- The Spot Netflow from Ethereum remained negative for seven days and signaled stable accumulation between investor segments.

- Market makers have returned with accumulation-heavy activity, and point to structural support for an upward move.

Ethereum [ETH] continued to exchange sideways, but the momentum seemed to build under the surface.

Although market players had taken a step back when the market stagnated, data on chains indicated that the Ethereum ecosystem is more active than ever before.

Eth -Marketmakers are back in the game

Source: X

As such, repactic founder Joao Wedson observed That Ethereum market makers had returned with violence.

According to his Wyckoff-based analysis, both accumulation and distribution patterns played together in combination, but the accumulation seemed to dominate.

Source: Coinglass

This was of course not just speculation.

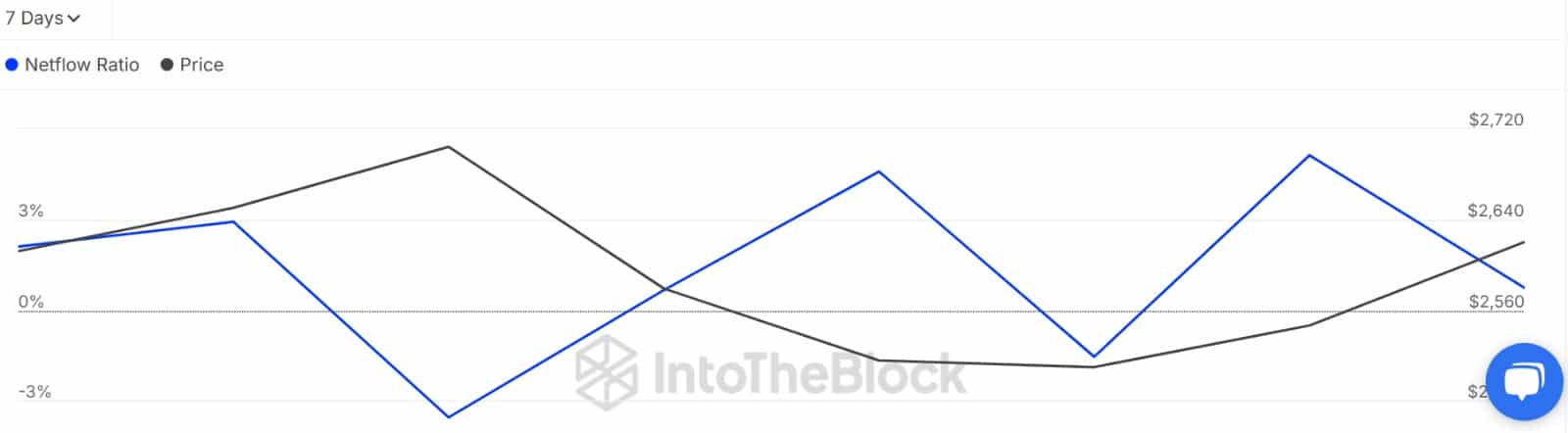

Ethereum sees a strong accumulation of all market participants. To begin with, the Spot Netflow of Ethereum remained negative for a full week, which confirmed consistent outskirts of fairs.

Source: Intotheblock

This indicates that there are more buyers than sellers on the market. Currently there are buyers of all sizes; For example, Ethereumwalvissen also make aggressive purchases.

The big holders Netflow to change the Netflow ratio also supported this display. It fell sharply from 4.28% to 0.62%, which implied that whales had withdrawn from exchange activity.

This means that whales do not sell Ethereum instead, buy them.

Source: Cryptuquant

Increased buy activity had the buyers dominate the market last day. The ETH Taker Buy-Sell ratio became positive.

A positive ratio here suggests that investors in the market usually buy. As such, more buying orders are equipped with buyers that lift offers that reflect a strong accumulation on the market.

Can ETH finally break out?

As observed above, Ethereum experiences considerable accumulation, which sets the Altcoin for a large movement. So, the longer this accumulation lasts, the greater the move will be.

An outbreak above $ 2,660 would open the door to $ 2,830 – an area stacked with high liquidity that could attract aggressive movements.

Source: Alfractaal

However, Ethereum has to release this zone with conviction. If this is the case, the next key resistance is $ 3,000.

To keep this setup alive, Bulls must defend the support of $ 2,556. A breakdown below this level can make the bullish thesis invalid.