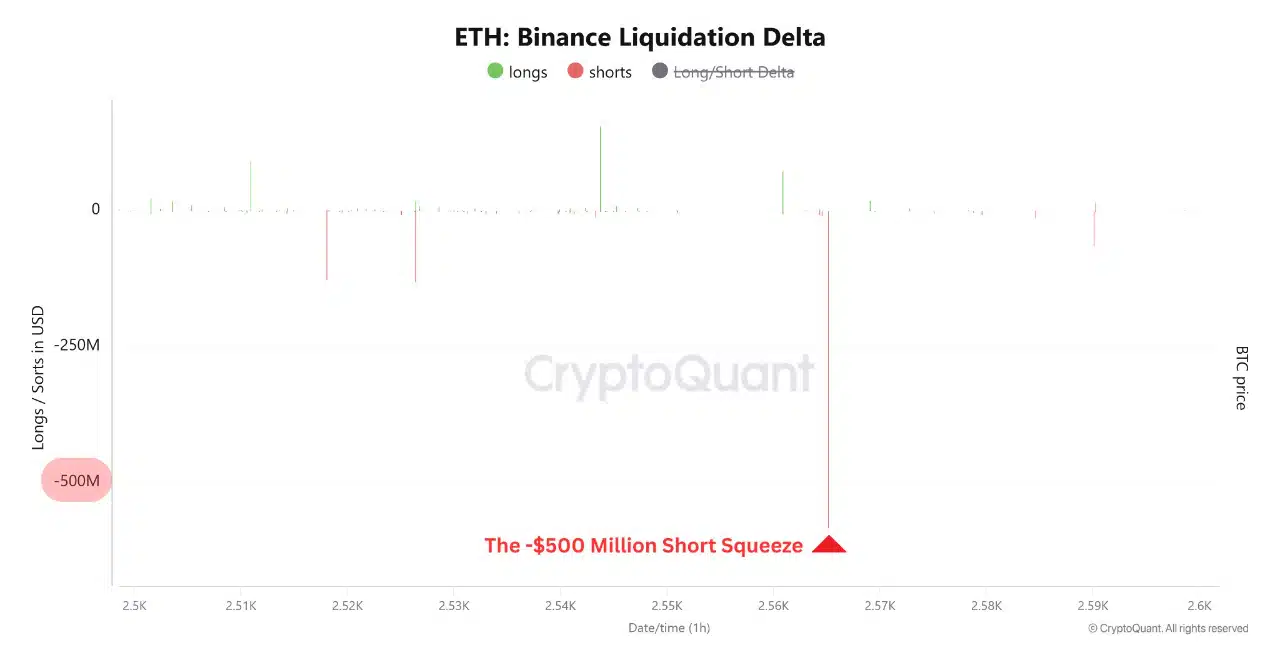

- The Rebound of Ethereum above $ 2,670 led to a huge short squeeze, so that $ 500 million was liquidated in shorts

- Rising ETH entry into derivatives and positive financing percentages suggest that there may be more volatility

Ethereum [ETH] Repeated just remembered how a short squeeze feels.

After he had folded his way above $ 2,670, the sudden rebound only wiped more than half a billion dollars in short positions on Binance road, which marked one of the biggest liquidations that the market has seen in recent times.

And now, with fresh ETH that flows in derived exchanges, the setup looks like more.

Ethereum: What has the squeeze activated?

The Ethereum meeting above $ 2,670 caught overwhelming leverage, so that one of the largest liquidation waves has been rejected in recent months.

Cryptoquant -Data Shows a dramatic $ 500 million in short liquidations on Binance – a clear sign of overcrowded Bearish bets.

Source: Cryptuquant

Furthermore, in addition to expecting traders aggressive short positions. But when Eth reversed the direction, Margin forced a quick purchase.

These forced liquidations fed the price rally, squeezed late shorts and rapidly shifting market sentiment.

The chain reaction pushed the financing percentages to a positive area, which emphasized the sharp settlement of Bearish leverage.