Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

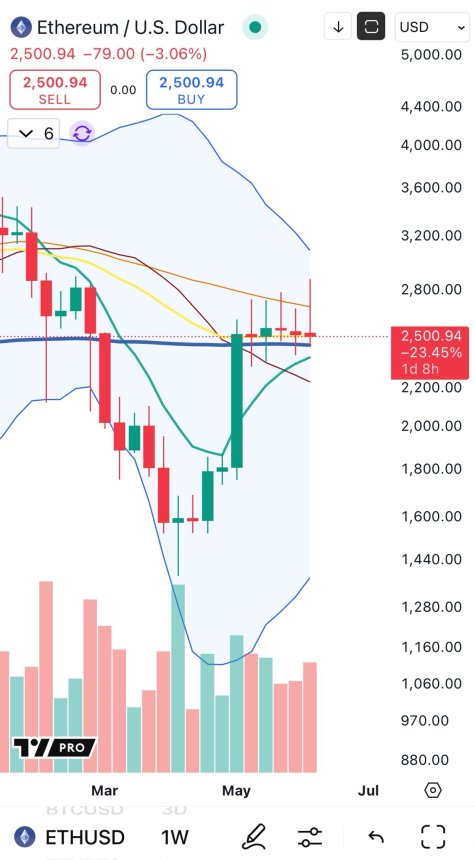

Ethereum acts at a critical moment after intense volatility the wider market rocked after renewed conflict in the middle. After he had pushed over $ 2,800 earlier this week, Eth Bulls seemed to get control. However, the price promotion could not retain above that level, which means that they came back sharply and hesitate for market participants.

Related lecture

This retracement comes as macro-economic and geopolitical tensions rise, especially after the strike of Israel over Iran, widespread risk-off sentiment about global assets. Ethereum, often seen as an active with a high beta, has not been immune to turbulence. Nevertheless, floating remains near important technical zones, which maintains the potential for a larger movement in both directions.

Top analyst Big Cheds weighed the situation and emphasizes a remarkable technical pattern: ETH is bending another small body with an upper shade on the weekly graph. This suggests indecision and potential weakness at the top, although the structure has not yet been fully affected. The following daily candles can be crucial when defining the short -term trend from Ethereum. Bulls must reclaim $ 2,800 with conviction to restore the momentum, while further disadvantage could open the door for a deeper correction for earlier consolidation zones.

Ethereum has a reach when the market is waiting for the next movement

Since last Wednesday, Ethereum has lost more than 15%, withdrawn from local highlights near $ 2,830 and falling back into the trade range that held at the beginning of May. Despite the drop, ETH remains structurally intact, with still respect for the broader consolidation zone. Price promotion, however, continues under the resistance of $ 2,770, whereby traders and analysts split the next step.

Some market participants believe that Ethereum could ignite the next Altcoin season if it succeeds in breaking with conviction above his current reach. A decisive closure above $ 2,800 can restore Bullish Momentum and Signal capital rotation from Bitcoin in ETH and wider altcoins. Others remain cautious and point to weakening the momentum, global instability and failure to support support as early warning signals of a possible demolition under the area of $ 2,500 – $ 2,550.

In addition to the analysis, Cheds shared a Technical perspective Show that the weekly graph of Ethereum is the print of a small candle with an upper shade. This structure is consistent with what he sees as a “pre-tower top” arrangement-a pattern that often precedes increased volatility or a reversal. It emphasizes the current hesitation of the market and the constant struggle between buyers and sellers.

Macro -economic conditions don’t help either. Rising American treasury continues to put pressure on risk activa, while constant geopolitical unrest – especially the escalating conflict between Israel and Iran – adds another layer of volatility and fear to financial markets.