Ethereum is now being traded at a crucial moment after days of consistent sales pressure that the price has fallen by more than 12% since last Tuesday. Currently, around $ 2,400 Mark is struggling, ETH is struggling to maintain Bullish Momentum, and many analysts warn that a deeper correction could follow if bulls cannot defend this crucial support zone. The recent drop reflects a broader market insecurity, with increasing volatility that shaking the confidence of investors, just when ETH seemed ready to participate in a wider breakout from Altcoin.

Despite this weakness, there is growing optimism in some corners of the market. Top Analyst TED pillows shared a technical analysis showing that a Golden Cross has been attached to the 12-hour graph of Ethereum-a signal that is traditionally seen as a precursor of large bullish movements. This crossover, which occurs when the progressive average of 50 periods crosses the progressive average of 200 periods, often marks the start of an extensive upward trend.

If bulls succeed in holding the current levels and to recover a higher resistance near $ 2,600, the Golden Cross could become a turning point. Until that time, in the coming days will be crucial to determine whether Ethereum can bounce or sink into a longer consolidation phase.

Volatility touches Ethereum in the midst of Golden Cross -signal

Ethereum saw a sharp volatility at the weekend, along $ 2,550 rises before it quickly reversed and returned within a few hours in the $ 2,400 zone. This sudden move has fueled renewed uncertainty, while analysts become careful about the fading bullish momentum and rising sales pressure. Although ETH remains one of the stronger artists on the wider Altcoin market, it is still 36% falling compared to its high of December of around $ 4,100. This makes bulls with a clear challenge: hold the current level and regained control by pushing prices over $ 2,800 to ignite a persistent rally.

The level of $ 2,400 now acts as a critical support zone. A break underneath can cause a deeper retracement, so that Ethereum is probably dragged to a consolidation range or even to lower support levels. Yet technical signals offer a spark of hope.

According to pillowsEthereum recently confirmed a Golden Cross on the 12-hour graph-one bullish pattern that occurs when the progressive average of 50 periods crosses above the progressive average of 200 periods. Historically, such signals preceded strong upward movements, and Pillow believes that it can free up the way for Ethereum to reach $ 3,000 in the short term.

However, buyers have to step decisively to make that happen. The volume has been demolished and the sentiment seems vulnerable after last week’s malfunction. If bulls can defend the $ 2,400 region and quickly reclaim higher resistance, the Golden Cross can mark the start of Ethereum’s next leg. Until then, the market remains in a wait -and -see mode and looks out at whether the bullish signal can outweigh the growing pressure of sellers.

ETH tests important support after drop of local highlights

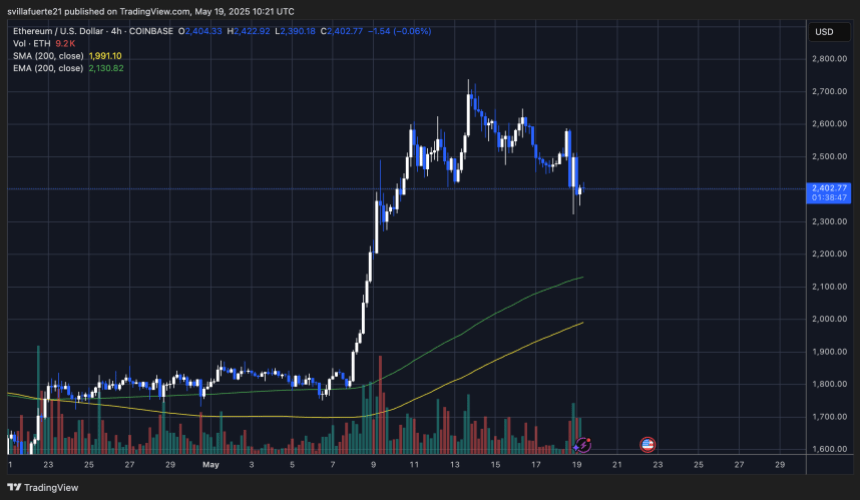

Ethereum is traded at $ 2,402 after a competitive sale on Sunday, where the price distributed to $ 2,670 before he was reclaimed in less than 24 hours more than 10%. As can be seen in the 4-hour graph, ETH now consolidates directly above $ 2,390- $ 2,400 zone, a level that is crucial for bulls to hold. This area coincides with an earlier consolidation zone and could act as a short -term support basis.

The EMA of 200 periods on the 4h graphics is currently at $ 2,130 and the 200 SMA is almost $ 1,991-LIJNE are considerably below the current price and offer long-term trend support. However, the volume profile shows a peak in sales activity during the pullback, which suggests that traders lock profit in the short term. If the price breaks below $ 2,390, a deeper return to the range of $ 2,200 – $ 2,300 is probably.

At the top, EH $ 2,550 must reclaim to restore the momentum. If you don’t do this, a local top can confirm. The price promotion is clearly indecisive and this reach -related structure could maintain, unless bulls re -confirm the power with a decisive movement above $ 2,600. Until then, the level of $ 2,400 remains a battlefield between buyers and sellers in the midst of increased volatility.

Featured image of Dall-E, graph of TradingView