- ETHs $ 2.7k breakout led to a brief squeeze, however rising trade reserves sign weakening momentum

- The decoupling of Ethereum from Bitcoin requires concern about sustainability, with L2S and buying participation shaking

Ethereum’s [ETH] Break over the $ 2,700 model shocked the market and solely precipitated greater than $ 50 million in brief liquidations on Binance.

However below the floor there is a bit more complicated: rising trade reserves and noteworthy whale working recommend that the bullish momentum can lose steam.

On the similar time, the current worth of Bitcoin van Ethereum – as soon as seen as an indication of rising energy – now disconnects new concern about sustainability and course for the broader Ethereum ecosystem.

Quick squeeze ignites when Eth $ 2.7k breaks

The rise in Ethereum past the $ 2,700 resistance degree led to a aggressive liquidation occasion on Binance, in line with greater than $ 50 million in brief positions, in line with Cryptoquant details.

Supply: Cryptuquant

This zone, marked as a liquidity cluster on the Delta-graphic Liquidation, grew to become a magnet for stop-lussies whereas ETH pierced.

Supply: Cryptuquant

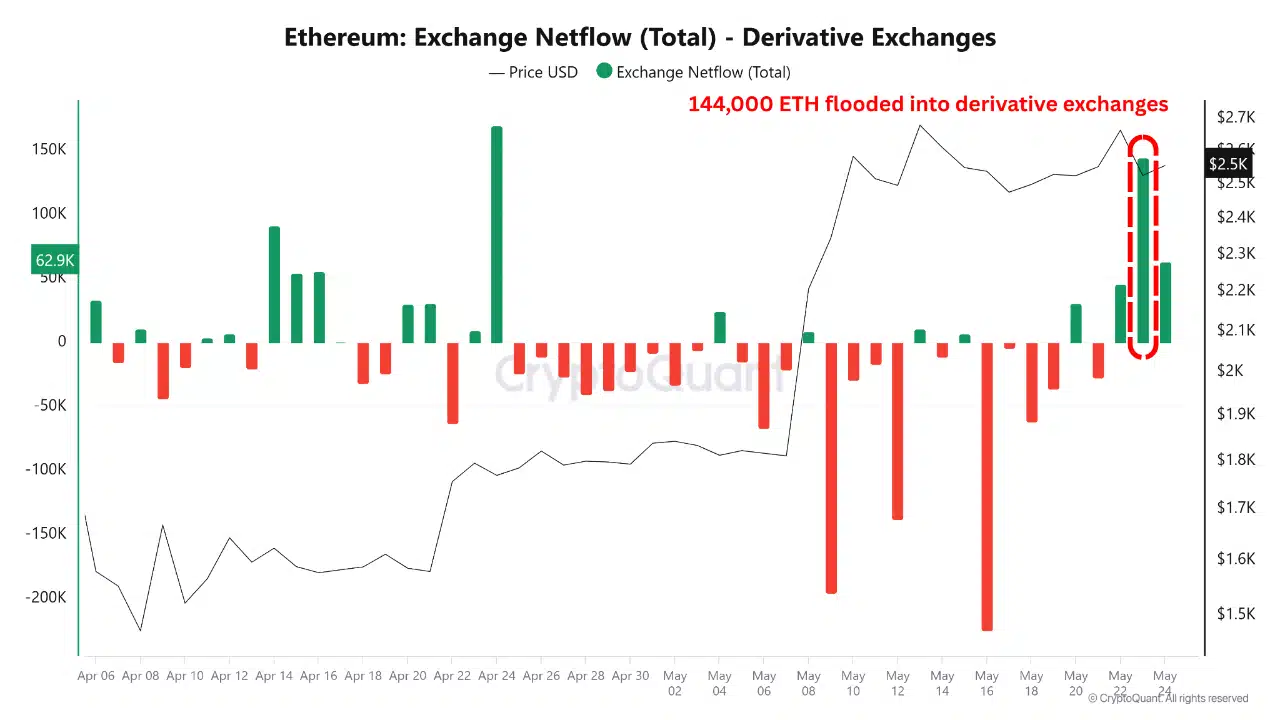

Nevertheless, that squeeze was instantly adopted by greater than 144,000 ETH that flowed in by-product trade reserves – a crimson flag. Such influx often precedes renewed quick positioning, not previous to the continuation of the development.

Whereas the bulls briefly claimed the victory, the speedy consumption and warmth cap stress warning recommend warning within the midst of the preliminary euphoria.

Ethereum-Bitcoin correlation collapses

For years, Ethereum and Bitcoin moved almost-lockstep and sometimes shared a correlation above 0.7. However that relationship has nearly evaporated.

In line with Cryptuquant, The 1-year correlation of ETH with BTC fell to solely 0.05 from 22 Might towards 0.63 in the beginning of the 12 months.

Supply: Cryptuquant

This sudden decoupling disrupts one of the vital constant patterns of the cryptomarket, forcing a reassessment of conventional portfolio methods.

Extra critically coincides with the relative underperformance of ETH through the Bitcoin assembly.

Decoupling of Demps Momentum

The divergence of Ethereum of Bitcoin is eroding the belief of the market. With out the rugwind of synchronized BTC rallies, the Ethereum ecosystem is struggling to help progress.

Retail participation appears to be thinner and main L2s corresponding to optimism, arbitrum and polygon haven’t acquired a grip in 2025. Prediction fashions that have been as soon as depending on Bitcoin’s directionalality, dropping predictive energy.

Ethereum can evolve right into a extra autonomous property powered by inner fundamentals, however that independence dangers it throughout bull cycles.

For now, the decoupling appears to be extra solely wind than evolution.