- The network activity and whale accumulation of Ethereum emphasized bullish coordination despite the reach -related price

- Rising scarcity and cooling -specific demand can support a long -term outbreak above $ 2,833

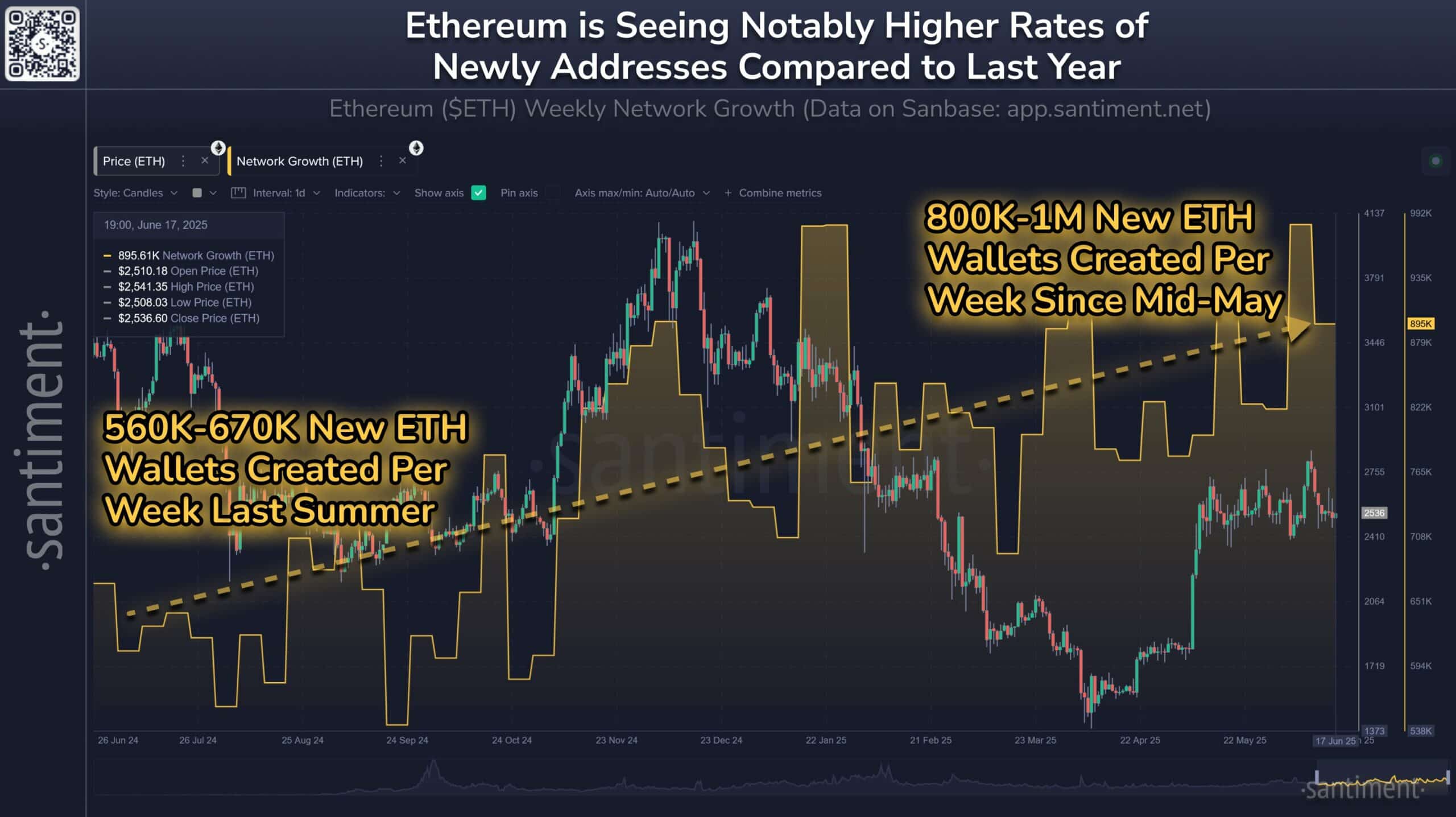

Ethereum [ETH] has recently seen a consistent increase in weekly address creation, ranging between 800K and 1m since mid-May-a rise of 560K-670K this time last year.

With ETH trading within a narrow band near $ 2,500, the golf In new portfolios, it can mean that the basic principles of the network quickly strengthen.

A walk in user participation often means a deeper acceptance of utilities, especially when making wallets grows in addition to stable price action.

That is why the growing network base of Ethereum can serve as a basis for a stronger demand and long -term valuation.

Source: Santiment/X

Will whales return quietly to accumulate ETH?

Large holder -netflows have been sharply reversed last week and, after weeks of muted activity, increased by more than 7,400%. This peak followed a long -term period of negative flows, which may have indicated distribution or repositioning.

Now the renewed entry can mean the growing trust between whales. This trend also seemed to coincide with steady price support, which may be a reflection of strategic accumulation.

Moreover, this whale behavior can precede a nutritional crisis if the trend continues. That is why the latest accumulation trend can indicate the start of a more bullish phase by large holders.

Source: Intotheblock

Will the price fracture of Ethereum be free from his consolidation pattern?

ETH is locked in a range between $ 2,396 and $ 2,833, with respect for a rising channel structure.

Despite several attempts, Bulls have difficulty breaking the resistance of $ 2,833, while Beren did not succeed in breaking $ 2,396. This price compression reflects indecision, but something like that often precedes explosive movement.

At the time of writing, the stochastic RSI was low – which implies an incoming reversal if the purchasing pressure increases. Until a breakout takes place, the price will probably oscillate in this tight zone. However, the growing basic principles can give the balance soon.

Source: TradingView

Does ETH move from short -term hype to long -term value?

Finally, the activity of the short-term ETH, measured by the 0-1 day realized Cap Hodl waves, saw a decline after weeks of sharp spikes. This suggested that recent buyers may be able to leave a profit or take a profit, reduce short -term volatility and reduce sales pressure.

At the same time, the supply-flow ratio rose from ETH to 43.2-the highest in months-what the growing scarcity indicated as the new issue delayed.

This combination of fading speculative behavior and rising long -term value statistics could be the scene for a more sustainable upward movement.

If the long -term demand persists, ETH will soon be able to break its current price ceiling and shift firmly into the accumulation area.

Source: Santiment

Is Ethereum preparing for an outbreak of more than $ 2,800?

The power of Ethereum is becoming increasingly difficult to ignore. With the accelerating of new wallet creation, the return of whales and scarcity statistics such as Peak from stock-to-flow spiking, the basic principles can connect with a potential rally.

Although the price remains trapped within a defined range, the rising network activity and falling short -term holder can quickly shift the balance. If the bullish pressure applies, ETH can break by $ 2,800.