Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Dogecoin is currently acting on critical levels and consolidates just below the most important resistance zone of $ 0.25. After a period of relative calmness, the momentum starts to build when Bullish Sentiment returns to the Altcoin market. With Bitcoin in the vicinity of all time and Ethereum who push higher, analysts call up to the start of a long-awaited altiation season and dogecoin shows early signs of participation.

Related lecture

Price promotion has remained constructive, whereby do -up higher lows defends and gradually tightened up within an important range. Now, traders pay close attention to a breakout above the level of $ 0.25, which could unlock the next phase of the top.

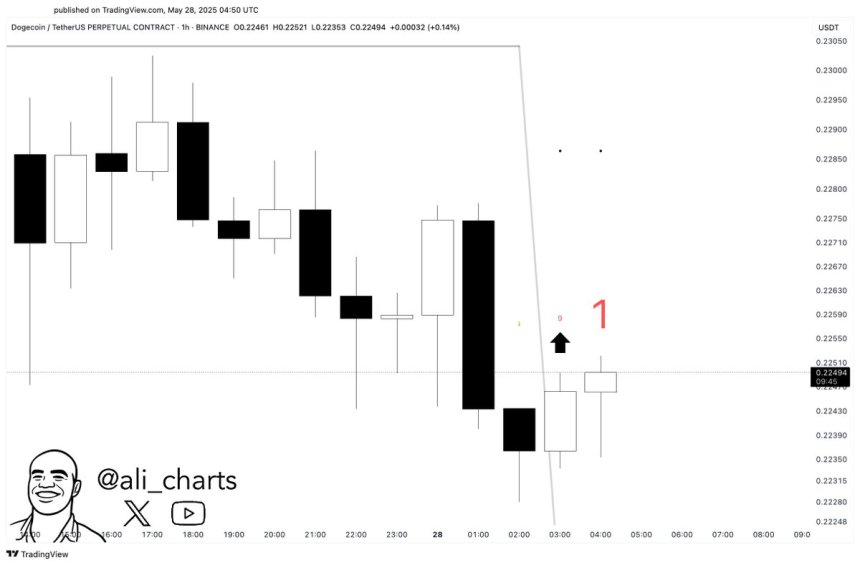

Add to optimism, top analyst Ali Martinez shared a technical signal that is worth mentioning: the TD -sequential indicator has flashed a purchase signal on the hourlyer of Dogecoin. Historically, this pattern preceded rebounds in the short term and local trend covers, especially when confirmed in the vicinity of important support zones.

As sentiment improves and capital starts to rotate in altcoins with high beta, Dogecoin seems well positioned for a possible movement. If bulls can push through the resistance and validate the TD signal with follow-through volume, Doge can quickly test higher levels that are last seen during early year-olds. The upcoming sessions can be crucial.

Dogecoin consolidates as buying signal hints in the event of incoming outbreak

Dogecoin shows signs of renewed strength and consolidates within an important range between $ 0.21 and $ 0.25. After a powerful increase of more than 90% since the beginning of April, Doge has cooled somewhat, but stays firmly on bullish territory. The recent price promotion is characterized by steadily higher lows and a tighter range structure, which suggests that it is actively preparing for the next major movement.

The resistance of $ 0.25 remains a critical level to view. A confirmed outbreak above this zone could open the door for a more aggressive rally and shift market sentiment in favor of the bulls. However, Momentum has been delayed in recent days and the global macro -economic uncertainty – in particular around inflation and interest capacity – contacts risk assets across the board.

Despite these challenges, optimism continues to exist. Martinez recently pointed out To a TD sequential purchase signal that has appeared on the 1-hour graph for Dogecoin. This indicator, known for predicting trend covers and short -term impulses, is usually particularly effective when it flashes during consolidation phases such as the current one. If confirmed, the signal can offer the spark that is needed to push back to the resistance of $ 0.25 – and possibly further.

For now, Bulls must continue to defend the support level of $ 0.21 while looking for Momentum to build above the current reach. If broader market conditions remain favorable and can reclaim $ 0.25 with volume, a new leg can follow higher. Until then, the set -up will remain constructive, with strong technical support and early signals that indicate a possible outbreak.

Related lecture

Doge consolidates under resistance

Dogecoin (Doge) is currently trading at $ 0.222 and consolidates after a strong rally at the beginning of May. The graph shows the price company within a tight reach between $ 0.21 and $ 0.25, where the level of $ 0.25 works as a strong resistance. Despite recent pullbacks, Doge continues to exchange above his most important advanced averages, indicating that bullish structure remains intact in the short term.

The 34 EMA (green) for $ 0.2112 offers dynamic support, while the 50 SMA (blue) for $ 0.1929 has just strengthened a solid basis below. The 200 SMA (Red), currently at $ 0.2714, is the following significant resistance if Doge breaks above $ 0.25.

The volume has decreased somewhat during this consolidation, a typical sign of a market that pauses before a potential outbreak or breakdown. The lack of aggressive sales pressure suggests that bulls are still under control, but needs to be restricted momentum to challenge and reclaim the level of $ 0.25.

Related lecture

A clean break and close to $ 0.25 would probably confirm the continuation of the bullish trend, which may be aimed at the range of $ 0.28 – $ 0.30. However, not holding above $ 0.21 could open the door for a retest of deeper support near the 100 SMA. For now, Doge remains in a constructive detention pattern.

Featured image of Dall-E, graph of TradingView