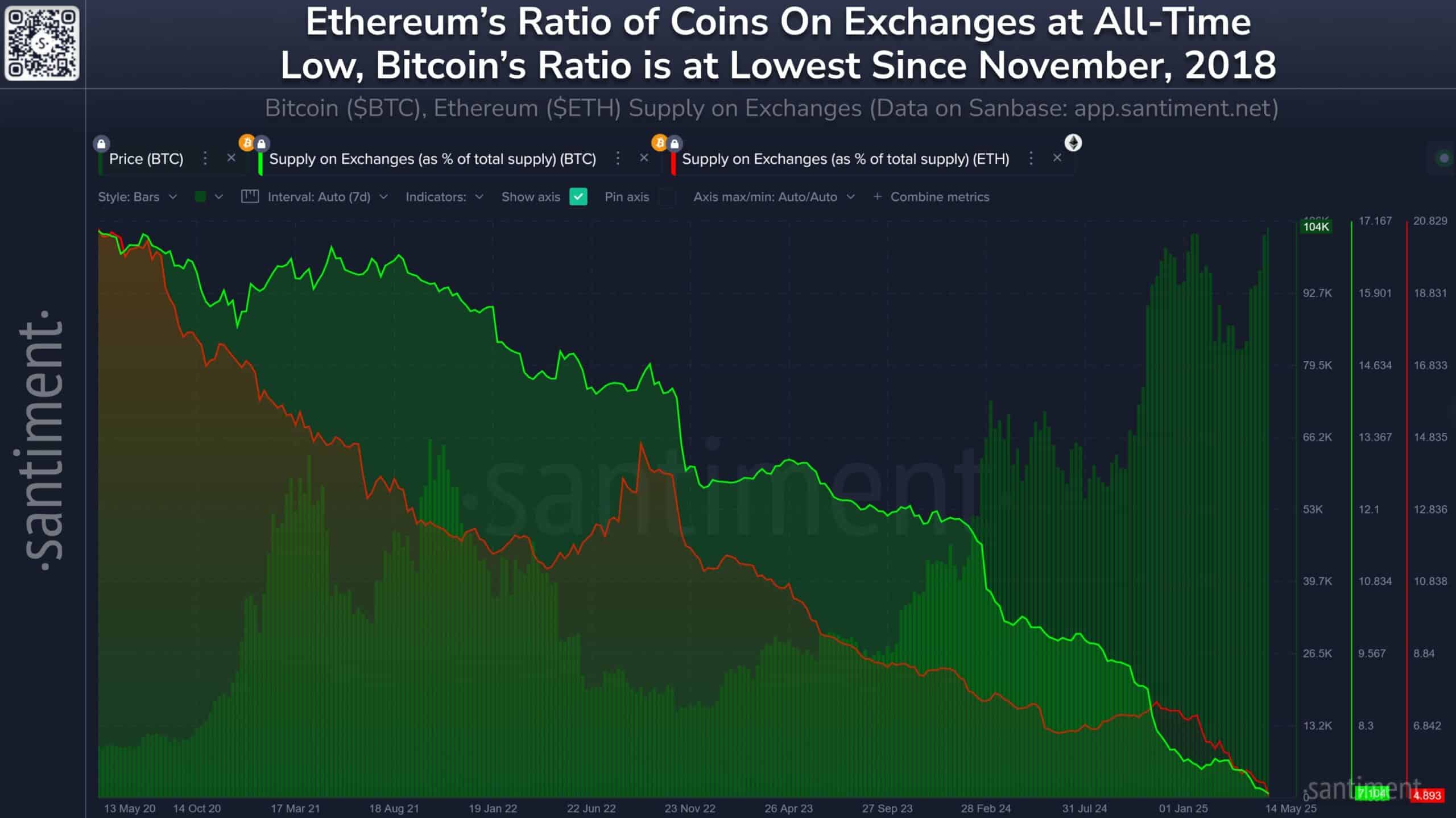

Bitcoin’s Delivery on exchanges has fallen to solely 7.1% – the bottom degree since November 2018 – whereas Ethereum has fallen under 4.9% for the primary time in its historical past of 10 years.

The tempo of the outflows up to now 5 years is placing: greater than 1.7 million BTC and 15.3 million ETH have been withdrawn from Cexes.

These figures point out a rising pattern within the route of self -spice and lengthy -term retains, in order that it could be the scene for a suggestion if the demand begins to speed up.

Supply: Santiment

The provision shock debate

A provide shock normally happens when out there tokens on exchanges lower, simply as demand will increase, creating an upward stress on costs. With BTC and ETH baldi on multi-year lows, the stage appears to find out.

Traditionally, comparable traits preceded giant rallies, as a result of shrinking float limits could be the liquidity on the gross sales aspect on the gross sales aspect. However not everyone seems to be satisfied.

Some declare that whales might simply transfer funds to chilly storage for safety, no accumulation. Others level to a nonetheless cautious retailer viewers and a potential Koelbuzz post-etfs.

If the sentiment shifts, the capital on the aspect of the top could be modified, in order that the pattern is shortly reversed.

Bitcoin: from frills to mainstream

About 50 million People now have Bitcoin – surpassing gold possession with a large margin, per river and the Nakamoto venture. Whereas BTC disappears from inventory markets, this shift is big so far as the priorities go.

Supply: X

Bitcoin is not a frills however a rising spare various. The sharp fall within the change facility could be much less linked to hypothesis and extra to a protracted -term redefinition of worth within the digital age.