Defi-active loans have been extended to a peak of three years, so that the almost complete recovery of loans from the 2022 crash is marked. More than $ 24 billion in active loan points for improving trust in the cryptomarket.

Defi continued to grow into new peaks in 2025, with loans as one of the most common activities. Active loans climbed to a new high for the year so far, with more than $ 24 billion in active loans. The loan percentage doubled almost in less than a year, driven by the demand for Stablecoin licidity and DEX trade.

Aave dominated the Defi -credit growth, where the curve was moved as the leader from the previous bull cycle. | Source: Intotheblock

The growth of the loans shows more confidence in the collateral, as well as improved tools to avoid liquidations. Most loans take place on large protocols, with the help of blue chipactiva as collateral. NFT -lending is not part of the trend and never recovered and loses 97% of its volumes.

Active loans have continuously grown without drawings since January 23, even during the market in March and April. The current trend is expected to continue, which increases loans to an even higher range.

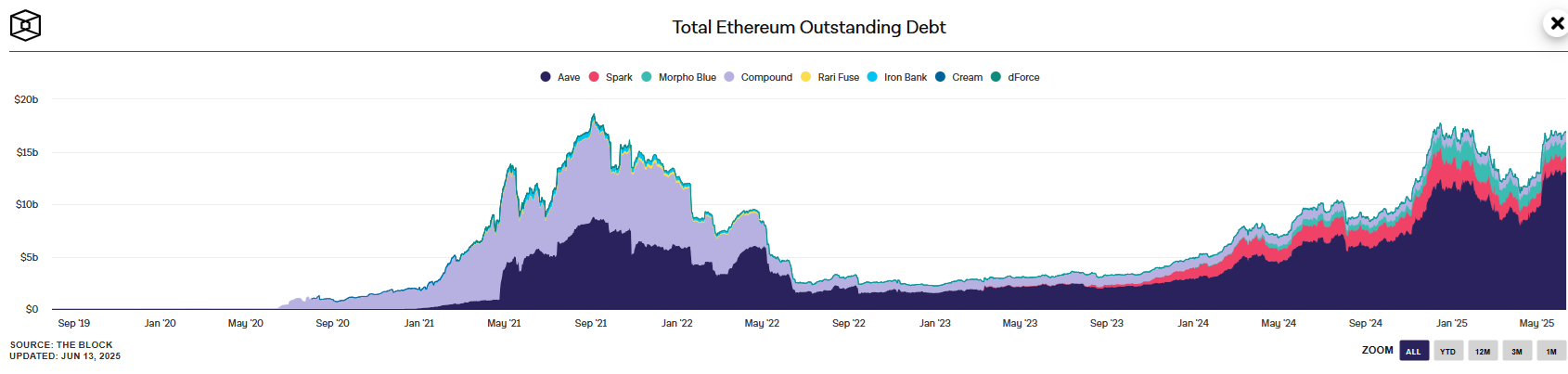

Ethereum supports Defi -Loingen

While some of the credit protocols saw liquidations of ETH loans, the market regained its foot and rebuilds ETH liquidity. After the last market recovery, liquidating positions for ETH -under building at $ 1500.

ETH currently has $ 1 billion in liquidation positions, in which other tokens also increase their influence. Lending also supports the Ethereum Ecosystem, whereby the Legacy status of the chain is retained. Solana and other chains have much smaller credit markets. Kamino Lend, however, breaks from the peloton, with over $ 2b In collateral and $ 1.5 billion in active loans. The basic ecosystem is also growing, with more than $ 1 billion in active loans.

The relative stability of ETH above $ 2,500 in recent weeks the loan pushed further forward. The growth is a mix of the expansion of Aave as the leading protocol and the value of the value of smaller new credit protocols.

Aave still leads Defi -Loingen

The bulk volumes in active loans come from the Aave protocol, which recovered from the Berenmarkt to come as the most important liquidity hub.

Aave is wearing more than $ 16.9 billion in active loans, which moves a connection as the leader from the previous bull cycle. As a result of growth, the Native Aave -token still acts close to its upper range for the past three months, at $ 286.87.

Aave is wearing $ 24.99 in collateral, to support a healthy over-collateral ratio. In total, the Ethereum -Ecosystem was supplied $ 33.58b In collateral, which represent around 33% of the entire Defi Ecosystem.

Smaller protocols have also demonstrated considerable growth in new loans in the past month. Maple Finance is the leader, with an increase of 42% in borrowing. Morpho, Spark and Fluid also raised their active loans in the past month.

Defi loans quickly become one of the characteristics of the current cycle. The credit landscape is more diverse, even when it is dominated by Aave. In the coming months, World Liberty Fi, the Trump Family Fund, will also participate in his own credit safe and indigenous Stablecoin.