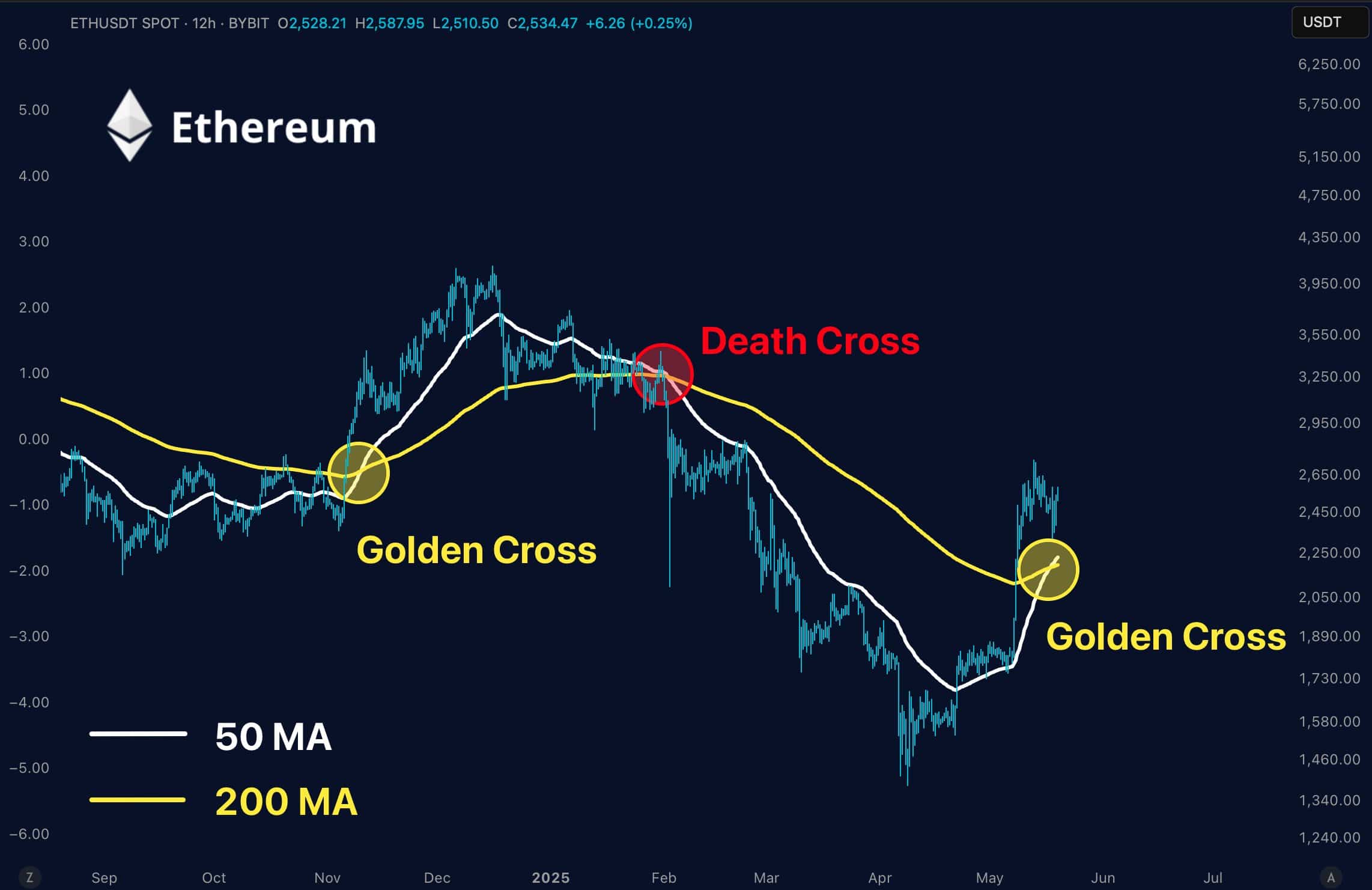

Ethereum has simply printed a recent gold cross, as marked in a graph shared By @MerlijnTrader on X (previously Twitter).

The 50-day advancing common is above the 200-day advancing common crossed-a sample that beforehand preceded a rally of virtually 90% in the long run of 2024.

Supply: X

After a Bearish Loss of life Cross had precipitated an extended -term downward development earlier this 12 months, this renewed sign attracts the eye of the merchants.

As a result of ETH is now being held above $ 2,500, market individuals are intently watching to see if the historical past is about to repeat.

What occurred the final time?

The earlier Golden Cross befell originally of November 2024.

After the sign, Ethereum rose from round $ 1,800 to a peak virtually $ 3,400 on the finish of December – which marked a revenue of round 89% in slightly below two months.

The transfer was not solely pushed by technicalities. This rally coincided with growing anticipation round Spot Bitcoin ETF approvals within the US, which fed huge optimism in crypto markets.

Elevated institutional significance, together with rising Ethereum -using deposits, added to the bullish stress and helped to help the rally on the finish of the 12 months.

Again to Bull?

Supply: Cryptuquant

Ethereum Trade Reserves have fallen to 18.7 million ETH, the bottom in additional than a 12 months – an indication of persistent retailers and potential accumulation.

Supply: Coinglass

On the identical time, financing percentages simply considerably destructive, which means that the present rally will not be powered by aggressive lengthy hypothesis.

This wholesome background of lowering supply and impartial leverage provides credibility to the Golden Cross sign and reduces the likelihood of a pointy correction.